Storm & High Winds Take Down Frisco TX Silo!

Displaying blog entries 461-470 of 517

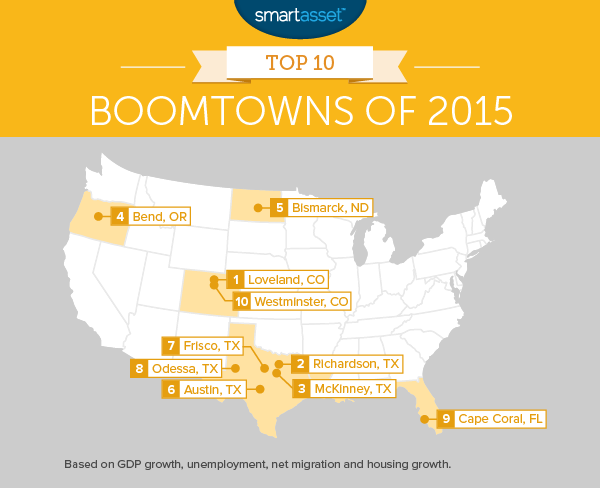

A few days ago I posted on Smartasset.com's Top Boomtowns from 2015.

Published in Nov, 2015, Smartasset released their top 25 list of the Safest Cities in America, Texas gracing 11 of the top 25 posts!

Our very own, Frisco TX makes the list at #10!

- Christie Cannon - Keller Williams Frisco

Once again, Texas (and especially North TX) boasts strong standing in a natioanl "Top 10" list.

Smartasset.com just published their list of 2015 top 10 Boomtowns, with Texas holding 5 of the top 10 spots!

Holding top honors for Texas, the list finds:

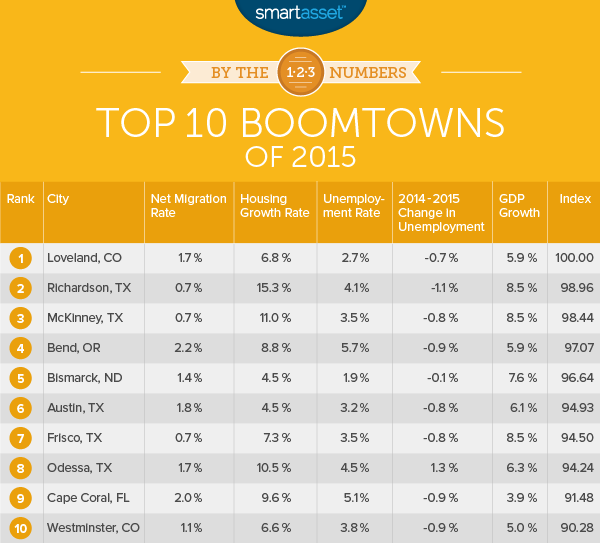

The National Association of REALTOR has recently published their latest report on existing homes sales for November (likewise, they revised their October numbers). The most recent report Existing Home Sales offers that preowned home sales:

“…fell 10.5 percent to a seasonally adjusted annual rate of 4.76 million in November (lowest since April 2014 at 4.75 million)…” The report reflects that November was the slowest in 19th months for existing home sales. This was displayed in a 10.5% decrease in month-over-month sales.

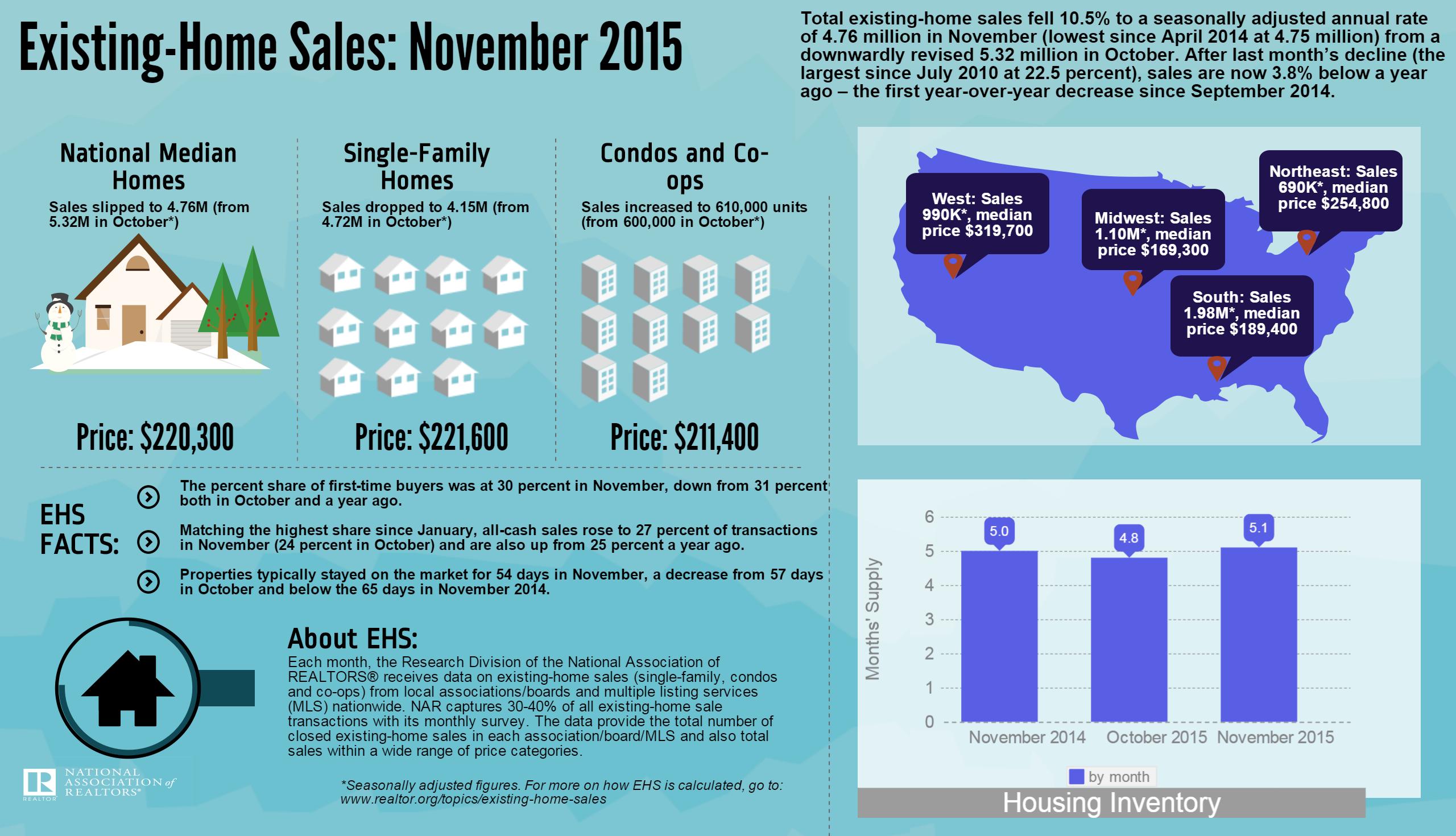

While there are still many hypotheses for the reasons of the drop, many industry insiders are placing a large portion of the blame on real estate’s adjustment to the latest changes in mortgage lending laws. With these adjustments, the industry has seen an overall increase in the amount of time it takes to close a traditional loan.

The numbers may seem miniscule on paper, the three day average increase reflects a whopping 15.7% of available banking days in November. Traditionally, most homes close in the last 3-days of the month, as such even a 2-3 day average increase “pushes” closings into the following month.

When we compare both written contract volume & anecdotal experience from the industry, most indications are that the sales are not lost. December reporting will be critical to see if the decrease was simply due to delay, or if November's numbers are a foreshadowing of a deeper market shift.

Christie Cannon - Keller Williams Frisco TX

New Master-Planned community announced west of the Dallas North Tollway & just north of Legacy! This new Hines development is situated in the heart of West Frisco & is expected to boast some of the area's top builders - Huntington Homes, Shaddock Homes, Darling Homes, Coventry Homes & Village Builders. With approimately 311 acres, Edgestone at Legacy is currently planned for single-family residences.

Nationwide just released their 2015 Q2 report on the Health of US Housing & incase the conflict of numbers is not great enough.... they rank TX negatively in affordability! Several years of strong housing has started to reflect a drop in housing affordability in Dallas & North Texas. While overall Dallas-Irving-Plano continue to rank in the top 10 best performing markets, this is largely due to our otherwise strong economic indicators. The entire Q2 2015 report can be viewed here!

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey.

Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.

Have questions about our local market - please feel free to give me a call - Christie Cannon - 469-951-9588

The price of any item is determined by the supply of that item, and the market demand. The National Association of Realtors (NAR) recently released their latest Existing Home Sales Report.

Sales of existing homes rose 3.2% from May, outpacing year-over-year figures for the ninth consecutive month. Total unsold housing inventory is at a 5.0-month supply.

This is down from May’s 5.1-month supply and remains below the 6 months that is needed for a historically normal market.

Consumer confidence is at the highest level in over a decade. Pair that with interest rates still around 4%, new programs available for down payments as low as 3%, and you have an attractive market for buyers.

Buyer demand for housing surged to it’s highest level since June 2013.

June marked the 40th consecutive month of year-over-year price gains as the median price of existing homes sold rose to $236,400 (up 6.5% from 2014).

The chart below shows the impact that inventory levels have on home prices.

NAR’s Chief Economist, Lawrence Yun gave some insight into the correlation:

"Limited inventory amidst strong demand continues to push home prices higher, leading to declining affordability for prospective buyers."

NAR’s President, Chris Polychron added:

"The demand for buying has really heated up this summer, leading to multiple bidders and homes selling at or above asking price."

If you are debating putting your home on the market in 2015, now may be the time. The number of buyers ready and willing to make a purchase is at the highest level in years. Contact a local professional in your area to get the process started.

The fact that residential home prices are increasing substantially in most regions of the country is music to the ears of homeowners. However, if you are in the process of selling your home, make sure you realize the major challenge a hot real estate market creates.

Each house must be sold twice; once to a buyer and a second time to an appraiser who represents the bank that will grant the purchaser a mortgage to buy the home (unless it is an “all cash” purchase). In a real market with escalating prices, the second sale may be the more difficult. And a recent survey by Quicken Loans reveals that the gap between what a homeowner believes is the value of their home compared to an appraiser is widening.

This could lead to an increase in the percentage of real estate transactions being challenged by a ‘short’ appraisal (where the appraiser value is less than the contracted price of the home).

Whether you are a buyer or a seller, you must be prepared for this possibility as it may result in a renegotiation of the price of the home.

Sky-rocketing rises in real estate values have left many people worrying if we are in the middle of another housing bubble.

According to Jack M. Guttentag, Professor of Finance Emeritus at the Wharton School of the University of Pennsylvania:

“A price bubble is a rise in price based on the expectation that the price will rise. Sooner or later something happens to erode confidence in continued price increases, at which point the bubble bursts and prices drop. What makes it a price bubble is that the cause of the price increase is an expectation that the price will increase, which sooner or later must reverse itself.”

In a recent article, he explained:

“My view is that we are a long way from another house price bubble. Home buyers, lenders, investors and regulators now understand that a nationwide decline in house prices is possible -- because we recently lived through one.”

Though home values are continuing to appreciate, the acceleration of the increases has slowed to year-over-year numbers which reflect a healthy housing market. Here is a chart showing year-over-year appreciation since January of last year:

The Take Away

Nick Timiraos of the Wall Street Journal put it best in a recent tweet:

“Predictions of a new national home price bubble look unfounded for now, according to data.”

Displaying blog entries 461-470 of 517