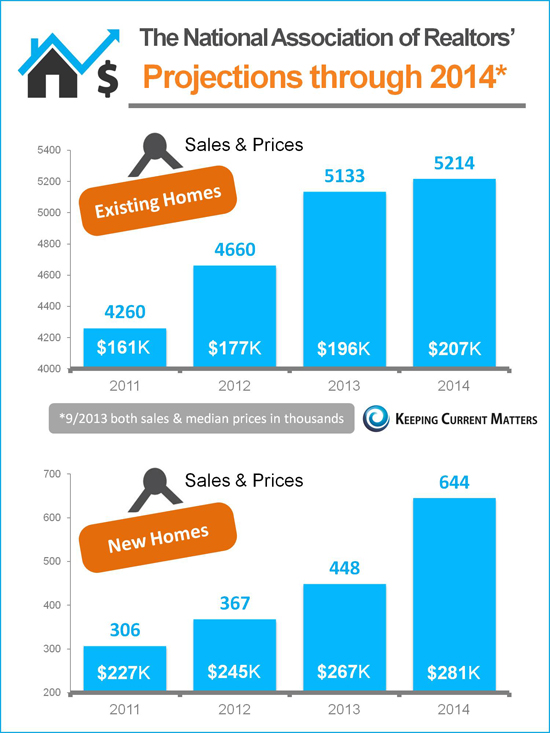

National Association of Realtors 2014 Projections!

Displaying blog entries 101-105 of 105

Thank you to Marcel Deitrich of WR Starkey!

The mortgage market is changing again. Over the next two months, we have several changes that will affect mortgage options for consumers.

Because the FED did not begin the tapering of Quantitative Easing, interest rates have lowered a bit, and are now at 6 week lows. It was a shock to most who were expecting the tapering to begin, which means the FED may also shock and start the tapering when most now do not expect it. Quantitative Easing is the 85 Billion Dollars that the US Treasury is putting in to bonds and mortgage backed securities monthly meant to artificially keep interest rates low and stimulate housing and the economy.

On October 1st, the government will be shut down if the our politicians do not come to an agreement on raising the debt ceiling and Obamacare. Part of this shut down could be the IRS. This is important to home buyers because lenders have to verify filed tax returns through a transcript they order from the IRS. If the IRS is closed, it would stop mortgages where the lender had not received those transcripts.

FHA starting on October 15th is changing their rules with regard to collection accounts. After that date, collection accounts over $2,000 will have to be paid off, or 5% of the collection balance will put in the debt to income ratios, meaning buyers will qualify for a lesser loan. The is true not only for the home buyer, but also for a spouse not on the loan.

On November 15th, Fannie Mae is changing their Automated Underwriting system. It will no longer allow for the very popular 3% down conventional loan program. Buyers interested in using the conventional 3% down program must act quickly.

That wraps up my Mortgage Minute.

Give me a call if you have any questions.

MARCEL DEITRICH

SENIOR LOAN OFFICER

The Christie Cannon Team just wanted to say THANK YOU & Congratulations to Sandy Stewart, our lead buyer's agent, for being recognized by Texas Monthly Magazine as a 5-Star Professional!

Sandy joins Christie Cannon & Kevin Cannon, 2nd year recipients, as real estate professionals recognized for the quality service & care they provide. Honorees are selected by 5-Star Professionals based on independent research and featured by Texas Monthly Magazine.

How are homes selling in your city? Find the latest Dallas Housing Stats & Market News at www.DFWHomeTrends.com

SEP-12 Quick Facts:

Frisco at a Glance:

Specific Sales & Housing Stats with City breakdowns available here: www.DFWHomeTrends.com

_________________________________________________

Search homes (including foreclosures) in the North TX MLS at www.CannonMLS.com or www.ChristieCannon.com. Recent changes even allow you to search by map locations!

New Builder Inventories can also be found here New Home & Builder Inventory

Displaying blog entries 101-105 of 105