The Power of Interest Rates!

The Take Away:

- Interest rate changes have a profound affect on buying power.

- Affordability and interest rate have direct relationship.

- Spend your money on your dream home, not on interest.

Displaying blog entries 11-20 of 22

The Take Away:

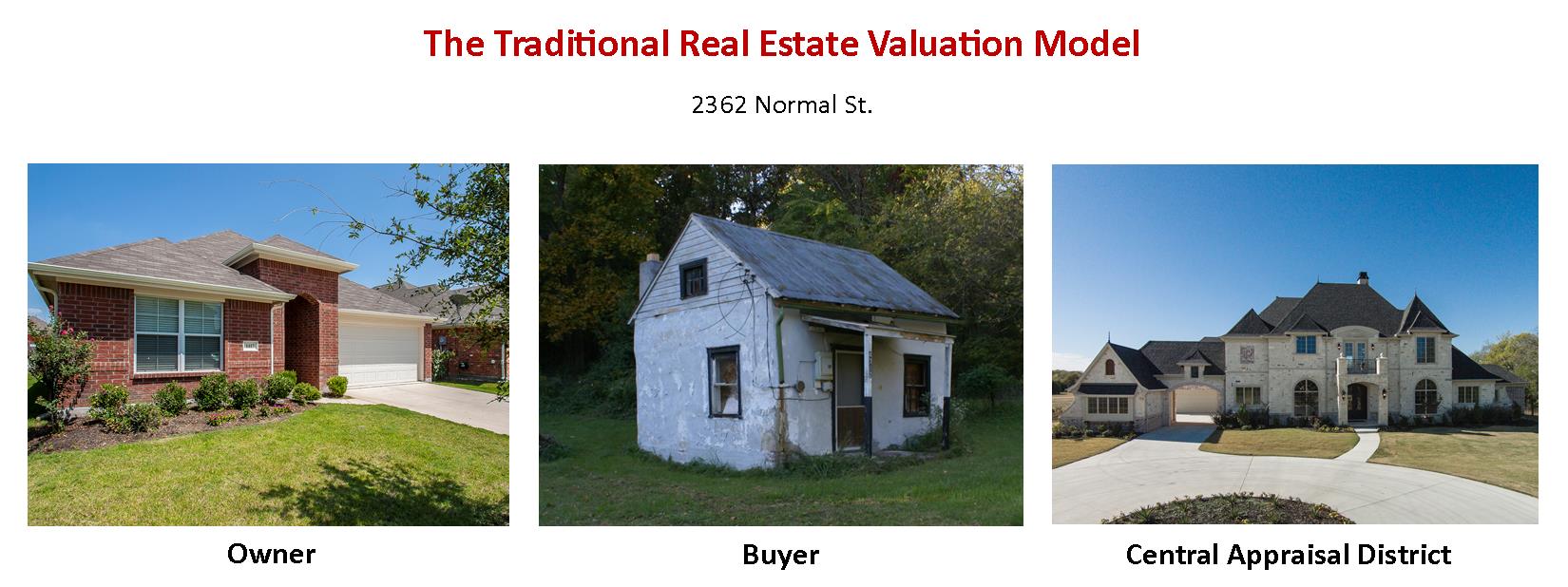

The season is upon us - let the tax protests begin! So the dreaded letter arrived; the good news, the market is up; the bad news, your local appraiser knows it!

So when your tax assessed value jumps the full 10%, what comes next? First don't panic, second review our helpful tips on determining if you should protest.

- Good Luck & please let me know if you have any questions - Christie Cannon

* Be sure to check with a qualified tax agent & your county's central appraisal district for specific procedures & questions.

SelfStorage.com's blog posted their 12 best places to move to in 2015 & Texas takes 4 of the 12 top spots!

So how did the Lonestar state fair:

The capital of Texas boasts the highest long-term job growth and the second-highest economic growth numbers among the Top 12. It also has the second-highest share of recent construction. Yet homes remain affordable, with median prices slightly higher than three times median incomes. The only drawback? Real estate taxes, which are higher in Austin than anywhere else in the Top 12.

Four of the Top 12 spots belong to metro areas in Texas, and Houston actually outperforms Austin in many ways: cost premiums are lower, prices recently have increased more and real estate taxes are lower. However, there’s less recent construction in Houston, and economic growth — while healthy — is slower than in Austin.

Like its Texas compatriots on our list, San Antonio scores well across the board and offers buyers a low cost premium combined with attractive recent price increases. Real estate taxes per capita are lower here than in the other Texas cities, too.

Dallas’ economic numbers are essentially the same as San Antonio’s. However, Dallas’ recent price increases and real estate taxes are higher, and the cost premium is slightly higher here than in San Antonio.

Appraisals & why we must sell every home twice!

Every house on the market has to be sold twice; once to a prospective buyer and then to the bank (through the bank’s appraisal). In a housing market where supply is very low and demand is very high, home values increase rapidly. One major challenge in such a market is that bank appraisal. If prices are jumping, it is difficult for appraisers to find adequate comparable sales (similar houses in the neighborhood that closed recently) to defend the price when doing the appraisal for the bank.

With escalating prices, the second sale might be even more difficult than the first. And now, there may be a second issue further complicating the appraisal issue.

The Mortgage News Daily (MND) recently published an article titled Conservative Appraisals Increasingly Mentioned in 2015; Did Something Change?

The article revealed that there was a “flurry” of comments on their website from members expressing concern about…

“…a sudden increase in appraisals reflecting market values well below what had been expected. In some cases the low appraisals had merely required the restructuring of the loan, in others they killed the deal.”

The National Association of Realtors revealed this month that 8% of the contracts that fell through over the last three months were terminated because of appraisal issues.

MND decided to survey their members and ask why this sudden increase in “short” appraisals could be taking place. Here is one result of that survey:

“Almost everyone we spoke to mentioned Fannie Mae's new Collateral Underwriter (CU).”

Collateral Underwriter provides a risk score on individual appraisals which will lead to a ranking of appraisals by risk profile, allowing lenders to identify appraisals with heightened risk of quality issues, overvaluation, and compliance violations. It went on-line on January 26.

Marianne Sullivan, senior vice president of single-family business capability with Fannie Mae believes that CU is not a problem for appraisers. She claimed:

“From an appraiser perspective, one of the lender's responsibilities has always been to review the quality of an appraiser, and they have been using various methods to do that forever. I don’t think appraisers will find this tool to be disruptive.”

However, some think that CU has caused appraisers to become too cautious with their appraised values. One mortgage professional in the MND article explained it this way:

"My personal opinion is that appraisers are being overly conservative in choosing comps because of CU. If CU questions the comps, adjustments, etc., the appraiser would have to do a lot of extra work to justify them. I had anticipated that CU would cause delays because of this extra work, but it seems that appraisers are one step ahead and are being ultra conservative, thus avoiding the extra work in the first place. I haven't spoken to an appraiser about it; this is just my interpretation of what I am seeing."

Ryan Lundquist, a Certified Residential Appraiser in the Sacramento area, agreed:

“One of the unintended consequences of CU may be more conservative appraisals.”

We must realize that, in today’s housing market, every house must be sold twice and the second sale (to the bank’s appraiser) could be the more difficult one.

Thank you to Caitlin Clark of D Magazine & D Home for thinking of us in their recent blog post & QA. We discussed the affect of corporate relocations to the North TX area & how this may affect Frisco's real estate market.

Below is a quick glimpse - For all the Questions & Answers, please be sure to check out the Blog - HERE

________________________

How do you think all the development in and around Frisco will affect the city’s housing market?

It is an exciting time to be in Frisco! The name recognition that comes with the Cowboys is priceless. As we continue develop and draw new employment anchors and employees, that name recognition will keep our great city in the forefront of buyers’ minds. Likewise, the affect we will see from our new corporate neighbors will be profound...

Are there any up-and-coming neighborhoods or residential developments that homebuyers looking in Frisco should know about?

We could talk all day! New home communities include: Phillips Creek Ranch with huge amenities, Lawler Park with creek lots and mature trees, and the gated Newman Village, which has come on strong over this past year. I do caution buyers not to let new build prices or inventory scare you from our market; the traditional heavy hitters in Frisco will always draw interest like Trails of West Frisco, Starwood, Stonebriar, Griffin Parc, etc. Likewise, the Hillcrest & Lebanon area of Plantation Estates, Hillcrest Estates, Cecile Place and others are wonderfully priced, just off 121, and offer amazing schools and amenities. Really, we could talk all day!

Do you have any tips or insight for homebuyers looking to make the move to Frisco?

Sure I do; give us a call!

The best advice I can offer is to get started early. Frisco is much larger than people expect. The city offers such a wide variety of communities, home styles, and amenities that it can be overwhelming for home seekers new to the area. Work with someone to get to know the area, not just the houses. This isn’t just about where you lay your head at night, but where do you work, live, relax, and play – how can your home, community, & city enhance this?

And, if you are relocating from another state, don’t worry, we native Texans are easy to win over – just let us know that while you may not be from here, you got here as soon as you could.

A recent Bloomberg Business article reports that both Lowes & Home Depot experienced fourth quarter profits that beat revenue projections by the most in six quarters. So what does that mean to the housing market?

Lowe’s Chief Executive Officer Robert Niblock said,

“Consumers are feeling better about their jobs, their wages and certainly feeling better about the value of their home, they are re-engaging in projects that they have put off.”

Sales to professional contractors have increased significantly as well, and were a driving factor in the quarter. Home Depot’s Chief Financial Officer Carol Tome calls this a “sign of health. If they are putting more items in their basket, it means they have work coming at them.”

In a quarterly consumer survey conducted by Lowe’s since 2007, the percentage of respondents who said that the value of their home is rising increased to its highest value ever, at 50%.

Whether Americans are finally adding that man-cave they’ve always wanted, or renovating a master suite, an increased confidence in the value of one’s home often sparks homeowners to invest in big-ticket projects.

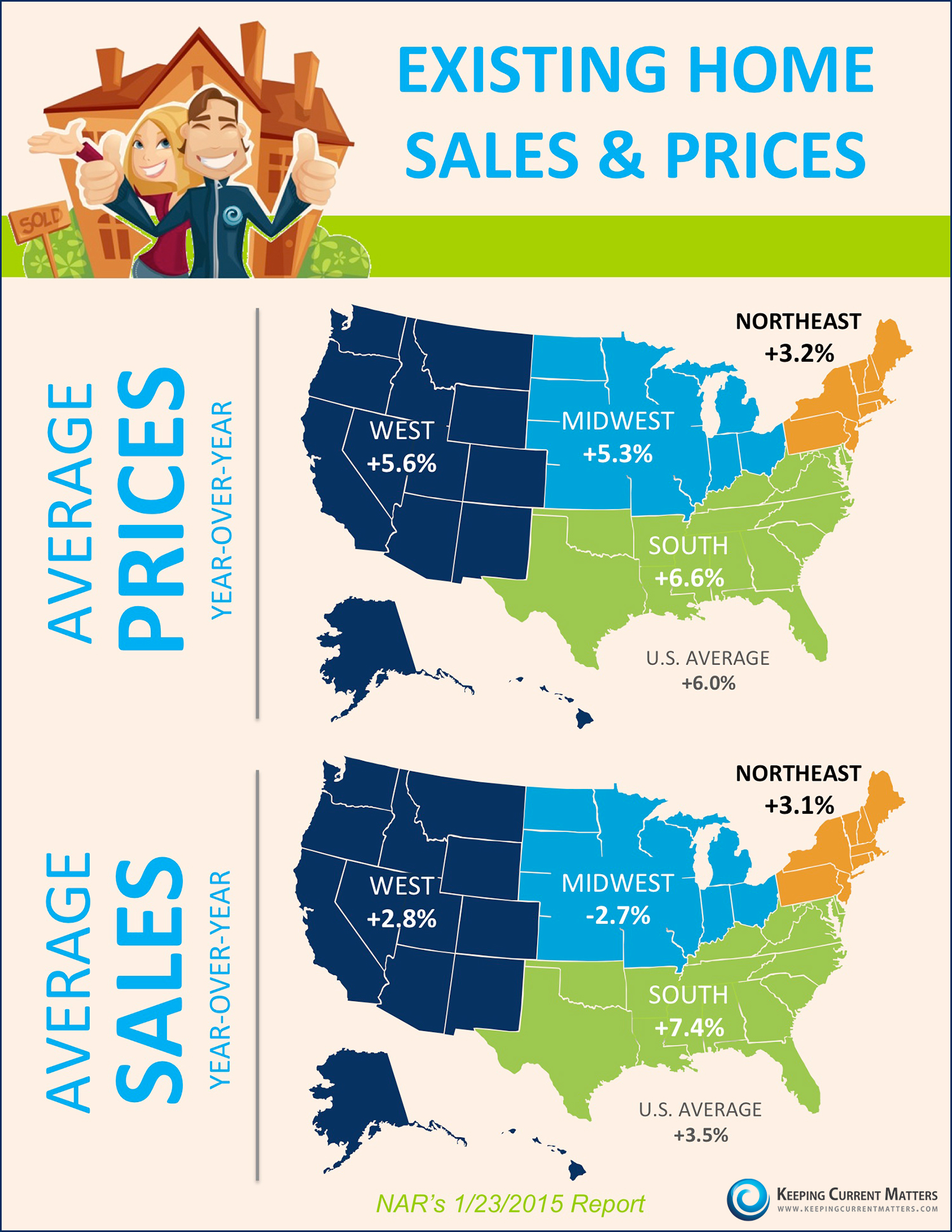

The National Association of Realtors (NAR) reports that the median price of an existing home (for all housing types) rose year-over-year for the 35th consecutive month.

Not all who are renovating are planning on staying in their home. The Demand Institute reports that “nearly half of American households plan to move at some point in the future.”

For those who are planning on listing their home this spring, spending the time and money needed to update that 1950’s bathroom or kitchen can fetch higher prices in today’s market.

Meeting with a local real estate professional can give you insight into the small (or big) improvements your home could use to draw the highest price and return on investment this spring. Have Questions about our local market? - Please give me a call - Christie Cannon - 469-951-9588

The housing market has taken a great turn toward recovery over the last few years. The opinions of the American public toward real estate took longer to recover, until recently.

For the first time since 2006, Americans have an overall positive view of real estate, giving the industry a 12% positive ranking in a Gallup poll.

Americans were asked to rate 24 different business sectors and industries on a five-point scale ranging from "very positive" to "very negative." The poll was first conducted in 2001, and has been used as an indicator of “Americans’ overall attitudes toward each industry”.

Americans’ view of the real estate industry worsened from 2003 to the -40% plummet of 2008. Gallup offers some insight into the reason for decline:

“In late 2006, real estate prices in the U.S. began falling rapidly, and continued to drop. Many homeowners saw their home values plummet, likely contributing to real estate's image taking a hard hit.”

“The large drops in the positive images of banking and real estate in 2008 and 2009 reflect both industries' close ties to the recession, which was precipitated in large part because of the mortgage-related housing bubble.”

“Although the image of real estate remains below the average of 24 industries Gallup has tracked, the sharp recovery from previous extreme low points suggests it is heading in the right direction.”

- Have Questions? Call Christie - 469-951-9588

Another national Real Estate source affirms strengthin the DFW market

December 2014 - Core Logic Home Price Index Report

- Hvae questions about the local market? Please feel free to give me a call - Christie Cannon - Keller Williams Frisco - 469-951-9588

Looking for more Local Data - Try Here for data or Here for a custom report on your home.

Have Questions? - You can always give me a call at 469-951-9588 - Christie Cannon

Why Have Interest Rates Dropped Despite Predictions of Rising Rates?

The headlines agree mortgage interest rates have dropped substantially below initial projections. Many who are considering purchasing a home, or moving up to their dream home, might think that they should wait to buy, because rates may continue to fall.

A recent article on the Economists’ Outlook blog by the National Association of REALTORS® (NAR) provides insight into one major factor in the decline in interest rates, the crude oil price.

“As of January 5, 2015, the U.S. Energy Information Administration (EIA) reported that the price of regular gasoline was $2.20/gallon, the lowest since gas prices peaked to about $ 4/gallon in May 2011.”

You may have noticed that filling your gas tank has become substantially less expensive in recent months. A welcome change from the close to $5 a gallon that many Americans were paying this time last year. The average US household is projected to save around $550 in 2015.

NAR explains the correlation like this:

“Lower oil prices mean lower inflation rate, which pushes down mortgage rates.”

Based on Freddie Mac’s weekly mortgage survey as of January 22, 2015, the 30-year fixed rate averaged 3.63% and the 15-year fixed rate averaged 2.93%.

“The decline in oil prices is generally positive to households by way of the gas savings and lower mortgage payments. That savings will boost consumer spending in other areas. But there may be some layoffs in oil-producing states.”

No one really knows how long oil prices will continue to support low mortgage rates. In a New York Times article, the author points to the fact that “adding hundreds of billions of dollars to consumer spending” could start to have a “counter effect” on rates as the economy continues to strengthen.

“If firms start hiring again, and wages increase — that’s when the level of all interest rates in the U.S. would increase.”

The low interest rates we are currently experiencing are not going to stay around forever. The current projections from Freddie Mac, Fannie Mae, NAR and the Mortgage Bankers Association all agree that interest rates will increase to between 4.3-5.4% by the end of 2015.

NAR reports: “At the median home price of $205,300, a 0.75 percentage point drop in mortgage rates will yield savings of about $1,000 annually.”

- Looking for a Mortgage Expert to assist you? Please feel free to give me a call - 469-951-9588

Displaying blog entries 11-20 of 22