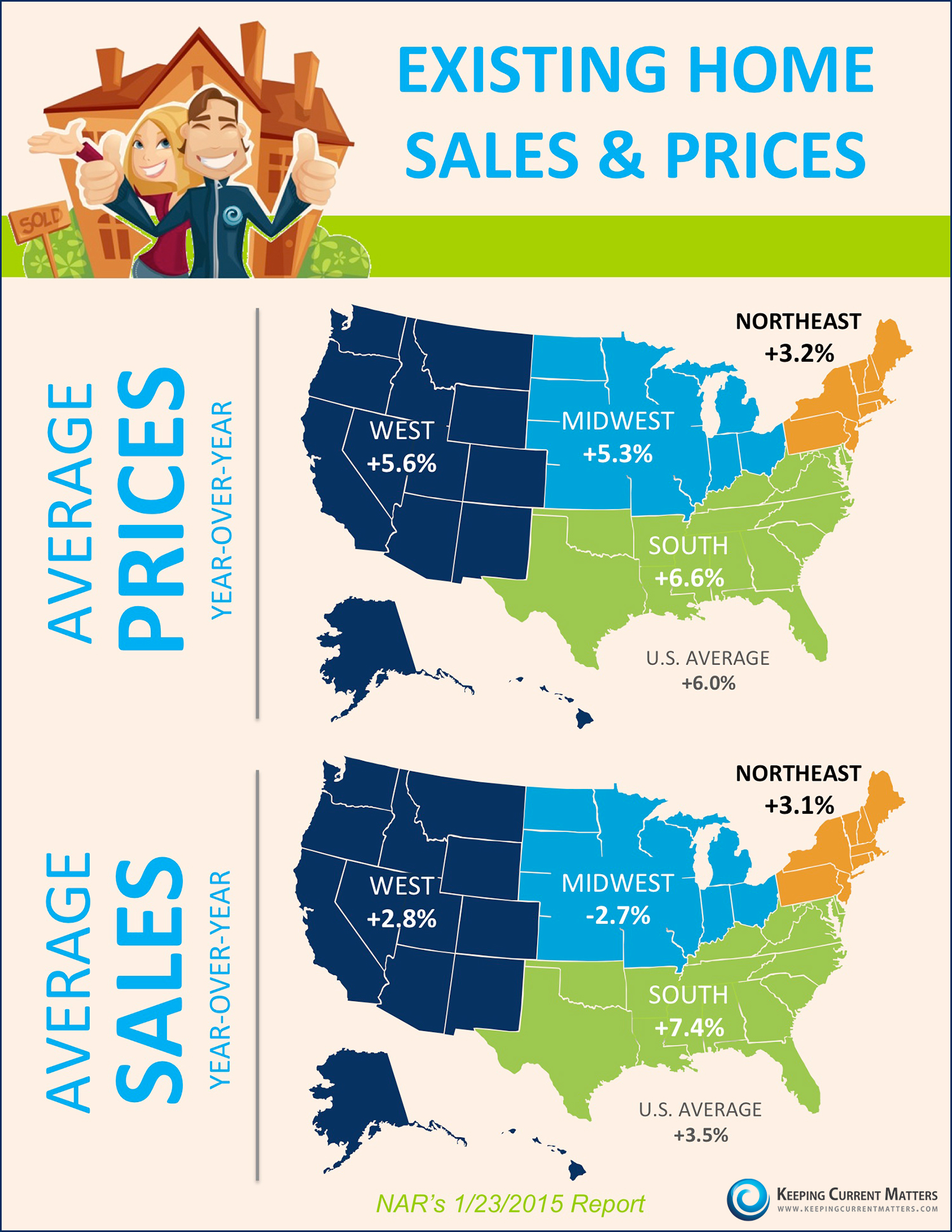

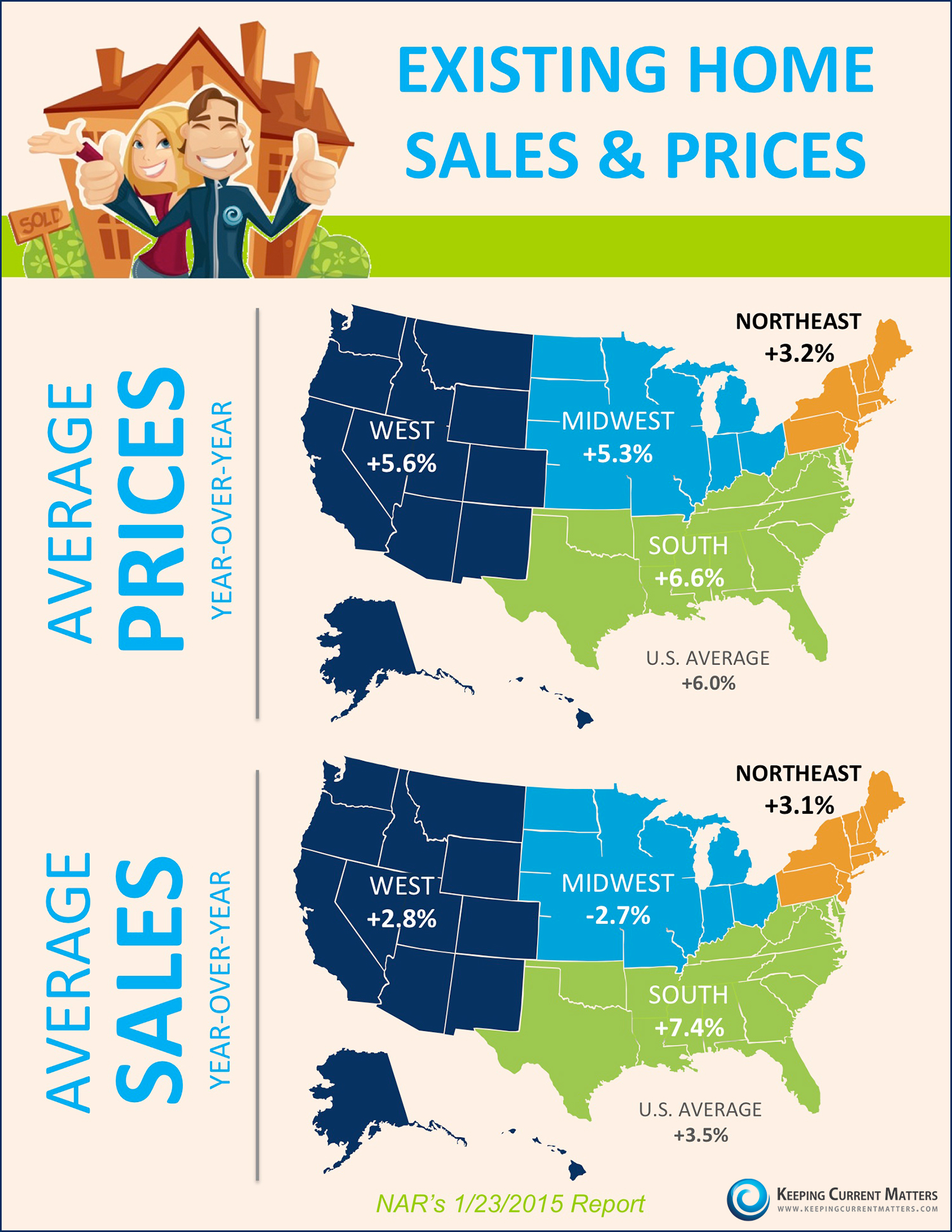

National Home Prices - Infographic

Looking for more Local Data - Try Here for data or Here for a custom report on your home.

Have Questions? - You can always give me a call at 469-951-9588 - Christie Cannon

Displaying blog entries 591-600 of 706

Looking for more Local Data - Try Here for data or Here for a custom report on your home.

Have Questions? - You can always give me a call at 469-951-9588 - Christie Cannon

Why Have Interest Rates Dropped Despite Predictions of Rising Rates?

The headlines agree mortgage interest rates have dropped substantially below initial projections. Many who are considering purchasing a home, or moving up to their dream home, might think that they should wait to buy, because rates may continue to fall.

A recent article on the Economists’ Outlook blog by the National Association of REALTORS® (NAR) provides insight into one major factor in the decline in interest rates, the crude oil price.

“As of January 5, 2015, the U.S. Energy Information Administration (EIA) reported that the price of regular gasoline was $2.20/gallon, the lowest since gas prices peaked to about $ 4/gallon in May 2011.”

You may have noticed that filling your gas tank has become substantially less expensive in recent months. A welcome change from the close to $5 a gallon that many Americans were paying this time last year. The average US household is projected to save around $550 in 2015.

NAR explains the correlation like this:

“Lower oil prices mean lower inflation rate, which pushes down mortgage rates.”

Based on Freddie Mac’s weekly mortgage survey as of January 22, 2015, the 30-year fixed rate averaged 3.63% and the 15-year fixed rate averaged 2.93%.

“The decline in oil prices is generally positive to households by way of the gas savings and lower mortgage payments. That savings will boost consumer spending in other areas. But there may be some layoffs in oil-producing states.”

No one really knows how long oil prices will continue to support low mortgage rates. In a New York Times article, the author points to the fact that “adding hundreds of billions of dollars to consumer spending” could start to have a “counter effect” on rates as the economy continues to strengthen.

“If firms start hiring again, and wages increase — that’s when the level of all interest rates in the U.S. would increase.”

The low interest rates we are currently experiencing are not going to stay around forever. The current projections from Freddie Mac, Fannie Mae, NAR and the Mortgage Bankers Association all agree that interest rates will increase to between 4.3-5.4% by the end of 2015.

NAR reports: “At the median home price of $205,300, a 0.75 percentage point drop in mortgage rates will yield savings of about $1,000 annually.”

- Looking for a Mortgage Expert to assist you? Please feel free to give me a call - 469-951-9588

Every home must be sold TWICE! Once to the buyer, and once to the bank appraiser if a mortgage is involved.

A new program announced by Fannie Mae may slow down the home-sale closing process by causing more disputes over prices between sellers and buyers.

In a recent Washington Post article they explained the basics of the program:

“Starting Jan. 26, Fannie plans to offer mortgage lenders access to proprietary home valuation databases that they can use to assess the accuracy and risks posed by the reports submitted by appraisers.”

“The Fannie data will flag possible errors in the appraiser’s work before the lender commits to fund the loan, will score the appraisal for overall risk of inaccuracy and may provide as many as 20 alternative “comps” — properties in the area that have sold recently and are roughly comparable to the house the lender is considering for financing but were not used by the appraiser.”

Using the additional information provided by Fannie Mae, the lender can then ask for an explanation from the appraisal company for any discrepancies and request an amended appraisal.

This added step in the process of determining the price of the home to be bought/sold, could add time to the closing process and cost to the appraisal for the additional work.

Fannie Mae wants lenders to make informed decisions when agreeing to the amount of a loan that a buyer will be approved for.

“Excessive valuations create the risk of future losses to lenders and investors if the borrower defaults and the house goes to foreclosure.”

You’ve put your house on the market, picked an agent who has helped you determine that the best price to list your home for is $250,000, and found a buyer willing to pay that price. The appraiser comes to the home and agrees your home is worth the asking price and writes their report. Everything is working perfectly!

You’ve found your dream home, in the right neighborhood, in the right school district, with the perfect yard, at the high end of your budget, but all the pluses are worth it. You agree on a price and start daydreaming about living in your new home.

The lender submits the appraisal report to the new Fannie Mae program and they come back with “lower-risk comps” that value the home at $230,000. The lender then turns to the appraisal company to justify the $20,000 difference, adding time and frustration to the process.

If the lender does not agree with the reasons for the price difference they will not lend the buyer the amount they need to purchase their dream home and the amicable, agreeable sale turns into a heated justification of the higher price. The buyer may even have to give up on the home if the funding isn’t there.

An article by Housing Wire shares the appraiser’s point of view:

“The bottom line, appraisers say, is this could lead to delays to closings and higher costs, as well as a depression of prices in markets where prices are rising.

Appraisers complain that if they have to justify every step of their comps for their valuation, rather than those coming from the one-size-fits-all evaluation from Fannie, it will delay closing, throw off buyer and seller timetables, and delay real estate broker commissions.”

The fear of some real estate practitioners is that if appraisers feel as though they are constantly being second-guessed, they may become more conservative in their assessments, impacting home values and slowing growth in the market.

There are several big changes with Fannie Mae this year (& last):

1. As of Dec 2014, Fannie Mae will offer 3% down (97% LTV) Conventional financing.

Why not just go FHA you say...?

- Remember that with FHA loans, the FHA MIP (Mortgage Insurance) is for the life of the FHA loan! Conversely, conventional PMI (Private Mortgage Insurance) may be eliminated when the equity target is reached (usually above 20%). This means, that a borrower may not be required to refinance out of their mortgage insurance at a later date, risking a potentially higher interest rate in the future.

- Also, traditional FHA loans come with an upfront FHA funding fee & higher monthly mortgage insurance cost.

..... which leads us to #2....

2. FHA has reduced their Monthly Mortgage Insurance from 1.35% to .85% oN FHA loans.

Despite that seemingly small difference, this has a fairly large affect.

Marcel Deitrich, Senior Loan Officer with Starkey Mortgage offered the following on the affect this has on a $250,000 FHA buyer:

What does this mean to the average FHA Buyer at $250,000? It means a month ago, on a $250K FHA purchase, their monthly MI was $269.23. When the change is implemented, it would drop the monthly MI to $169.52. That is $99.71 in savings on a monthly bases. This compares a $2,019.48 monthly PITI to a new $1919.77 monthly PITI.

- OR - If a buyer was in their comfort range with a $2,019.48 monthly payment, at that same payment, they can increase their purchase price to $265,000.

This is a huge step to putting FHA loans back in the game. - Marcel Deitrich - 972-672-3246 - NMLSR #231135

3. FHA Loan limits for Collin, Denton, Dallas, & Tarrant counties have been increased to $310,500.

We finished 2014 with the 30 year fixed mortgage rate at 3.87% as per Freddie Mac. This is very close to the historic lows in the spring of 2013.

However, the Mortgage Bankers Association projects mortgage rates to be about 5% by the end of 2015. The website Investopedia agrees and gives some perspective on the 5% rate:

“Barring another financial and housing market implosion, and if the economy continues to improve, expect interest rates to rise in the latter half of 2015. If they do jump to the 5% range it will be a modest hike when compared to historical averages. Rates will still be far below the approximately 8.5% 30-year fixed-rates mortgages have averaged since 1971 when Freddie Mac started tracking them. Rates averaged 6% in the years leading up to the recession.”

Here are the latest 2015 mortgage rate projections from Fannie Mae, Freddie Mac, the Mortgage Bankers’ Association and the National Association of Realtors:

Freddie Mac's chief economist looks back & reexamines their 2014 predictions! Click here to read. It is a great review of the US Housing Data from 2014.

Their 2015 predictions can also be found here!

- Christie Cannon

Have you heard what has been going on in McKinney? McKinney is growing and has been named #1 Best Place to Live in America! Check out these great videos showcasing everything McKinney has to offer.

One of the top financial ratings firms, Fitch Ratings, is blowing the whistle on Texas' hot housing market. Home sale prices in the Dallas-Fort Worth area are at record levels this year and Fitch Ratings warns that Texas home prices are about 11 percent overvalued. A lack of homes available for purchase coupled with North Texas' fast-growing economy has caused residential prices to jump by about 7 percent over the past year.

Economist Jim Gaines with the Real Estate Center at Texas A&M Unversity said he’s looked at Fitch’s new Texas housing report and doesn’t agree with the conclusions. “I’m not buying the overvalued card right now,” Gaines said. “Yes, prices have increased substantially for Texas markets – but only after being essentially flat for almost five years.

Despite its warning about the inflated prices, Fitch's report points out the overall strength of the state's economy. Texas has been leading the country in both job growth and population gains.

Texas home price gains have already cooled from late last year and early in 2014. But the year-over-year gains in residential prices in the Dallas-Fort Worth area is still running about twice the long-term average rate and are higher than nationwide increases.

During the recent recession when many metropolitan areas in California, Nevada and Florida lost 50 percent or more of their home values, Texas prices fell only slightly. And the housing markets in Dallas, Houston, Austin and San Antonio were some of the first in the country to recover. For more information on Fitch's findings click here.

469-951-9588

Stuck in the house with Cousin Eddie this week?.... perhaps a quick dash around town to see some of our areas best nods to the Griswolds.

And you do detect a hint of jealousy, as my father-in law "taught me everything I know about exterior illumiination".... which explains why our lights don't work.

Find a spot near you & make some memories.... suggestions are very welcome!

- Christie Cannon

The "Elves" at RealtyTrac offer the Naughty and Nice U.S. Cities List.

Texas cities make 6 of the top 10; with Frisco as number 5!

You can see their report & methodology here:

The original article can be found on Realty Trac

Displaying blog entries 591-600 of 706