Harvest Fun in the DFW Area!

Displaying blog entries 241-250 of 555

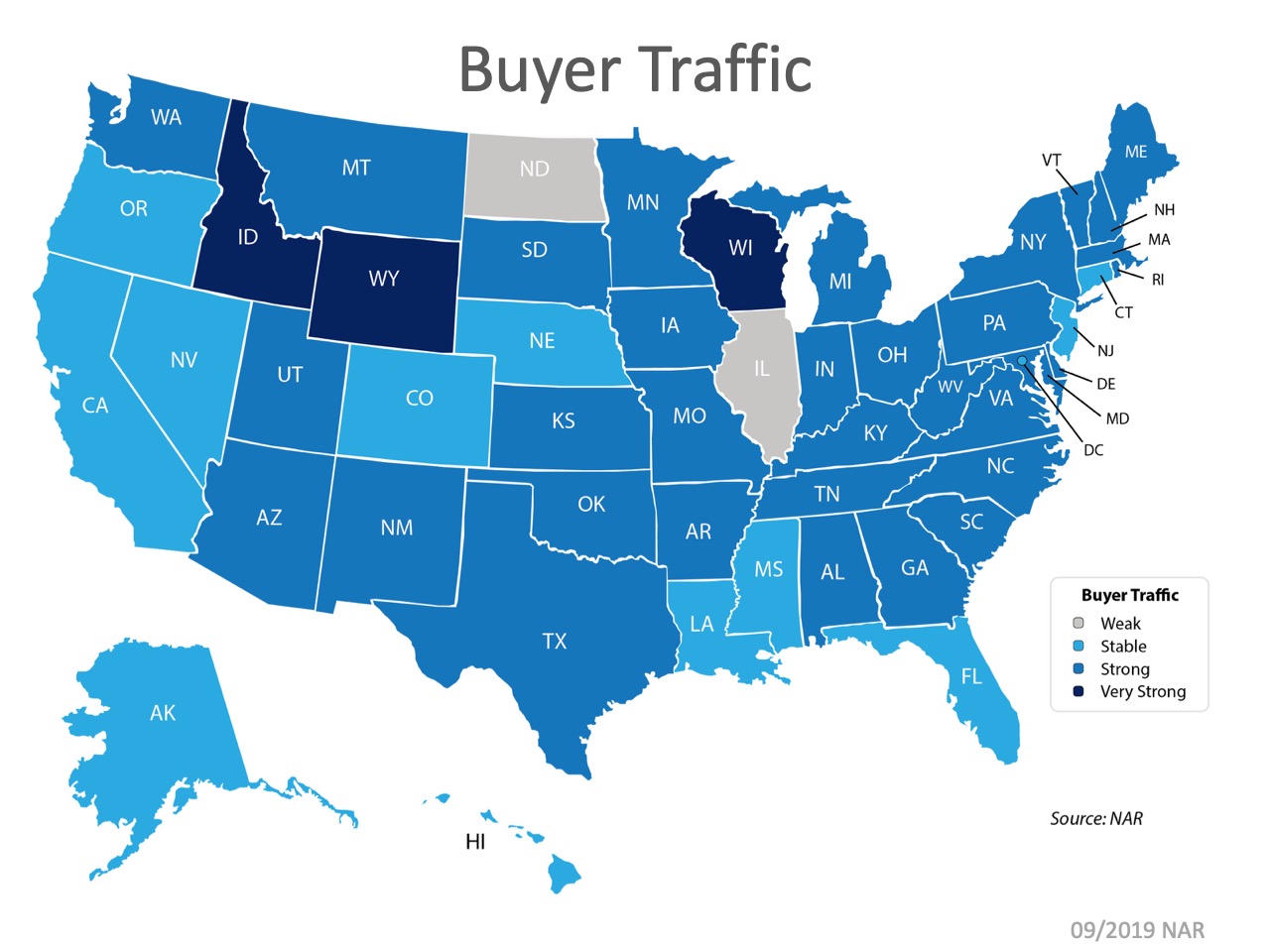

The price of any item is determined by supply, as well as the market’s demand for the item. The National Association of REALTORS (NAR) surveys “over 50,000 real estate practitioners about their expectations for home sales, prices and market conditions” for their monthly REALTORS Confidence Index.

Their latest edition sheds some light on the relationship between seller traffic (supply) and buyer traffic (demand).

The map below was created after asking the question: “How would you rate buyer traffic in your area?” The darker the blue, the stronger the demand for homes is in that area. The survey shows that in 3 of the 50 U.S. states, buyer demand is now very strong; only 2 of the 50 states have a ‘weak’ demand. Overall, buyer demand is slightly lower than this time last year but remains strong.

The darker the blue, the stronger the demand for homes is in that area. The survey shows that in 3 of the 50 U.S. states, buyer demand is now very strong; only 2 of the 50 states have a ‘weak’ demand. Overall, buyer demand is slightly lower than this time last year but remains strong.

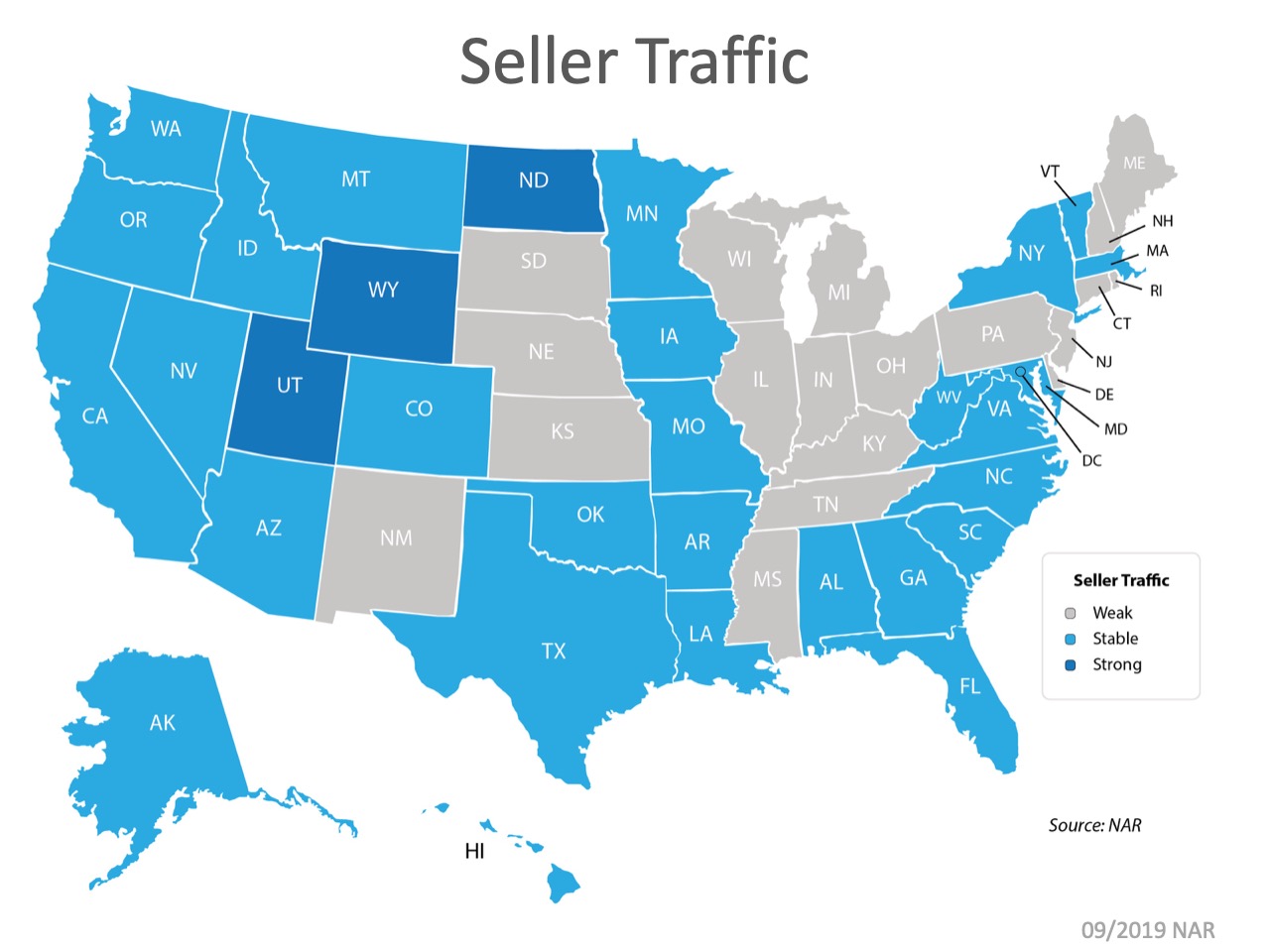

The index also asked: “How would you rate seller traffic in your area?” As the map below shows, 18 states reported ‘weak’ seller traffic, 29 states and Washington, D.C. reported ‘stable’ seller traffic, and 3 states reported ‘strong’ seller traffic. This means there are far fewer homes on the market than what is needed to satisfy the buyers who are looking for homes.

As the map below shows, 18 states reported ‘weak’ seller traffic, 29 states and Washington, D.C. reported ‘stable’ seller traffic, and 3 states reported ‘strong’ seller traffic. This means there are far fewer homes on the market than what is needed to satisfy the buyers who are looking for homes.

Looking at the maps above, it is not hard to see why prices are appreciating in many areas of the country. Until the supply of homes for sale starts to meet buyer demand, prices will continue to increase. If you are debating listing your home for sale, let’s get together to help you capitalize on the demand in our market now.

With the fall season upon us, change is in the air. For many families, children are growing up and moving out of the house, maybe leaving for college or taking a jump into the working world. Parents are finding themselves as empty nesters for the first time. The question inevitably arises: is it finally time to downsize?

If you’re pondering that thought, you may also be wondering if you should fix-up your house before you sell it, or go straight to the market as-is, allowing a potential buyer to do the updates and remodeling. If you’re one of the many homeowners this camp, here are a few tips to help you decide which way to go.

A real estate professional can help you to understand your market and the potential level of buyer interest and demand for your home. Are you in a seller’s market or a buyer’s market? This can change based on the price range of your home, too. A professional can also give you some insight on what you can change or remodel, and how to declutter your house to make it attractive to buyers in your area.

Right now, the average length of time a family stays in a home is between 9-10 years. That’s a little longer than the historical average, so if you’ve been living in your home for a while, it might be time to make some significant improvements. Think: electrical system, HVAC units, roof, siding, etc. An inspector can give you a better idea of the condition of your home, if it is up to current code standards, and recommendations on how to have your house ready before you put it on the market.

You may also be thinking about driving buyer appeal with something like a kitchen or a bathroom remodel. If so, first dig into the market value of your home, and compare it to the actual cost of the remodel. A local real estate professional can help you determine your home’s market value, and you’ll want to get a few quotes from contractors on the potential remodel pricing as well. Once you have those two factors narrowed down, you can to decide if a remodel will give you a return on your investment when you sell. Oftentimes, it is actually more advantageous to price your house to sell, list it competitively, and then let the buyer pick the colors they want for their bathroom tiles and the type of countertop they prefer. The 2019 Cost vs. Value Report in Remodeling Magazine compares the average cost for remodeling projects with the value those projects typically retain at resale.

Nationwide, inventory is low, meaning there is less than the 6-month housing supply needed for a normal market. This drives buyer demand, creating a perfect time to sell. If you’re considering selling your house, let’s get together to help you confidently determine what will be the best choice for you and your family.

![4 Reasons to Sell This Fall [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/09/19104136/20190920-MEM-1046x808.jpg)

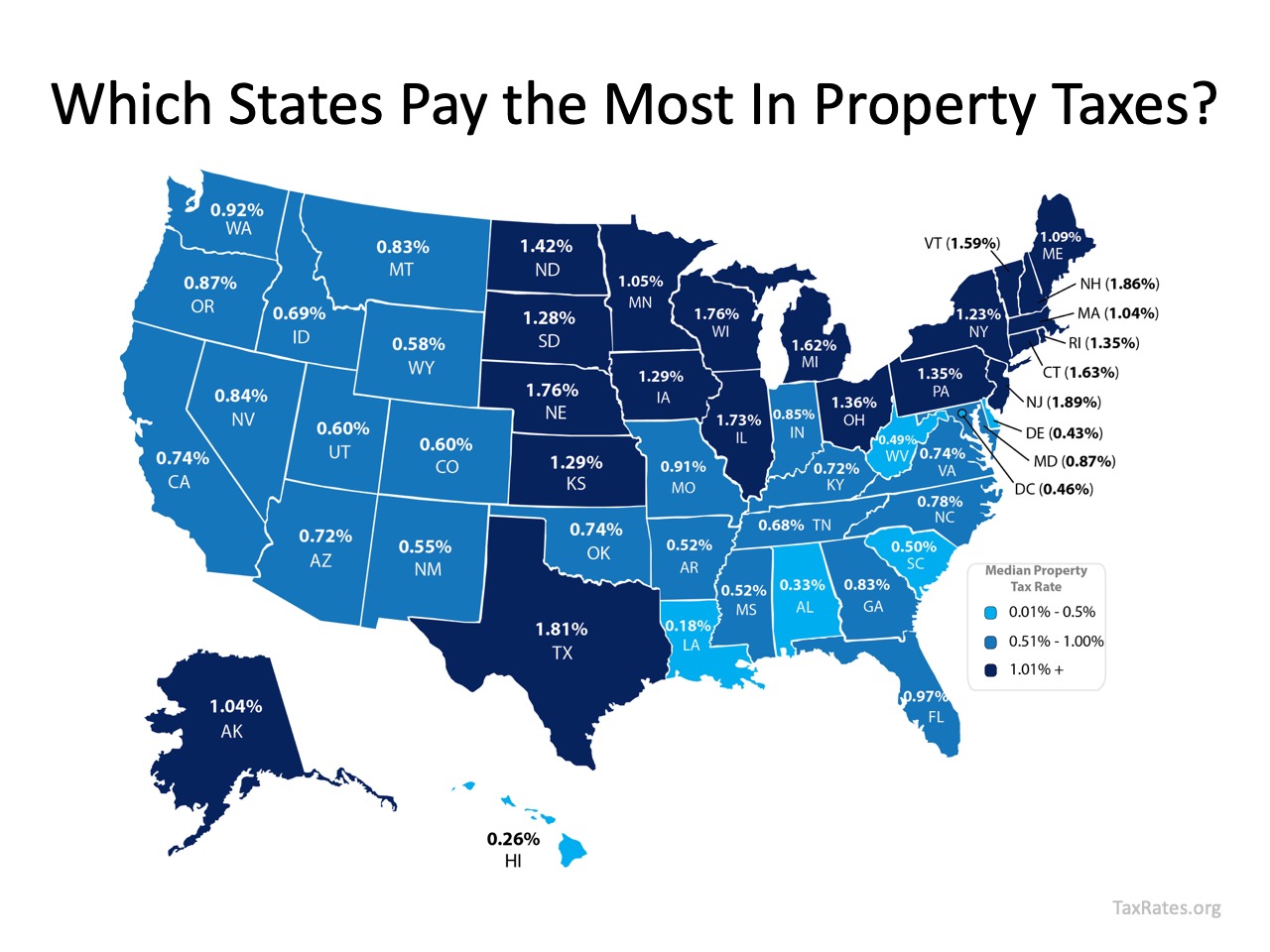

When buying a home, taxes are one of the expenses that can make a significant difference in your monthly payment. Do you know how much you might pay for property taxes in your state or local area?

When applying for a mortgage, you’ll see one of two acronyms in your paperwork – P&I or PITI – depending on how you’re including your taxes in your mortgage payment.

P&I stands for Principal and Interest, and both are parts of your monthly mortgage payment that go toward paying off the loan you borrow. PITI stands for Principal, Interest, Taxes, and Insurance, and they’re all important factors to calculate when you want to determine exactly what the cost of your new home will be.

TaxRates.org defines property taxes as,

“A municipal tax levied by counties, cities, or special tax districts on most types of real estate - including homes, businesses, and parcels of land. The amount of property tax owed depends on the appraised fair market value of the property, as determined by the property tax assessor.”

This organization also provides a map showing annual property taxes by state (including the District of Columbia), from lowest to highest, as a percentage of median home value. The top 5 states with the highest median property taxes are New Jersey, New Hampshire, Texas, Nebraska, and Wisconsin. The states with the lowest median property taxes are Louisiana, Hawaii, Alabama, and Delaware, followed by the District of Columbia.

The top 5 states with the highest median property taxes are New Jersey, New Hampshire, Texas, Nebraska, and Wisconsin. The states with the lowest median property taxes are Louisiana, Hawaii, Alabama, and Delaware, followed by the District of Columbia.

Depending on where you live, property taxes can have a big impact on your monthly payment. To make sure your estimated taxes will fall within your desired budget, let’s get together today to determine how the neighborhood or area you choose can make a difference in your overall costs when buying a home.

On Labor Day we celebrate the hard work that helps us achieve the American Dream.

Growing up, many of us thought about our future lives with great ambition. We drew pictures of what jobs we wanted to have and where we would live as a representation of a secure life for ourselves and our families. Today we celebrate the workers that make this country a place where those dreams can become a reality.

According to Wikipedia,

“Labor Day honors the American labor movement and the contributions that workers have made to the development, growth, endurance, strength, security, prosperity, productivity, laws, sustainability, persistence, structure, and well-being of the country.”

The hard work that happens every day across this country allows so many to achieve the American Dream. The 2019 Aspiring Home Buyers Profile by the National Association of Realtors (NAR) says,

“Approximately 75% of non-homeowners believe homeownership is part of their American Dream, while 9 in 10 current homeowners said the same.”

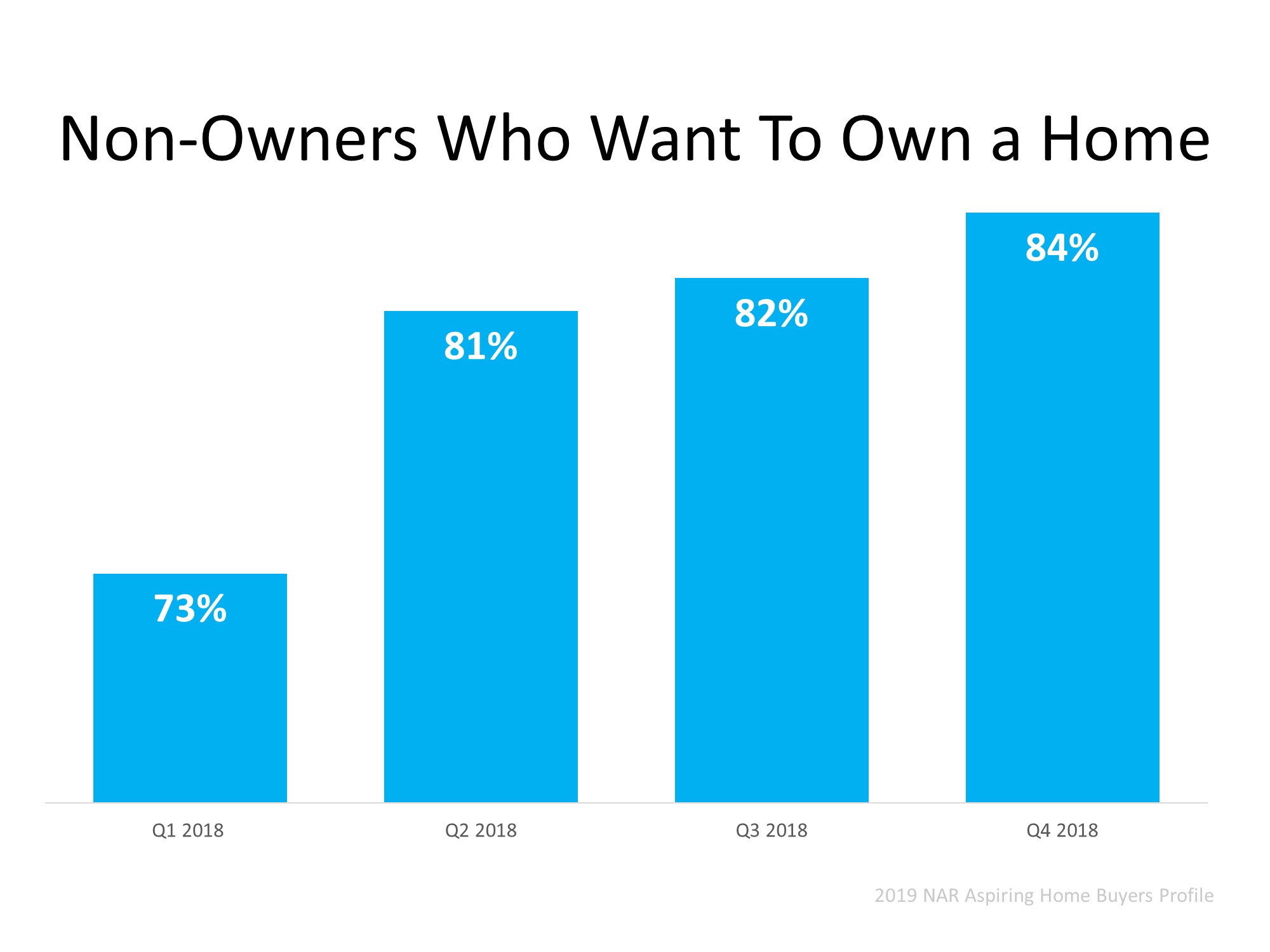

Looking at the number of non-owners, you may wonder, ‘If they believe in homeownership, why haven’t they bought a home yet?’. Well, increasing home prices and low inventory can be part of the reason why some haven’t jumped in, but that does not mean there is a lack of interest. The same report shows the increase in the desire to buy in the last year (as shown in the graph below): As we can see, there are more and more people each quarter who want to buy a home. The good news is, as more inventory comes to the market, more non-homeowners will be able to fulfill their dreams. Finally, they’ll be able to move into that home they drew when they were little kids!

As we can see, there are more and more people each quarter who want to buy a home. The good news is, as more inventory comes to the market, more non-homeowners will be able to fulfill their dreams. Finally, they’ll be able to move into that home they drew when they were little kids!

If you’re a homeowner considering selling, this fall might be the right time, as there are buyers in the market ready to buy. Let’s get together to determine how you can benefit from the pent-up housing demand.

Below are 5 compelling reasons listing your home for sale this fall makes sense.

The latest Buyer Traffic Report from the National Association of Realtors (NAR) shows that buyer demand remains strong throughout the vast majority of the country. These buyers are ready, willing, and able to purchase…and are in the market right now. More often than not, in many areas of the country, multiple buyers are competing with each other to buy the same home.

Take advantage of the buyer activity currently in the market.

Housing inventory is still under the 6-month supply that is needed for a normal market. This means that in the majority of the country, there are not enough homes for sale to satisfy the number of buyers.

Historically, a homeowner would stay an average of six years in his or her home. Since 2011, that number has hovered between nine and ten years. There is a pent-up desire for many homeowners to move as they were unable to sell over the last few years due to a negative equity situation. As home values continue to appreciate, more and more homeowners will be given the freedom to move.

Many homeowners were reluctant to list their homes over the last couple years, for fear that they would not find a home to move to. That is all changing now as more homes come to market at the higher end. The choices buyers have will continue to increase. Don’t wait until additional inventory comes to market before you decide to sell.

Today’s competitive environment has forced buyers to do all they can to stand out from the crowd, including getting pre-approved for their mortgage financing. This makes the entire selling process much faster and simpler, as buyers know exactly what they can afford before shopping for a home. According to Ellie Mae’s latest Origination Insights Report, the time needed to close a loan is 43 days.

If your next move will be into a premium or luxury home, now is the time to move up. There is currently ample inventory for sale at higher price ranges. This means if you're planning on selling a starter or trade-up home and moving into your dream home, you’ll be able to do that in the luxury or premium market.

According to CoreLogic, prices are projected to appreciate by 5.2% over the next year. If you’re moving to a higher-priced home, it will wind up costing you more in raw dollars (both in down payment and mortgage) if you wait.

Look at the reason you decided to sell in the first place and determine whether it is worth waiting. Is money more important than being with family? Is money more important than having the freedom to go on with your life the way you think you should?

Only you know the answers to these questions. You have the power to take control of the situation by putting your home on the market. Perhaps the time has come for you and your family to move on and start living the life you desire.

That is what is truly important.

![A Recession Does Not Equal a Housing Crisis [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/08/29021439/20190830-MEM-1046x1308.jpg)

According to the Pew Research Center, around 37% of U.S students will be going back to school soon and the rest have already started the new academic year. With school-aged children in your home, buying or selling a house can take on a whole different approach when it comes to finding the right size, location, school district, and more.

Recently, the 2019 Moving with Kids Report from the National Association of Realtors®(NAR) studied “the different purchasing habits as well as seller preferences during the home buying and selling process.” This is what they found:

The major difference between the homebuyers who have children and those who do not is the importance of the neighborhood. In fact, 53% said the quality of the school district is an important factor when purchasing a home, and 50% select neighborhoods by the convenience to the schools.

Buyers with children also purchase larger, detached single-family homes with 4 bedrooms and 2 full bathrooms at approximately 2,110 square feet.

Furthermore, 26% noted how childcare expenses delayed the home-buying process and forced additional compromises: 31% in the size of the home, 24% in the price, and 18% in the distance from work.

Of those polled, 23% of buyers with children sold their home "very urgently," and 46% indicated "somewhat urgently, within a reasonable time frame." Selling with urgency can pressure sellers to accept offers that are not in their favor. Lawrence Yun, Chief Economist at NAR explains,

“When buying or selling a home, exercising patience is beneficial, but in some cases – such as facing an upcoming school year or the outgrowing of a home – sellers find themselves rushed and forced to accept a less than ideal offer.”

For sellers with children, 21% want a real estate professional to help them sell the home within a specific time frame, 20% at a competitive price, and 19% to market their home to potential buyers.

Buying or selling a home can be driven by different priorities when you are also raising a family. If you’re a seller with children and looking to relocate, let’s get together to navigate the process in the most reasonable time frame for you and your family.

All the world’s a stage, said the Bard.

That includes your house. Which is for sale. And thus needs to look bee-yoo-tee-ful.

Staging entails hiring experts with a flair for interior design. They reimagine your living space and give your house a makeover (with temporary decor and furnishings) so that it gets “oohs” and “aahs” from the buying masses.

Great staging isn’t an insurance policy — there’s no guarantee it will bring in more money when you sell your home — but it’s an important marketing tool. It presents your house in a flattering light and helps you compete at a favorable price. (In that sense, staging is like dressing your house for the price you want, and not the price you have.)

Staging also leads to eye-catching listing photos, which are especially valuable given that most home buyers begin their search by scrolling through listings online.

So, are you thinking about hiring stagers for your home? Here’s what to consider.

But you don’t have to take our word for it. A recent survey from the NATIONAL ASSOCIATION OF REALTORS® revealed that:

Many listings agents offer staging services to clients as part of their services. If you want to use someone you find yourself, you typically will have to pay out of pocket.

Staging costs vary depending on where you live and how many rooms you’re staging. On average, home sellers pay between $302 and $1,358 for staging, according to HomeAdvisor.com. If your house is empty because you’ve already moved, you might also have additional expenses for renting furniture and other homey decorations to make it look lived-in.

Many stagers offer consultations for as low as $150, Fixr.com reports. Using the advice you learn during the consultation to try DIY staging may be your best option if you’re on a tight budget. Listen for tips on how to use the furniture and decor you already have to show off your home’s best assets.

Related Topic: Sell a Home: Step-by-Step

Spoiler alert: No buyer wants to walk into a messy house.

So, take time to clean and declutter your home. Organize everyday household items into crates and keep them out of sight. Stow away seasonal decorations (that means no Christmas in July). Make time for — or invest in — a whole-house cleaning, including carpet shampooing. Change lightbulbs, finally make those minor repairs, and add a fresh coat of paint to any room that needs it. Clean out closet spaced- because buyers will want to check out the closets.

Also worth considering? Removing personal items from view, such as copious family photos, artwork, or religious keepsakes. The concern is not that home buyers will be offended by you or your lifestyle. The goal is to neutralize the space and help home buyers imagine themselves living there. (But don’t go overboard. You don’t want rooms to feel sterile, either.)

Yes, we did just tell you to clean out your closets. So where are you supposed to put all this stuff? If you don’t have a discrete place to tuck things away, consider renting a storage unit.

If your agent doesn’t offer staging services, he or she can likely recommend local stagers for you to work with. Before you hire a stager, it’s best to interview at least three candidates in person. You’ll want to get a sense of how much they charge — and whether they have good taste.

To do your due diligence, here are 10 questions to ask prospective stagers:

You don’t have to stage your whole house to make buyers swoon.

Staging the rooms where people tend to spend the most time usually makes the biggest impression on buyers. Start with thefollowed by the master bedroom and the kitchen.

Keep in mind that you’re not going for an HGTV-worthy overhaul: Even small touches, like putting fluffy towels in the bathroom or replacing shabby throw pillows in the family room, can make your home that much more attractive.

Your house has to look its best — inside and outside. After all, buyers form their first impression when they pull up in front of your home. It’s no surprise, then, that curb appeal — how your home looks from the exterior — can increase your home’s sales value up to 17%, a Texas Tech University study found.

If you’ve never had your yard professionally landscaped, now may be the time to do it. Landscaped homes have a sales price advantage ranging from 5.5% to 12.7%, according to research by Alex Niemiera, a horticulturist at Virginia Tech. That would mean an extra $16,500 to $38,100 in value on a $300,000 home.

Professional landscaping, however, can cost a lot. You’re aiming for polish, not a new garden of Versailles. If budget is a concern, start with these DIY improvements:

Then move on to these easy upgrades to your home’s exterior:

Even basic upgrades — like laying fresh mulch, changing porch lights, or installing a new mailbox — can help a buyer fall in love at first sight.

Just wait ’til they come inside and see what else you’ve done with the place.

Displaying blog entries 241-250 of 555