Preliminary Tax Values have Arrived - "Let's Get Ready to Rumble!"

Well the dreaded letter arrived; the good news, the market is up; the bad news, your county appraiser knows it...

So what comes next?

- Key things to keep in mind

- There are generally no costs in contesting your tax value (if you do so on your own),

- There is no separate penalty for protesting your taxes but not succeeding,

- Some counties allow for an "informal review" & even encourage such a review prior to an ARB (Appraisal Review Board) hearing,

- County procedures differ for the request of a review or protest (some allow mail or electronic methods, others require a scheduled appointment conducted in person),

- Like most "government" services, there is a processes that appears much more complex than it actually is,

- Your fellow citizens & residents serve as part of the final Appraisal Review Board,

- You have a right to review the information that the appraisal office used in determining your value.

- Thoroughly review your Notice of Appraised Value

- Have you taken full advantage of tax exceptions for which you qualify (Homestead if owned before Jan 1st, Over 65, etc),

- Is the information on your appraisal about your home correct?,

- Is the information on the CAD's (Central Appraisal District) website correct (bedrooms, SqFt, etc)

- Did your appraised value increase greater than 10%, if you have a homestead exemption & no new improvements.

- Understand what you can protest

- Proposed value,

- Denied exemptions for which you believe you qualify,

- Incorrect information regarding the scope or use of your property,

- Incorrect owner,

- Incorrect taxing units (authorities),

- Defects of the home or property that would otherwise affect the value.

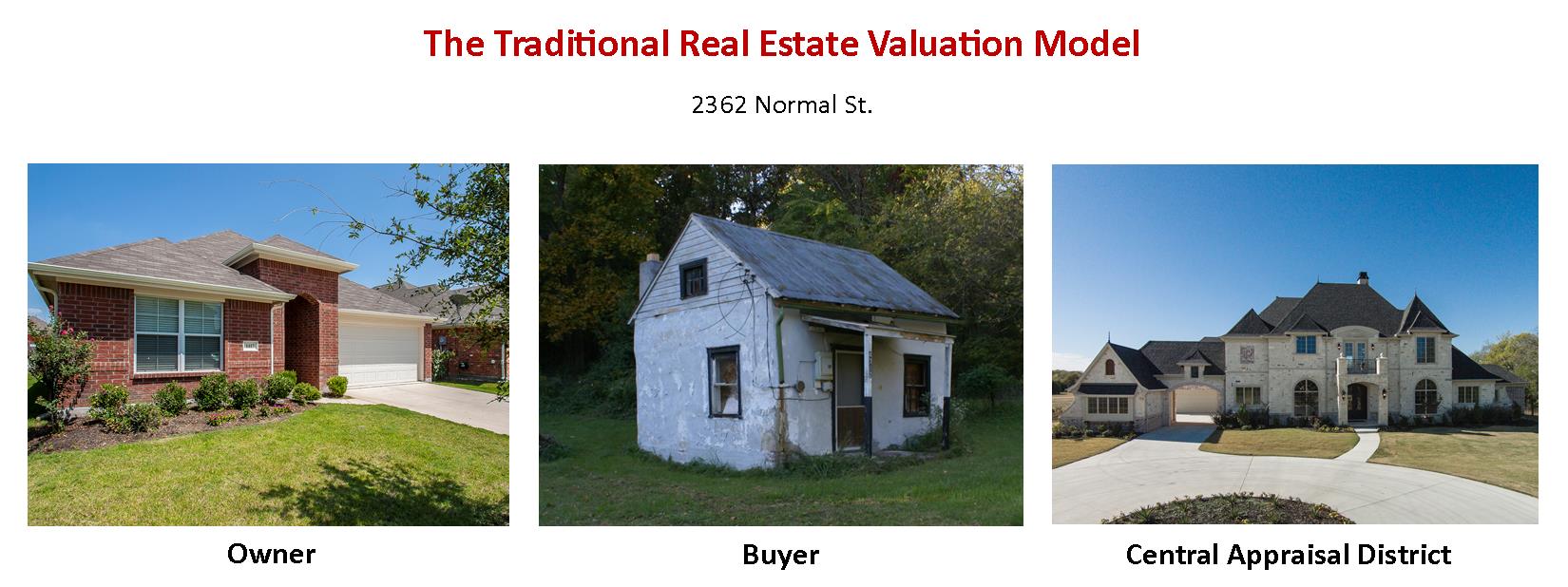

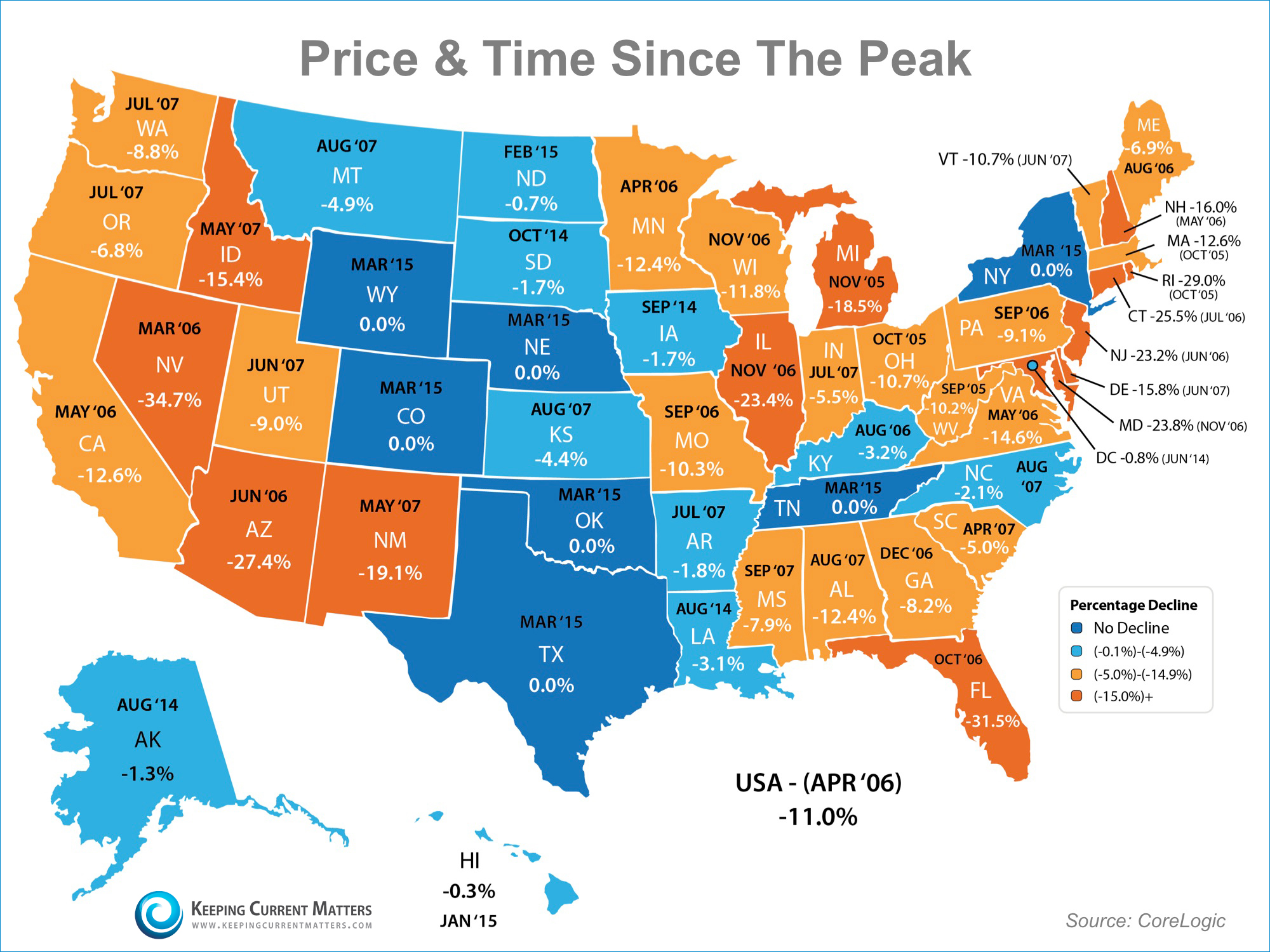

- Understand how value is derived in Texas for the property tax assessed value

- Appraisers look for homes that sold closest to Jan 1st in the tax year assessed

- Homes that are closest in size, year built, location, age, & construction style are given the greatest weight.

- Be Prepared - Bring organized data whether you are meeting "informally" with an appraiser or for an ARB hearing

- If you purchased or refinanced your home recently (especially close to Jan 1st) and your tax assessed value exceeds your sales price, bring your signed HUD-1 (Closing Disclosure) &/or a copy of the appraisal conducted for your mortgage

- Bring Sales Comps for comparable properties (see 4.2) & include: address, sale date, sale price, supporting docs, names of owners, MLS information, etc.

- Proof of defects of your home, functional or economic obsolescence

- Know your Dates, Deadlines, & Procedures

- File on-time or you may miss your chance

- In most cases your protest must be filed by May 31st (*BE SURE TO CHECK with your CAD!)

- READ YOUR COUNTY's PROTEST INFORMATION CAREFULLY - if you don't understand something, give them a call!

- Denton CAD (click for info)

- Dallas CAD (click for info)

- Collin CAD (click for info)

- Texas Comptroller of Public Accounts (click for info)

- Good Luck & please let me know if you have any questions - Christie Cannon

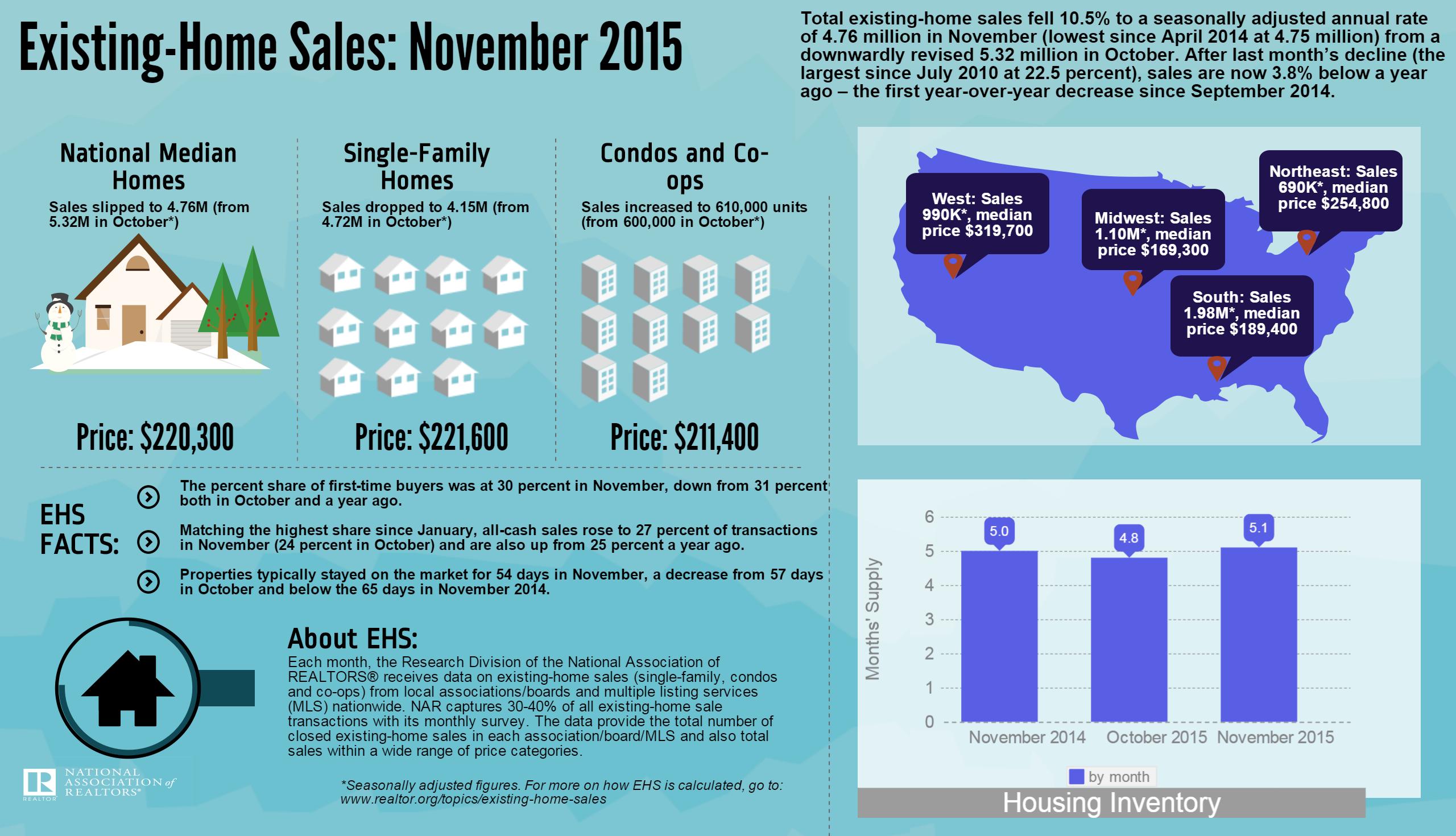

![Buyer Demand Exceeds Housing Supply [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2015/05/EHS-APRIL-KCM.jpg)