A Snapshot of Today's Sellers

A Snapshot of Today's Sellers

Christie Cannon | REALTOR

The Christie Cannon Team

Keller Williams Realty Frisco

972-215-7747

www.ChristieCannon.com

www.CannonTeamHomes.com

Displaying blog entries 311-320 of 517

A Snapshot of Today's Sellers

Christie Cannon | REALTOR

The Christie Cannon Team

Keller Williams Realty Frisco

972-215-7747

www.ChristieCannon.com

www.CannonTeamHomes.com

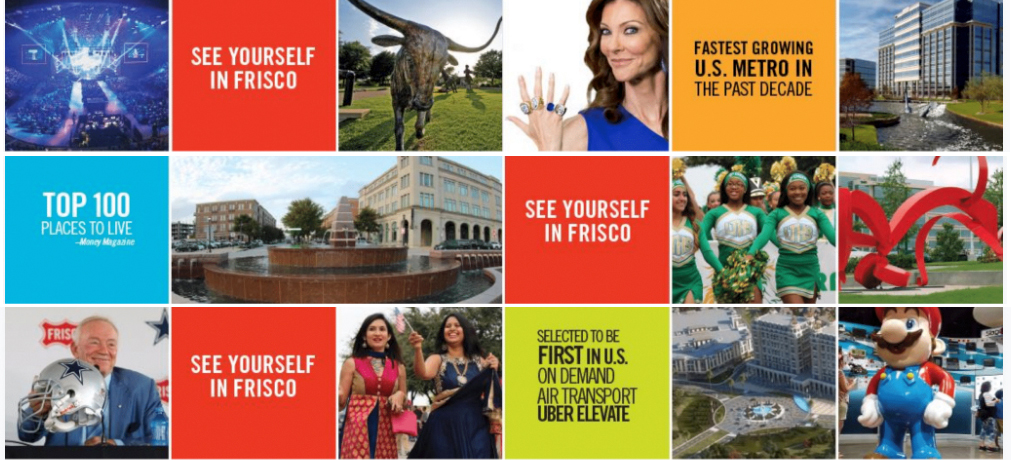

Do You Need Any More Reasons to Love Frisco?

The Frisco Economic Development Corporation recently released a list of top accolades the Fastest Growing U.S. Metro in the past decade has earned.

From "Best Places to Live in America" to the "Best Real Estate Market", let this list be your top reasons why you should "See Yourself in Frisco"!

.jpg)

.jpg)

.jpg)

Christie Cannon | REALTOR

The Christie Cannon Team

Keller Williams Realty Frisco

972-215-7747

www.ChristieCannon.com

www.CannonTeamHomes.com

Best Property Investment Market in 2019 is in DFW

Dallas-Fort Worth tops the list of U.S. cities that real estate industry execs say will be the best for their business in 2019.

The annual Emerging Trends in Real Estate report, which polled industry leaders on their outlook for 79 U.S. cities, rated DFW the highest for property investment & construction.

"I'm thrilled to see Dallas at the top of the list again," said Byron Carlock, national real estate leader with PriceWaterhouseCoopers, which, with the Urban Land Institute, sponsors the annual survey. "Dallas is doing a lot of things right.

"Dallas is one of the bright spots in our country," Carlock said. "We are watching Dallas lead the way among major cities pivoting to the new economy."

Read the full report here.

Christie Cannon | REALTOR

The Christie Cannon Team

Keller Williams Realty Frisco

972-215-7747

www.ChristieCannon.com

www.CannonTeamHomes.com

![3 Tips for Making Your Dream of Buying A Home Come True [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/02/20084419/3-Tips-ENG-MEM-1046x1354.jpg)

Christie Cannon | REALTOR

The Christie Cannon Team

Keller Williams Realty Frisco

972-215-7747

www.ChristieCannon.com

www.CannonTeamHomes.com

Google Plans to Open 2nd Data Center in North Texas

Google has announced it has plans underway to open a second data center in the North Texas area.

The first data center is currently underway in Midlothian, just south of Dallas. Google has not specified where exactly the second location will be, but it is not unlikely that it would be in the Collin or Denton county areas.

“This growth will allow us to invest in the communities where we operate, while we improve the products and services that help billions of people and businesses globally,” said Google CEO Sundar Pichai in a blog post. “Our new data center investments, in particular, will enhance our ability to provide the fastest and most reliable services for all our users and customers.”

The Google data centers house powerful equipment to handle internet traffic. Last year, Google spent $9 billion on expansions across the United States. This year, Google plans to invest over $13 billion in technology upgrades, and bring offices and data centers to other states, including Nebraska, Nevada, Ohio, Oklahoma, South Carolina and Virginia.

As of now, there is no expected completion date for either the Midlothian data center or the other North Texas data center.

Christie Cannon | REALTOR

The Christie Cannon Team

Keller Williams Realty Frisco

972-215-7747

www.ChristieCannon.com

www.CannonTeamHomes.com

In a CNBC article, self-made millionaire David Bach explained that: “The biggest mistake millennials are making is not buying their first home.” He goes on to say that, “If you want to build real financial security, real wealth for your lifetime, then you need to buy a home.”

Bach went on to explain:

“Homeowners are worth 40 times more than renters. Now, that first home doesn’t need to be a dream home, it can be a very small home. You might literally have to buy a small studio apartment, but that’s how you get started.”

Then he explains the secret to buying that home!

“Don’t do a 30-year mortgage. You want to take that 30-year mortgage and instead pay it off early, do a 15-year mortgage. What happens if you do a 15-year mortgage? Well, one, you pay the mortgage off 15-years sooner, that means you’ll be able to retire in your fifties. Number two, you’ll save a fortune (on potentially hundreds of thousands of dollars in interest payments).”

What will it cost to pay your mortgage in fifteen years? He explains further:

“For fifteen years, you got to brownbag your lunch. Think about that! Brownbag your lunch literally for fifteen years. You can retire ten years sooner than your friends. You’ll have real wealth, because you bought a home – you’re not a renter. And you’ll be financially secure for life.”

Whenever a well-respected millionaire gives investment advice, people usually clamor to hear it. This millionaire gave simple advice – if you don’t yet live in your own home, go buy one.

Bach is a self-made millionaire who has written nine consecutive New York Times bestsellers. His book, “The Automatic Millionaire,” spent 31 weeks on the New York Times bestseller list. He is one of the only business authors in history to have four books simultaneously on the New York Times, Wall Street Journal, BusinessWeek and USA Today bestseller lists.

He has been a contributor to NBC’s Today Show, appearing more than 100 times, as well as a regular on ABC, CBS, Fox, CNBC, CNN, Yahoo, The View, and PBS. He has also been profiled in many major publications, including the New York Times, BusinessWeek, USA Today, People, Reader’s Digest, Time, Financial Times, Washington Post, the Wall Street Journal, Working Woman, Glamour, Family Circle, Redbook, Huffington Post, Business Insider, Investors’ Business Daily, and Forbes.

Christie Cannon | REALTOR

The Christie Cannon Team

Keller Williams Realty Frisco

972-215-7747

www.ChristieCannon.com

www.CannonTeamHomes.com

Welcome to North Texas! Major Companies Continue to Flock to the Area

Global powerhouses with household names and large workforces continue to flock to North Texas. Companies like Toyota, Pizza Hut, Keurig Dr Pepper, Frito Lay & JCPenney have all left their longtime headquarters and set up new ones right here.

Global powerhouses with household names and large workforces continue to flock to North Texas. Companies like Toyota, Pizza Hut, Keurig Dr Pepper, Frito Lay & JCPenney have all left their longtime headquarters and set up new ones right here.

The latest of these is the PGA of America. who announced in December it would be making its new home in North Texas.

"There's an ecosystem of companies there now and they're in very innovative cities," says Bryan Daniel, executive director for economic development and tourism in Texas Gov. Greg Abbott's office.

The corporate buzz about North Texas is focused on suburban communities, particularly in Plano and Frisco. But other communities – Allen, McKinney and Prosper – are waiting in the wings. Talk to anyone in the North Texas business community, and they tout a good cost of living, excellent schools, housing that's affordable with lots of price points, safe neighborhoods, access to arts and sports, racial and ethnic diversity and Dallas/Fort Worth International Airport.

It is common knowledge that a great number of homes sell during the spring buying season. For that reason, many homeowners hold off putting their homes on the market until then. The question is whether or not that is a good strategy this year.

The other listings that come out in the spring will represent increased competition to any seller. Do a greater number of homes actually come to the market during this season in comparison to the rest of the year? The National Association of Realtors (NAR) recently revealed the months during which most people listed their homes for sale in 2018. This graphic shows the results:

The three months in the second quarter of the year (represented in red) are consistently the most popular months for sellers to list their homes on the market. Last year, the number of homes available for sale in January was 1,520,000.

With the national job situation improving and mortgage interest rates projected to rise later in the year, buyers are not waiting until the spring; they are out looking for homes right now.

If you are looking to sell this year, waiting until the spring to list your home means you will have the greatest competition amongst buyers. Beat the rush of housing inventory that will enter the market and list your home today!

Christie Cannon | REALTOR

The Christie Cannon Team

Keller Williams Realty Frisco

972-215-7747

www.ChristieCannon.com

www.CannonTeamHomes.com

North Texas Homeowners are Hatching Larger Nest Eggs

While home prices are slowing down in appreciation rate, most North Texas homeowners have already built up large nest eggs in their home values.

The average return on home sales across the country was the highest since before the Great Recession and equaled a 32 percent gain on the property's original purchase price. The profits were even greater in the D-FW area, where the average owner made $78,865 off the sale of their home. That represents a 45-percent gain.

In North Texas, the most equity rich homeowners are in about a dozen zip codes, where more than half the properties have mortgages of half or less the current value.

The D-FW neighborhoods with the largest share of equity rich homeowners includes the 75224 zip code in southwest Dallas (62 percent), the 76014 zip code in Arlington (59 percent) and 76106 in Fort Worth (58 percent).

Read the full report here.

Christie Cannon | REALTOR

The Christie Cannon Team

Keller Williams Realty Frisco

972-215-7747

www.ChristieCannon.com

www.CannonTeamHomes.com

Headlines spotlight the fact that buying a home is less affordable today than it was at any other time in more than a decade. Those headlines are accurate.

Understandably, buying a home is more expensive now than immediately following one of the worst housing crashes in American history. Over the past decade, the market was flooded with distressed properties (foreclosures and short sales) selling at 10-50% discounts. There were so many that this lowered the prices of non-distressed homes in the same neighborhoods. As a result, mortgage rates were kept low to help the economy.

Prices have since recovered. Mortgage rates have increased as the economy has gained strength. This has impacted housing affordability. However, it’s necessary to give historical context to the subject of affordability.

Two weeks ago, CoreLogic reported on what they call the “typical mortgage payment”. As they explain:

“One way to measure the impact of inflation, mortgage rates and home prices on affordability over time is to use what we call the ‘typical mortgage payment.’ It’s a mortgage-rate-adjusted monthly payment based on each month’s U.S. median home sale price. It is calculated using Freddie Mac’s average rate on a 30-year fixed-rate mortgage with a 20 percent down payment…

The typical mortgage payment is a good proxy for affordability because it shows the monthly amount that a borrower would have to qualify for to get a mortgage to buy the median-priced U.S. home…

When adjusted for inflation, the typical mortgage payment puts homebuyers’ current costs in the proper historical context.”

Here is a graph showing the results of CoreLogic’s research:

As the graph indicates, the most recent calculation remained 28% below the all-time peak of $1,275 in June 2006. That’s because the average mortgage rate at that time was 6.68%. As seen in the graph, both today’s typical payment and CoreLogic’s projection for the end of the year are less than it was in January 2000.

Even though home prices are appreciating at a slower rate, home affordability will likely continue to slide. However, this does not mean that buying a house is an unattainable goal in most markets. It is still less expensive today than it was prior to the housing bubble and crash.

Christie Cannon | REALTOR

The Christie Cannon Team

Keller Williams Realty Frisco

972-215-7747

www.ChristieCannon.com

www.CannonTeamHomes.com

Displaying blog entries 311-320 of 517