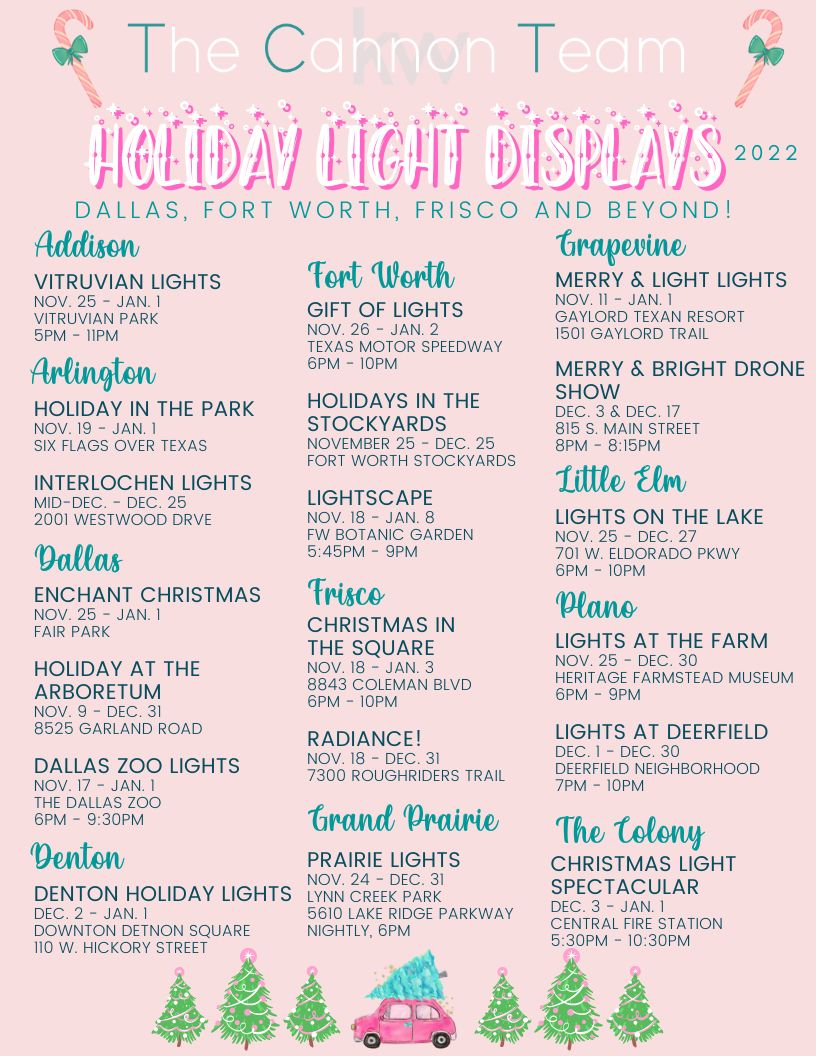

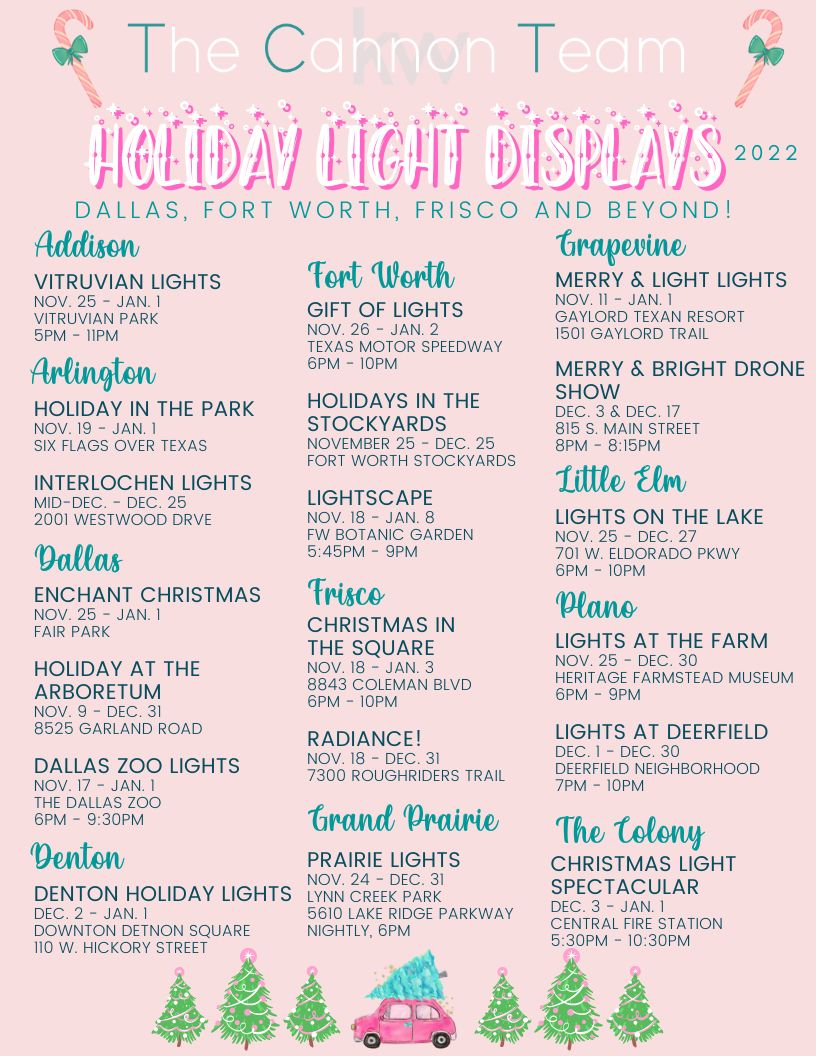

DFW Holiday Events

Brrrr.....Do you feel that chill? That can only mean one thing....

THE HOLIDAYS ARE HERE!

Check out all the cheery events happening all over DFW this holiday season!

Displaying blog entries 41-50 of 517

Brrrr.....Do you feel that chill? That can only mean one thing....

THE HOLIDAYS ARE HERE!

Check out all the cheery events happening all over DFW this holiday season!

While higher mortgage rates are creating affordability challenges for homebuyers this year, there is some good news for those people still looking to buy a home.

As the market has cooled this year, some of the intensity buyers faced during the peak frenzy of the pandemic has cooled too. Here are just a few trends that may benefit you when you go to buy a home today.

During the pandemic, housing supply hit a record low at the same time buyer demand skyrocketed. This combination made it difficult to find a home because there just weren’t enough to meet buyer demand. According to Calculated Risk, the supply of homes for sale increased by 39.5% for the week ending October 28 compared to the same week last year.

Even though it’s still a sellers’ market and supply is still lower than more normal levels, you have more to choose from in your home search. That makes finding your dream home a bit less difficult.

One of the top stories in real estate over the past two years was the intensity and frequency of bidding wars. But today, things are different. With more options, you’ll likely see less competition from other buyers looking for homes. According to the National Association of Realtors (NAR), the average number of offers on recently sold homes has declined. This September, the average was 2.5 offers per sale. In contrast, last September, the average was 3.7 offers per sale.

If you tried to buy a house over the past two years, you probably experienced the bidding war frenzy firsthand and may have been outbid on several homes along the way. Now you have a chance to jump back into the market and enjoy searching for a home with less competition.

And when you have less competition, you also have more negotiating power as a buyer. Over the last two years, more buyers were willing to skip important steps in the homebuying process, like the appraisal or inspection, to try to win a bidding war. But the latest data from the National Association of Realtors (NAR) shows the percentage of buyers waiving those contingencies is going down.

As a buyer, this is good news. The appraisal and the inspection give you important information about the value and condition of the home you’re buying. And if something turns up in the inspection, you have more power today to renegotiate with the seller.

A survey from realtor.com confirms more sellers are accepting offers that include contingencies today. According to that report, 95% of sellers said buyers requested a home inspection, and 67% negotiated with buyers on repairs as a result of the inspection findings.

While buyers still face challenges today, they’re not necessarily the same ones you may have been up against just a year or so ago. If you were outbid or had trouble finding a home in the past, now may be the moment you’ve been waiting for. Let’s connect to start the homebuying process today.

Does the latest news about the housing market have you questioning your plans to sell your house? If so, perspective is key. Here are some of the ways a trusted real estate professional can explain the shift that’s happening today and why it’s still a sellers’ market even during the cooldown.

While the supply of homes available for sale has increased this year compared to last, we’re still nowhere near what’s considered a balanced market. A recent article from Calculated Risk helps put this year’s increased inventory into context (see graph below):

It shows supply this year has surpassed 2021 levels by over 30%. But the further back you look, the more you’ll understand the big picture. Compared to 2020, we’re just barely above the level of inventory we saw then. And if you go all the way back to 2019, the last normal year in real estate, we’re roughly 40% below the housing supply we had at that time.

Why does this matter to you? When inventory is low, there is still demand for your house because there just aren’t enough homes available for sale.

And while homes aren’t selling as quickly as they did a few months ago, the average number of days on the market is still well below pre-pandemic norms – in large part because inventory is so low. The graph below uses data from the Realtors’ Confidence Index by the National Association of Realtors (NAR) to illustrate this trend:

As the graph shows, the pre-pandemic numbers (shown in blue) are higher than the numbers we saw during the pandemic (shown in green). That’s because the average days on the market started to decrease as homes sold at record pace during the pandemic. Most recently, due to the cooldown in the housing market, the average days on the market have started to tick back up slightly (shown in orange) but are still far below the pre-pandemic norm.

What does this mean for you? While it may not be as fast as it was a couple of months ago, homes are still selling much faster than they did in more normal, pre-pandemic years. And if you price it right, your home could still go under contract quickly.

Buyer demand has softened this year in response to rising mortgage rates. But again, perspective is key. Getting 3-5 offers like sellers did during the pandemic isn’t the norm. The graph below uses data from NAR going back to 2018 to help tell the story of this shift over time (see graph below):

Prior to the pandemic, it was typical for homes sold to see roughly 2-2.5 offers (shown in blue). As the market heated up during the pandemic, the average number of offers skyrocketed as record-low mortgage rates drove up demand (shown in green). But most recently, the number of offers on homes sold today (shown in orange) has started to return to pre-pandemic levels as the market cools from the frenzy.

What’s the takeaway for you? Buyer demand has moderated from the pandemic peak, but it hasn’t disappeared. The buyers are still out there, and if you price your house at current market value, you’ll still be able sell your house today.

If you have questions about selling your house in today’s housing market, let’s connect. That way you have context around what’s happening now, so you’re up to date on what you can expect when you’re ready to move.

Mortgage rates have increased significantly in recent weeks. And that may mean you have questions about what this means for you if you’re planning to buy a home. Here’s some information that can help you make an informed decision when you set your homebuying plans.

As mortgage rates rise, they impact your purchasing power by raising the cost of buying a home and limiting how much you can comfortably afford. Here’s how it works.

Let’s assume you want to buy a $400,000 home (the median-priced home according to the National Association of Realtors is $389,500). If you’re trying to shop at that price point and keep your monthly payment about $2,500-2,600 or below, here’s how your purchasing power can change as mortgage rates climb (see chart below). The red shows payments above that threshold and the green indicates a payment within your target range.

As the chart shows, as rates go up, the amount you can afford to borrow decreases and that may mean you have to look at homes at a different price point. That’s why it’s important to work with a real estate advisor to understand how mortgage rates impact your monthly mortgage payment at various home loan amounts.

The rise in mortgage rates and the resulting decrease in purchasing power may leave you wondering if you should wait for rates to go down before making your purchase. Realtor.com says this about where rates could go from here:

“Many homebuyers likely winced . . . upon hearing that the Federal Reserve yet again boosted its short-term interest rates by three-quarters of a percentage point—a move that’s pushing mortgage rates through the roof. And the already high rates are just going to get higher.”

So, if you’re waiting for mortgage rates to drop, you may be waiting for a while as the Federal Reserve works to get inflation under control.

And if you’re considering renting as your alternative while you wait it out, remember that’s going to get more expensive with time too. As Nadia Evangelou, Senior Economist and Director of Forecasting at the National Association of Realtors (NAR), says:

“There is no doubt that these higher rates hurt housing affordability. Nevertheless, apart from borrowing costs, rents additionally rose at their highest pace in nearly four decades.”

Basically, it is true that it costs more to buy a home today than it did last year, but the same is true for renting. This means, either way, you’re going to be paying more. The difference is, with homeownership, you’re also gaining equity over time which will help grow your net worth. The question now becomes: what makes more sense for you?

Each person’s situation is unique. To make the best decision for you, let's connect to explore your options.

If you’re following today’s housing market, you know two of the top issues consumers face are inflation and mortgage rates. Let’s take a look at each one.

This year, inflation reached a high not seen in forty years. For the average consumer, you probably felt the pinch at the gas pump and in the grocery store. It may have even impacted your ability to save money to buy a home.

While the Federal Reserve is working hard to lower inflation, the August data shows the inflation rate was still higher than expected. This news impacted the stock market and fueled conversations about a recession. It also played a role in the Federal Reserve’s decision to raise the Federal Funds Rate last week. As Bankrate says:

“. . . the Fed has raised rates again, announcing yet another three-quarter-point hike on September 21 . . . The hikes are designed to cool an economy that has been on fire. . .”

While their actions don’t directly dictate what happens with mortgage rates, their decisions have contributed to the intentional cooldown in the housing market. A recent article from Fortune explains:

“As the Federal Reserve moved into inflation-fighting mode, financial markets quickly put upward pressure on mortgage rates. Those elevated mortgage rates . . . coupled with sky-high home prices, threw cold water onto the housing boom.”

Over the past few months, mortgage rates have fluctuated in light of growing economic pressures. Most recently, the average 30-year fixed mortgage rate according to Freddie Mac ticked above 6% for the first time in well over a decade (see graph below):

The mortgage rate increases this year are the big reason buyer demand has pulled back in recent months. Basically, as rates (and home prices) rose, so did the cost of buying a home. That pushed on affordability and priced some buyers out of the market, so home sales slowed and the inventory of homes for sale grew as a result.

Moving forward, both of these factors will continue to impact the housing market. A recent article from CNET puts the relationship between inflation and mortgage rates in simple terms:

“As a general rule, when inflation is low, mortgage rates tend to be lower. When inflation is high, rates tend to be higher.”

Sam Khater, Chief Economist at Freddie Mac, has this to say about where rates may go from here:

“Mortgage rates remained volatile due to the tug of war between inflationary pressures and a clear slowdown in economic growth. The high uncertainty surrounding inflation and other factors will likely cause rates to remain variable, . . .”

While there’s no way to say with certainty where mortgage rates will go from here, there is something you can do to stay informed, and that’s connect with a trusted real estate advisor. They keep their pulse on what’s happening today and help you understand what the experts are projecting. They can provide you with the best advice possible.

Rising inflation and higher mortgage rates have had a clear impact on housing. For expert insights on the latest trends in the housing market and what they mean for you, let’s connect.

If recent headlines about the housing market cooling and buyer demand moderating have you worried you’ve missed your chance to sell, here’s what you need to know. Buyer demand hasn’t disappeared, it’s just eased from the peak intensity we saw over the past two years.

During the pandemic, mortgage rates hit record lows, and that spurred a significant rise in buyer demand. This year, as rates increased due to factors like rising inflation, buyer demand pulled back or softened as a result. The latest data from ShowingTime confirms this trend (see graph below):

The orange bars in the graph above represent the last few months of data and the clear cooldown in the volume of home showings the market has seen since mortgage rates started to rise. But context is important. To get the full picture of where today's demand stands, let's look at the July data for the past six years (see graph below):

This second visual makes it clear that, while moderating compared to the frenzy in 2020 and 2021, showing activity is still beating pre-pandemic levels – and those pre-pandemic years were great years for the housing market. That goes to show there’s still demand if you sell your house today.

The key to selling in a changing market is understanding where the housing market is now. It’s not the same market we had last year or even earlier this year, but that doesn’t mean the opportunity to sell has passed.

While things have cooled a bit, it’s still a sellers’ market. If you work with a trusted local expert to price your house at the current market value, the demand is still there, and it should sell quickly. According to a recent survey from realtor.com, 92% of homeowners who sold in August reported being satisfied with the outcome of their sale.

Buyer demand hasn’t disappeared, it’s just moderated this year. If you’re ready to sell your house today, let’s connect so you have expert insights on how the market has shifted and how to plan accordingly for your sale.

![A Crucial First Step: Mortgage Pre-Approval [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/09/15085222/20220916-MEM-1046x1558.png)

In a market that’s shifting as fast as it is today, many homeowners wonder what, if anything, needs to be renovated before they sell their house. That’s where a trusted real estate professional comes in. They can help you think through today’s market conditions and how they impact what you should – and shouldn’t – do before selling your house.

Here are some considerations a professional will guide you through.

Since the supply of homes for sale has increased so much this year, today’s buyers have more options than they had last year. That may mean you’re not able to ignore some of those repairs or cosmetic updates you could have skipped in previous months. As a recent article from realtor.com says:

“To stand out in the market, sellers should make their home attractive to buyers, which usually means some selective updates.”

The key word here is selective. Since it’s still a sellers’ market, focusing on a few key areas may be enough to make your house stand out from other options. And since inventory is still low overall, it’s also possible buyers may be willing to handle the renovations themselves once they move in. It all depends on buyer demand and the available inventory in your local area. For advice on what’s happening in your market and what to do to make your house show well, lean on a professional.

In addition to making sure your house makes a good first impression, you’ll also want to consider the return on your investment (ROI) for any renovations. According to the 2022 Remodeling Impact Report from the National Association of Realtors (NAR), here are the projects that could net you the best return when you sell your house (see visual below):

Again, your real estate advisor is your best resource. When your agent comes to your house for a walk-thru and consultation, they’ll use their expertise to offer any insight into what you may need to repair, replace, or refinish. They also know what other sellers are doing before listing their homes and how buyers are reacting to those upgrades to help steer you in the right direction. As Dr. Jessica Lautz, Vice President of Demographics and Behavioral Insights for NAR, explains:

“This year, the winner was hardwood flooring. Hardwood floor refinishing and putting in new wood flooring had the most significant value, . . .”

For any projects you’ve already completed or for those you plan to do before listing, make sure your real estate professional knows. They’re not just an advisor to help you decide where to focus your efforts, they’re also skilled at highlighting any upgrades in your listing. That way, potential buyers know about the features that may help sell them on the house.

No matter what, contact a local real estate professional for expert advice on what work needs to be done and how to make it as appealing as possible to future buyers. Every home is different, so a conversation with your agent is mission-critical to make sure you make the right moves when selling this season.

In today’s shifting market, it’s important to spend your time and money wisely when you’re getting ready to move. Let’s connect to find out where to focus your efforts before you sell.

If you’re thinking about buying a home, you likely have a lot of factors on your mind. You’re weighing your own needs against higher mortgage rates, today’s home prices, and more to try to decide if you want to jump into the market. While some buyers may wait things out, there’s a reason serious buyers are making moves right now, and that’s the growing number of homes for sale.

So far this year, housing inventory has been increasing and that’s making the prospect of finding your dream home less difficult. While there are always reasons you could delay making a big decision, there are also always reasons to consider moving forward. And having a growing number of options for your home search may be exactly what you needed to feel more confident in making a move.

As new data comes out, we're getting an updated picture of why housing supply is increasing so much this year. As Bill McBride, Author of Calculated Risk, explains:

“We are seeing a significant change in inventory, but no pickup in new listings. Most of the increase in inventory so far has been due to softer demand - likely because of higher mortgage rates.”

Basically, the inventory growth is primarily from homes staying on the market a bit longer (known as active listings). And that’s happening because higher mortgage rates and home prices have helped moderate the peak frenzy of buyer demand.

The graph below uses data from realtor.com to show how much active listings have risen over the past five months as a result (shown in green):

Regardless of the source, the increase in available housing supply is good for buyers. More housing supply actively for sale means you have more options as your search for your next home. A recent article from realtor.com explains just how significant the inventory growth has been and why it’s good news for your plans to buy:

“Nationally, the inventory of homes actively for sale on a typical day in July increased by 30.7% over the past year, the largest increase in inventory in the data history and higher than last month’s growth rate of 18.7% which was itself record-breaking. This amounted to 176,000 more homes actively for sale on a typical day in July compared to the previous year and more choice for buyers who are still looking for a new home.”

The growth this year is certainly good news for you, especially if you’ve had trouble finding a home that meets your needs. If you start your search today, those additional options should make it less difficult to find a home than it would have been over the past two years.

If you’re ready to jump into the market and take advantage of the increasing supply of homes for sale, let’s connect today. The opportunity is knocking, will you answer?

According to a recent survey from the Wall Street Journal, the percentage of economists who believe we’ll see a recession in the next 12 months is growing. When surveyed in July 2021, only 12% of economists consulted thought there’d be a recession by now. But this July, when polled, 49% believe we will see a recession in the coming 12 months.

And as more recession talk fills the air, one concern many people have is: should I delay my homeownership plans if there’s a recession?

Here’s a look at historical data to show what happened in real estate during previous recessions to help prove why you shouldn’t be afraid of what a recession would mean for the housing market today.

To show that home prices don’t fall every time there’s a recession, it helps to turn to historical data. As the graph below illustrates, looking at the recessions going all the way back to 1980, home prices appreciated in four of the last six recessions. So, historically, when the economy slows down, it doesn’t mean home values will fall.

Most people remember the housing crisis in 2008 (the larger of the two red bars in the graph above) and think another recession would repeat what happened then. But this housing market isn’t about to crash. The fundamentals are very different today than they were in 2008. So, don’t assume we’re heading down the same path.

Research also helps paint the picture of how a recession could impact the cost of financing a home. As the chart below shows, historically, each time the economy slowed down, mortgage rates decreased.

Fortune explains that mortgage rates typically fall during an economic slowdown:

“Over the past five recessions, mortgage rates have fallen an average of 1.8 percentage points from the peak seen during the recession to the trough. And in many cases, they continued to fall after the fact as it takes some time to turn things around even when the recession is technically over.”

And while history doesn’t always repeat itself, we can learn from and find comfort in the historical data.

There’s no doubt everyone remembers what happened in the housing market in 2008. But you don’t need to fear the word recession if you’re planning to buy or sell a home. According to historical data, in most recessions, home price gains have stayed strong, and mortgage rates have declined.

If you’re thinking about buying or selling a home, let’s connect so you have expert advice on what’s happening in the housing market and what that means for your homeownership goals.

Displaying blog entries 41-50 of 517