The Benefits of Homeownership May Reach Further Than You Think

The Benefits of Homeownership May Reach Further Than You Think

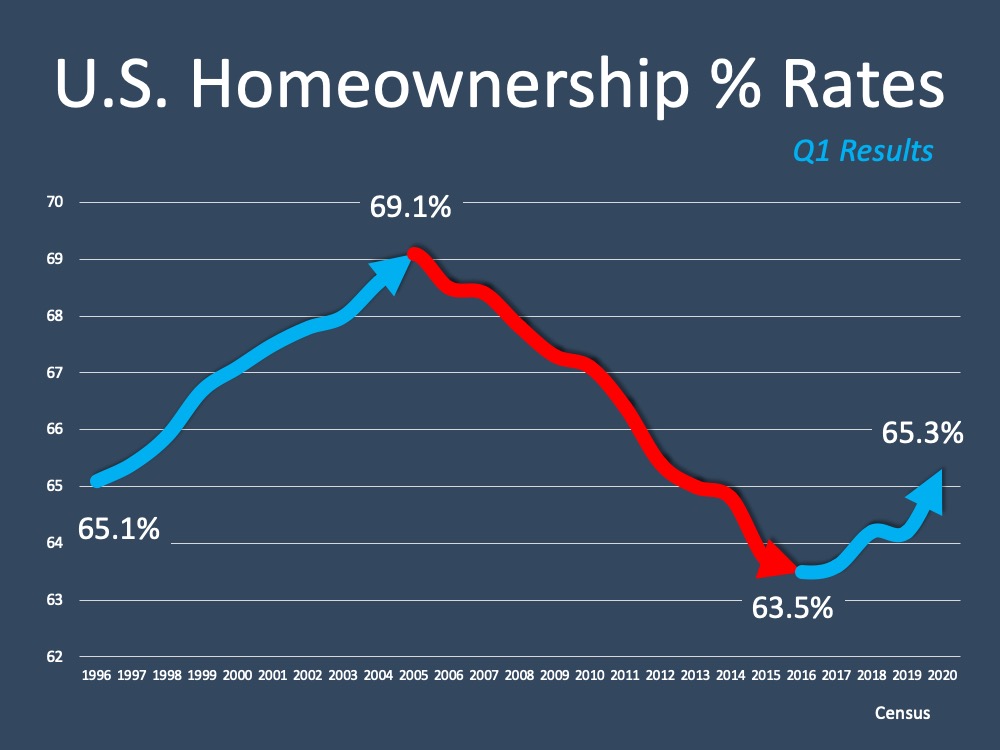

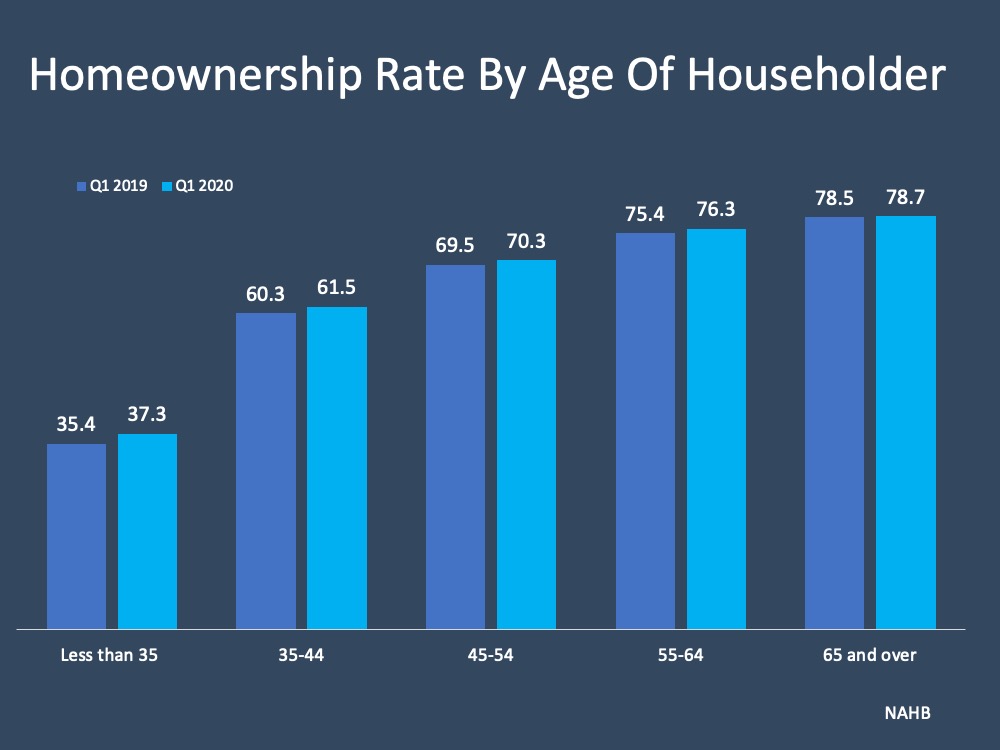

More than ever, our homes have become an integral part of our lives. Today they are much more than the houses we live in. They’re evolving into our workplaces, schools for our children, and safe havens that provide shelter, stability, and protection for our families through the evolving health crisis. Today, 65.3% of Americans are able to call their homes their own, a rate that has risen to its highest point in 8 years.

June is National Homeownership Month, and it’s a great time to reflect on the benefits of owning your own home. Below are some highlights and quotes recently shared by the National Association of Realtors (NAR). From non-financial to financial, and even including how owning a home benefits your local economy, these items may give you reason to think homeownership stretches well beyond a sound dollars and cents investment alone.

Non-Financial Benefits

Owning a home brings families a sense of happiness, satisfaction, and pride.

- Pride of Ownership: It feels good to have a place that’s truly your own, especially since you can customize it to your liking. “The personal satisfaction and sense of accomplishment achieved through homeownership can enhance psychological health, happiness and well-being for homeowners and those around them.”

- Property Maintenance and Improvement: Your home is your stake in the community, and a way to give back by driving value into your neighborhood.

- Civic Participation: Homeownership creates stability, a sense of community, and increases civic engagement. It’s a way to add to the strength of your local area.

Financial Benefits

Buying a home is also an investment in your family’s financial future.

- Net Worth: Homeownership builds your family’s net worth. “The median family net worth for all homeowners ($231,400) increased by nearly 15% since 2013, while net worth ($5,000) actually declined by approximately 9% since 2013 for renter families.”

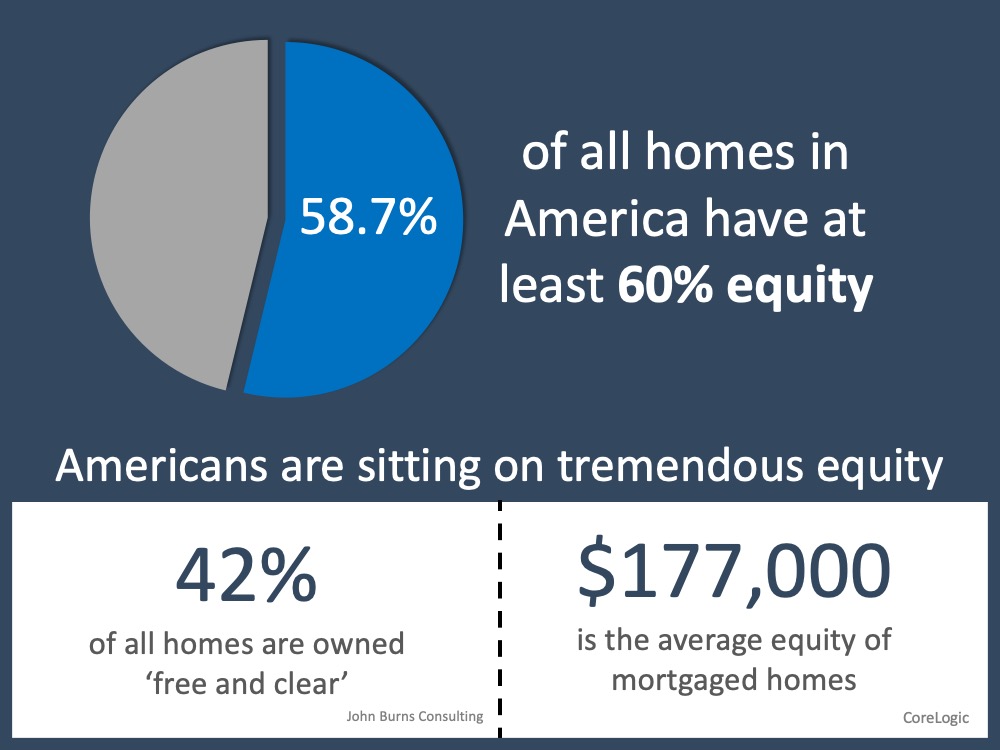

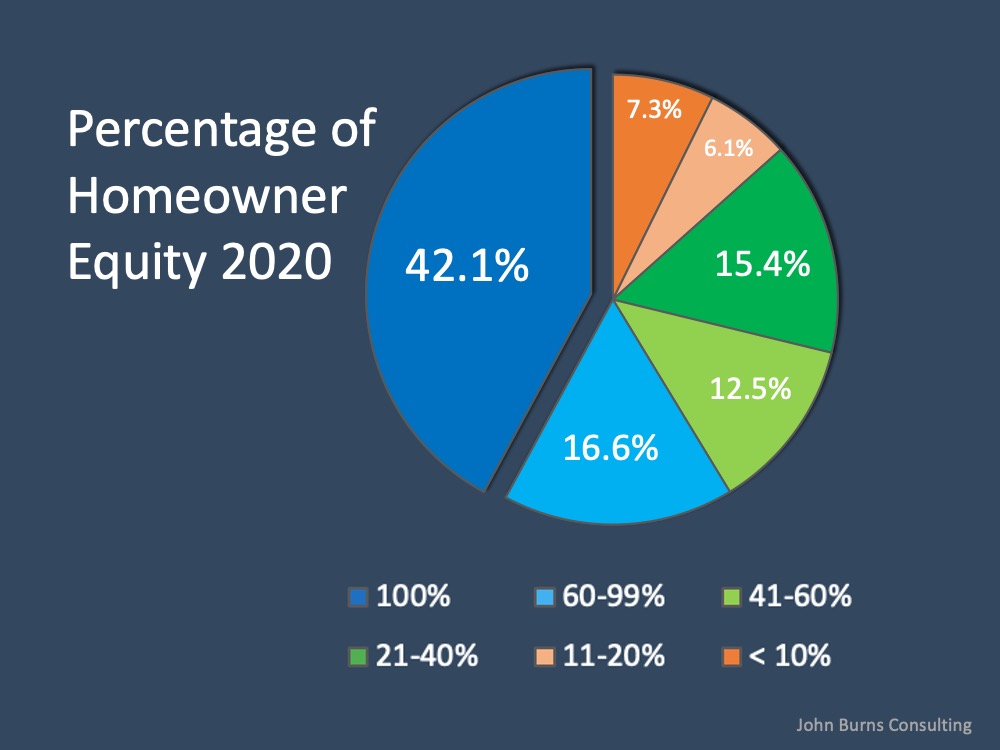

- Financial Security: Equity, appreciation, and predictable monthly housing expenses are huge financial benefits of homeownership. Homeownership is truly the best way to improve your long-term net worth.

Economic Benefits

Homeownership is even a local economic driver.

- Housing-Related Spending: An economic force throughout our nation, housing-related expenses accounted for more than one-sixth of the country’s economic activity over the past three decades.

- GDP Growth: Homeownership also helps drive GDP growth as the country aims to make an economic rebound. “Every 10% increase in total housing market wealth would translate to approximately $147 billion in additional consumer spending, or 0.8% of GDP, as well as billions of dollars in new federal tax revenue.”

- Entrepreneurship: Homeownership is even a form of forced savings that provides entrepreneurial opportunities as well. “Owning a home enables new entrepreneurs to obtain access to credit to start or expand a business and generate new jobs by using their home as collateral for small business loans.”

Bottom Line

The benefits of homeownership are vast and go well beyond the surface level. Homeownership is truly a way to build financial freedom, find greater satisfaction and happiness, and make a substantial impact on your local economy. If owning a home is part of your dream, let’s connect today so you can begin the homebuying process.

![Interest Rates Hover Near Historic All-Time Lows [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/05/21093649/20200522-MEM-1046x837.png)

![How Technology is Helping Buyers Navigate the Home Search Process [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/04/16133213/20200417-MEM-Eng-1046x1308.png)