The Difference An Hour Makes

The Difference an Hour Will Make This Fall

![The Difference an Hour Will Make This Fall [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/10/29073213/20191101-MEM-1046x1354.jpg)

Every Hour in the U.S. Housing Market:

- 614 Homes Are Sold

- 95 Homes Regain Positive Equity

- Median Home Values Go Up $1.38

Displaying blog entries 21-30 of 33

![The Difference an Hour Will Make This Fall [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/10/29073213/20191101-MEM-1046x1354.jpg)

![Buying a home can be SCARY…Until you know the FACTS [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/10/22080625/20191025-MEM-1046x667.jpg)

Many potential homebuyers believe they need a 20% down payment and a 780 FICO® score to qualify to buy a home. This stops many people from even trying to jump into homeownership! Here are some facts to help take the fear out of the process:

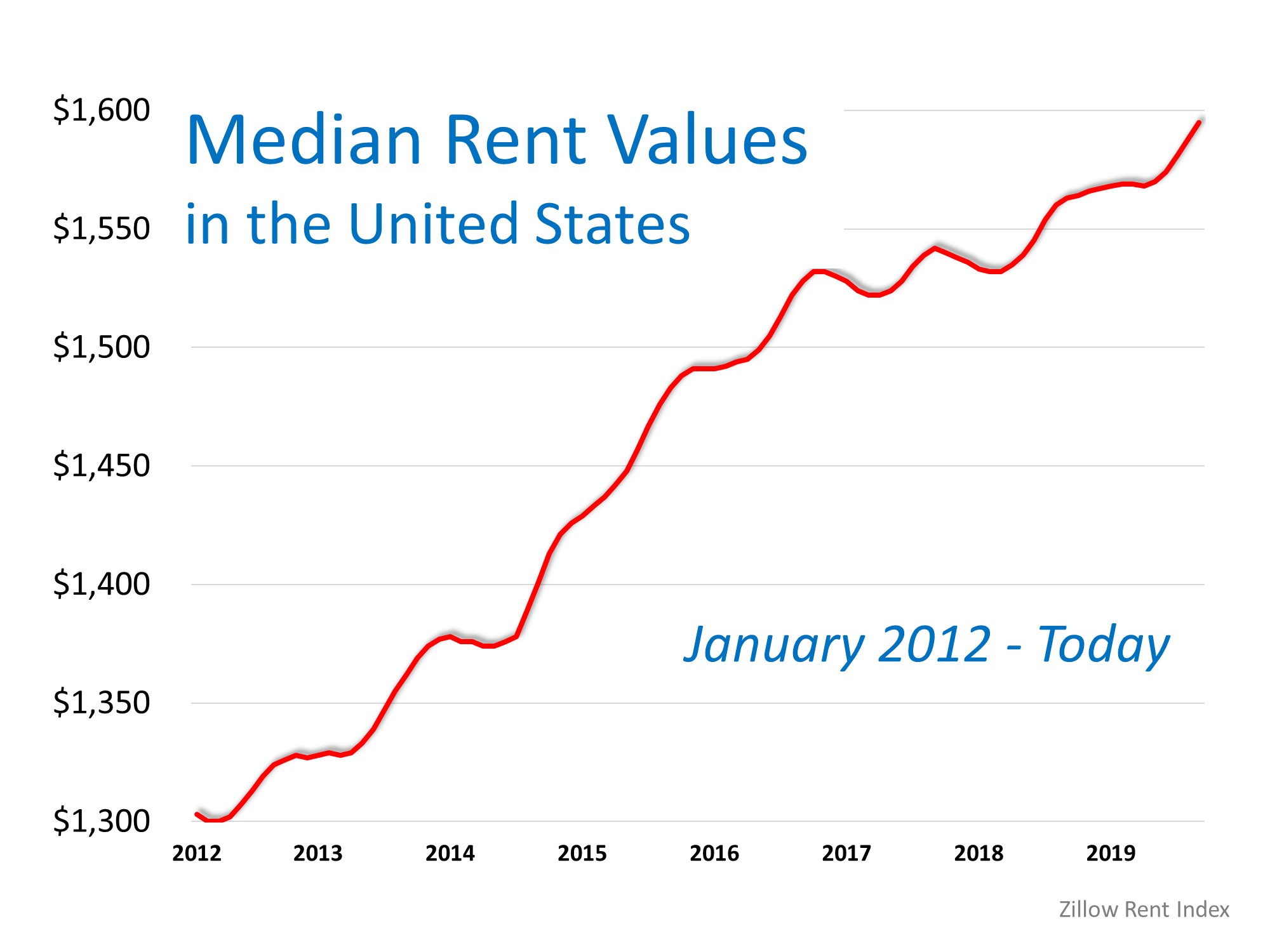

Much has been written about how residential real estate values have increased since the housing market started its recovery in 2012. However, little has been shared about what has taken place with residential rental prices. Let’s shed a little light on this subject.

In the most recent Apartment Rent Report, RentCafe explains how rents have continued to increase over the last twelve months because of a large demand and a limited supply.

“Continued interest in rental apartments and slowing construction keeps the national average rent on a strong upward trend.”

Zillow, in its latest Rent Index, agreed that rents are continuing on an “upward trend” across most of the country, and that the trend is accelerating:

“The median U.S. rent grew 2% year-over-year, to $1,595 per month. National rent growth is faster than a year ago, and while 46 of the 50 largest markets are showing deceleration in annual home value growth, annual rent growth is accelerating in 41 of the largest 50 markets.”

The Zillow report went on to detail rent increases since the beginning of the housing market recovery in 2012. Here is a graph showing the increases:

It is true that home prices have risen over the past seven years, increasing the cost of owning a home. However, the cost of renting a home has also increased over that same time period.

In today’s market, low inventory dominates the conversation in many areas of the country. It can often be frustrating to be a first-time homebuyer if you aren’t prepared. Here are five tips from realtor.com’s article, “How to Find Your Dream Home—Without Losing Your Mind.”

1. Get Pre-Approved for a Mortgage Before You Start Your Search

One way to show you’re serious about buying your dream home is to get pre-qualified or pre-approved for a mortgage. Even if you’re in a market that is not as competitive, understanding your budget will give you the confidence of knowing whether or not your dream home is within your reach. This will help you avoid the disappointment of falling in love with a home well outside your price range.

2. Know the Difference Between Your ‘Must-Haves’ and ‘Would-Like-To-Haves’

Do you really need that farmhouse sink in the kitchen to be happy with your home choice? Would a two-car garage be a convenience or a necessity? Before you start your search, list all the features of a home you would like. Qualify them as ‘must-haves’, ‘should-haves’, or ‘absolute-wish list’ items. This will help you stay focused on what’s most important.

3. Research and Choose a Neighborhood Where You Want to Live

Every neighborhood has unique charm. Before you commit to a home based solely on the house itself, take a test-drive of the area. Make sure it meets your needs for “amenities, commute, school district, etc. and then spend a weekend exploring before you commit.”

4. Pick a House Style You Love and Stick to It

Evaluate your family’s needs and settle on a style of home that will best serve those needs. Just because you’ve narrowed your search to a zip code doesn’t mean you need to tour every listing in that vicinity. An example from the article says, “if you have several younger kids and don’t want your bedroom on a different level, steer clear of Cape Cod–style homes, which typically feature two or more bedrooms on the upper level and the master on the main.”

5. Document Your Home Visits

Once you start touring homes, the features of each individual home will start to blur together. The article suggests keeping your camera handy and making notes on the listing sheet to document what you love and don’t love about each property you visit.

In a high-paced, competitive environment, any advantage you can give yourself will help you on your path to buying your dream home.

![4 Reasons to Sell This Fall [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/09/19104136/20190920-MEM-1046x808.jpg)

The Christie Cannon Team is proudly sponsoring The District Concert Series! Join us every Friday evening in October for some music, food and fun! Located at The Shops at Willowbend, The District hosted it's first concert series last year! See the flyer below to see the line up.

Contact us at 972-215-7747 if you have any questions! We can't wait to see you there!

Can you say “reversion to the norm”?

Last week realtor.com released the results of a survey that produced three major revelations:

Since we are currently experiencing the longest-ever economic expansion in American history, there is reason to believe a recession could occur in the not-too-distant future. And, it does make sense that buyers and sellers remember the horrors of 2008 when they hear the word “recession.”

Ali Wolf, Director of Economic Research at the real estate consulting firm Meyers Research, addressed this point in a recent interview:

“With people having PTSD from the last time, they’re still afraid of buying at the wrong time.”

Most experts, however, believe if there is a recession, it will not resemble 2008. This housing market is in no way the same as it was just over a decade ago.

Zillow Economist, Jeff Tucker, explained the difference in a recent article, Recessions Typically Have Limited Effect on the Housing Market:

“As we look ahead to the next recession, it's important to recognize how unusual the conditions were that caused the last one, and what's different about the housing market today. Rather than abundant homes, we have a shortage of new home supply. Rather than risky borrowers taking on adjustable-rate mortgages, we have buyers with sterling credit scores taking out predictable 30-year fixed-rate mortgages. The housing market is simply much less risky than it was 15 years ago."

George Ratiu, Senior Economist at realtor.com, also weighed in on the subject:

“This is going to be a much shorter recession than the last one, I don't think the next recession will be a repeat of 2008...The housing market is in a better position.”

In the past 23 years, there have been two national recessions – the dot-com crash in 2001 and the Great Recession in 2008. It is true that home values fell 19.7% during the 2008 recession, which was caused by a mortgage meltdown that heavily impacted the housing market. However, while stock prices fell almost 25% in 2001, home values appreciated 6.6%. The triggers of the next recession will more closely mirror those from 2001 – not those from 2008.

No one can accurately predict when the next recession will occur, but expecting one could possibly take place in the next 18-24 months is understandable. It is, however, important to realize that the impact of a recession on the housing market will in no way resemble 2008.

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/Z7XCJIUJVPW55LPV3DJGYD7LD4.jpg)

Displaying blog entries 21-30 of 33