DFW Makes TOP 10 Hidden Real Estate Gems

DFW Makes TOP 10 Hidden Real Estate Gems = That means these metro areas are likely to experience stronger price increases compared with other markets in 2022.

Article provided by: Swapna Venugopal Ramaswamy, USA TODAY | Yahoo.com

Go south, young people. Or at least invest in the Southern states.

Most of the top 10 affordable real estate markets that underperformed but have strong underlying fundamentals are in the South, according to a report by the National Association of Realtors (NAR). That means these metro areas are likely to experience stronger price increases compared with other markets in 2022.

NAR examined factors such as wage and job growth; percentage of people 25 to 44; and net domestic migration to create the list. Another metric was affordability of homes compared with the median income of the area.

DFW Makes TOP 10 Hidden Real Estate Gems

DFW Makes TOP 10 Hidden Real Estate Gems = That means these metro areas are likely to experience stronger price increases compared with other markets in 2022.

Article provided by: Swapna Venugopal Ramaswamy, USA TODAY | Yahoo.com

Go south, young people. Or at least invest in the Southern states.

Most of the top 10 affordable real estate markets that underperformed but have strong underlying fundamentals are in the South, according to a report by the National Association of Realtors (NAR). That means these metro areas are likely to experience stronger price increases compared with other markets in 2022.

NAR examined factors such as wage and job growth; percentage of people 25 to 44; and net domestic migration to create the list. Another metric was affordability of homes compared with the median income of the area.

DFW Makes TOP 10 Hidden Real Estate Gems

DFW Makes TOP 10 Hidden Real Estate Gems = That means these metro areas are likely to experience stronger price increases compared with other markets in 2022.

Article provided by: Swapna Venugopal Ramaswamy, USA TODAY | Yahoo.com

Go south, young people. Or at least invest in the Southern states.

Most of the top 10 affordable real estate markets that underperformed but have strong underlying fundamentals are in the South, according to a report by the National Association of Realtors (NAR). That means these metro areas are likely to experience stronger price increases compared with other markets in 2022.

NAR examined factors such as wage and job growth; percentage of people 25 to 44; and net domestic migration to create the list. Another metric was affordability of homes compared with the median income of the area.

Key Things To Avoid After Applying for a Mortgage

Once you’ve found your dream home and applied for a mortgage, there are some key things to keep in mind before you close. It’s exciting to start thinking about moving in and decorating your new place, but before you make any large purchases, move your money around, or make any major life changes, be sure to consult your lender – someone who’s qualified to explain how your financial decisions may impact your home loan.

Here’s a list of things you shouldn’t do after applying for a mortgage. They’re all important to know – or simply just good reminders – for the process.

1. Don’t Deposit Cash into Your Bank Accounts Before Speaking with Your Bank or Lender.

Lenders need to source your money, and cash isn’t easily traceable. Before you deposit any amount of cash into your accounts, discuss the proper way to document your transactions with your loan officer.

2. Don’t Make Any Large Purchases Like a New Car or Furniture for Your Home.

New debt comes with new monthly obligations. New obligations create new qualifications. People with new debt have higher debt-to-income ratios. Since higher ratios make for riskier loans, qualified borrowers may end up no longer qualifying for their mortgage.

3. Don’t Co-Sign Other Loans for Anyone.

When you co-sign, you’re obligated. With that obligation comes higher debt-to-income ratios as well. Even if you promise you won’t be the one making the payments, your lender will have to count the payments against you.

4. Don’t Change Bank Accounts.

Remember, lenders need to source and track your assets. That task is much easier when there’s consistency among your accounts. Before you transfer any money, speak with your loan officer.

5. Don’t Apply for New Credit.

It doesn’t matter whether it’s a new credit card or a new car. When you have your credit report run by organizations in multiple financial channels (mortgage, credit card, auto, etc.), your FICO® score will be impacted. Lower credit scores can determine your interest rate and possibly even your eligibility for approval.

6. Don’t Close Any Credit Accounts.

Many buyers believe having less available credit makes them less risky and more likely to be approved. This isn’t true. A major component of your score is your length and depth of credit history (as opposed to just your payment history) and your total usage of credit as a percentage of available credit. Closing accounts has a negative impact on both of those determinants of your score.

Bottom Line

Any blip in income, assets, or credit should be reviewed and executed in a way that ensures your home loan can still be approved. If your job or employment status has changed recently, share that with your lender as well. The best plan is to fully disclose and discuss your intentions with your loan officer before you do anything financial in nature.

Homebuyers Are Going on a Shopping Spree This Winter

Homebuyers Are Going on a Shopping Spree This Winter

Black Friday and Cyber Monday are over, which means some shoppers have wrapped up their holiday buying. But there’s still a group of buyers that are very active this holiday season – homebuyers.

Experts anticipate the real estate market will see a flurry of activity this winter, and that’s great news for today’s sellers. If you’re planning on listing your home, there’s no need to wait until the spring for better conditions – today’s real estate market is already heating up.

Buyers Have Warmed Up to the Idea of Purchasing This Winter

The past 18 months brought about significant lifestyle changes for many of us, including the rise in remote work, job changes, and even early retirement for some. For many people, it’s prompting a search for their next home now rather than waiting for warmer months.

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), points out how this winter may see a significant number of sales:

“Compared to other past winter seasons, this winter season’s sales activity will be stronger. . . . This winter, there will be more sales compared to pre-pandemic winters going back all the way to 2006.”

You might be wondering: what does strong sales activity mean for you? It means there are likely to be more buyers active in the market this winter – far more than more normal, pre-pandemic years.

In the same article, Danielle Hale, Chief Economist for realtor.com, puts it in these simple terms:

“Sellers can expect to see plenty of buyers.”

The more buyers there are in the market, the more likely it is your home will get noticed. That can lead to a multiple-offer scenario or a potential bidding war. Receiving multiple offers on your home means you can select the right offer and terms for your situation – so you can truly win as a seller when you list your house this winter.

Bottom Line

If you’re thinking about selling your house, you don’t need to wait until the spring. Buyers are ready now. Let’s connect to discuss why selling this holiday season could be the gift that keeps on giving.

Struggling To Find a Home To Buy? New Construction May Be an Option.

Struggling To Find a Home To Buy? New Construction May Be an Option.

There’s no question that the financial benefits of selling a house are outstanding today. Now is truly a great time to list if you’re ready to make a change. But if you do sell your house right now, you may be wondering where you’ll go when you move.

With so few homes available to buy right now, you might be considering building a new home as one of your options. But you may be unsure if that’s the way to go. Let’s compare the benefits of a newly built home versus moving into an existing one, and why working with a real estate agent throughout the process is mission-critical to your success no matter what you decide.

The Pros of Newly Built Homes

First, let’s look at the benefits of purchasing a newly constructed home. With a brand-new home, you’ll be able to:

1. Create your perfect home.

If you build a home from the ground up, you’ll have the option to select the custom features you want, including appliances, finishes, landscaping, layout, and more.

2. Cash-in on energy efficiency.

When building a home, you can choose energy-efficient options to help lower your utility costs, protect the environment, and reduce your carbon footprint.

3. Minimize the need for repairs.

Many builders offer a warranty, so you’ll have peace of mind on unlikely repairs. Plus, you won’t have as many little projects to tackle. QuickenLoans puts it like this:

“Buying a new construction vs. existing home typically means you’ll have fewer repairs to do. It can be a huge relief to know that it’s unlikely you’ll have to repair the roof or replace the furnace.”

4. Have brand new everything.

Another perk of a new home is that nothing in the house is used. It’s all brand new and uniquely yours from day one.

The Pros of Existing Homes

Now, let’s compare that to the perks that come with buying an existing home. With a pre-existing home, you can:

1. Explore a wider variety of home styles and floorplans.

With decades of homes to choose from, you’ll have a broader range of floorplans and designs available.

2. Join an established neighborhood.

Existing homes give you the option to get to know the neighborhood, community, or traffic patterns before you commit.

3. Enjoy mature trees and landscaping.

Established neighborhoods also have more developed landscaping and trees, which can give you additional privacy and curb appeal. As Investopedia says, if you buy an existing home:

“Odds are, too, that the home will have mature landscaping, so you won't have to worry about starting a lawn, planting shrubs, and waiting for trees to grow.”

4. Appreciate that lived-in charm.

The character of older homes is hard to reproduce. If you value timeless craftsmanship or design elements, you may prefer an existing home. According to Houseopedia:

“Charm is priceless. Existing homes, especially those built in the 1950’s or before, often offer architectural elements, historic charm and a quality of craftsmanship not available in new homes.”

The choice is yours. When you start your search for the perfect home, remember that you can go either route – you just need to decide which features and benefits are most important to you. Working with the guidance of your trusted real estate advisor will help you make the most informed and educated decision, so you can move into the home of your dreams.

Bottom Line

If you have questions about the options in your area, let’s discuss what's available and what's right for you, so you’re ready to make your next move with confidence.

Two Reasons Why Waiting To Buy a Home Will Cost You

Two Reasons Why Waiting To Buy a Home Will Cost You

If you’re a homeowner who’s decided your current house no longer fits your needs, or a renter with a strong desire to become a homeowner, you may be hoping that waiting until next year could mean better market conditions to purchase a home.

To determine whether you should buy now or wait another year, you can ask yourself two simple questions:

- Where will home prices be a year from now?

- Where will mortgage rates be a year from now?

Let’s shed some light on the answers to both of these questions.

Where Will Home Prices Be a Year from Now?

Three major housing industry entities are projecting ongoing home price appreciation in 2022. Here are their forecasts:

- Fannie Mae: 7.4%

- Freddie Mac: 7%

- Mortgage Bankers Association: 5.1%

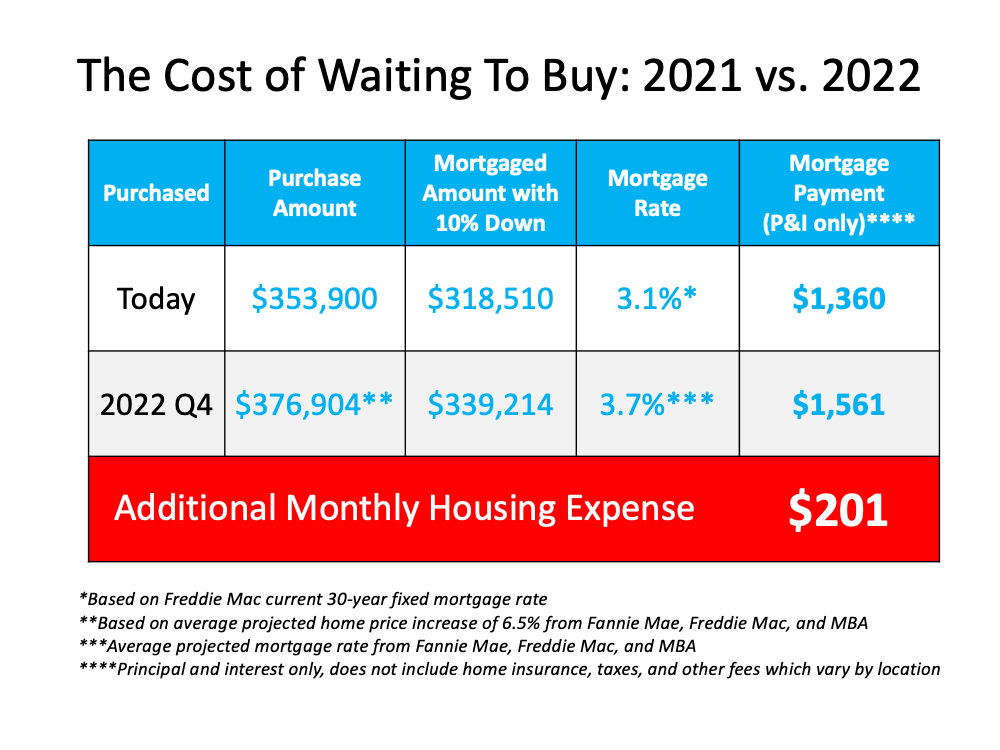

According to the National Association of Realtors (NAR), the median price of a home today is $353,900. Using an average of the three price projections above (6.5%), a home that sold for $353,900 today would be valued at $376,904 at the end of next year. As a prospective buyer, you would therefore pay an additional $23,004 by waiting.

Where Will Mortgage Rates Be a Year from Now?

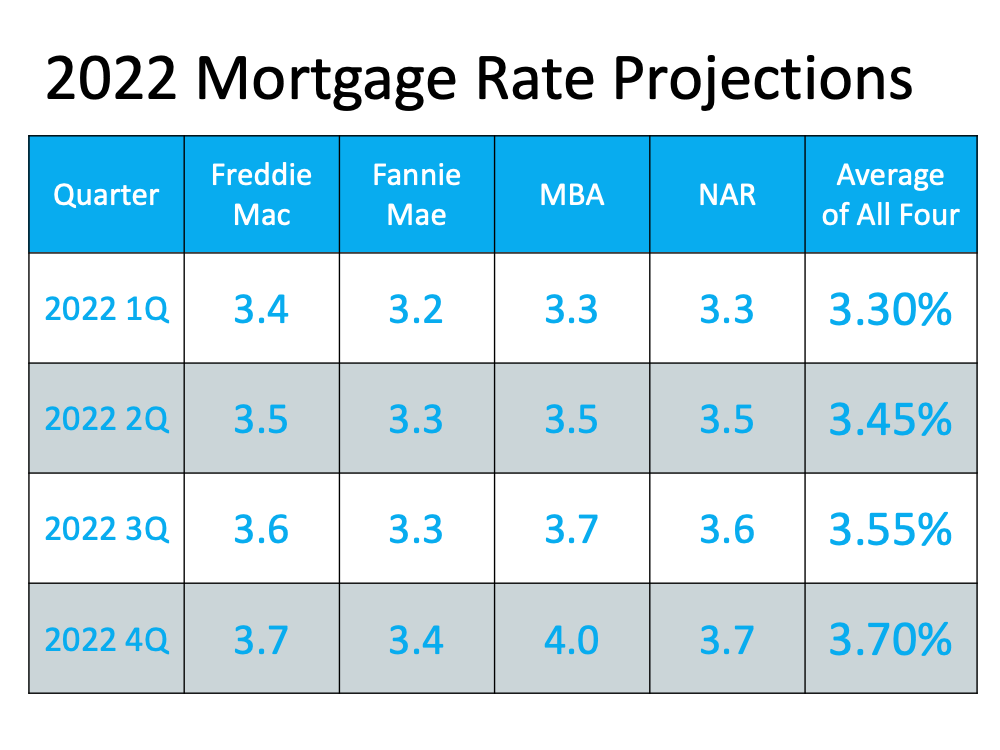

Today, Freddie Mac announced their 30-year fixed mortgage rate was at 3.1%. However, most experts believe mortgage rates will rise as the economy recovers. Here are the forecasts for the fourth quarter of 2022 by the three major entities mentioned above:

- Fannie Mae: 3.4%

- Freddie Mac: 3.7%

- Mortgage Bankers Association: 4%

That averages out to 3.7% if you include all three forecasts. Any increase in mortgage rates will increase your costs.

What Does It Mean for You if Home Values and Mortgage Rates Increase?

If both variables increase, you’ll pay a lot more in mortgage payments each month. Let’s assume you purchase a $353,900 home today with a 30-year fixed-rate loan at 3.1% (the current rate from Freddie Mac) after making a 10% down payment. According to mortgagecalculator.net, your monthly mortgage payment would be approximately $1,360 (this does not include insurance, taxes, and other fees because those vary by location).

That same home one year from now could cost $376,904, and the mortgage rate could be 3.7% (based on the industry forecasts mentioned above). Your monthly mortgage payment after putting down 10%, would be approximately $1,561. The difference in your monthly mortgage payment would be $201. That’s $2,412 more per year and $72,360 over the life of the loan.

The difference in your monthly mortgage payment would be $201. That’s $2,412 more per year and $72,360 over the life of the loan.

Add to that the approximately $23,004 a house with a similar value would build in home equity this year due to home price appreciation, and the total net worth increase you could gain by buying this year is over $95,364 (the $72,360 mortgage savings plus the $23,004 potential gain in equity if you buy now).

Bottom Line

When asking if you should buy a home, you may think of the non-financial benefits of homeownership. When asking when to buy, the financial benefits make it clear that doing so now is much more advantageous than waiting until next year.

Win When You Sell (And When You Move)

Win When You Sell (And When You Move)

.jpg)

If you’re trying to decide when to sell your house, there may not be a better time than this winter. Selling this season means you can take advantage of today’s strong sellers’ market when you make a move.

Win When You Sell

Right now, conditions are very favorable for current homeowners looking for a change. If you sell now, here’s what you can expect:

- Your House Will Stand Out – While recent data shows there are more sellers getting ready to list their homes this winter, there are still more buyers in the market than there are homes for sale. If you sell your house now before more houses are listed, it will get more attention from serious buyers who are eager to find a home.

- Your House Will Likely Get Multiple Offers – When supply is low and demand is high, buyers have to compete with each other for a limited number of homes. The latest Realtors Confidence Index from the National Association of Realtors (NAR) shows sellers are getting an average of 3.6 offers in today’s market.

- Your House Should Sell Quickly – According to the same report from NAR, homes are selling in an average of just 18 days. As a seller, that's great news for you if you’re looking for a quick process.

Win When You Move

In addition to these great perks, you’ll also win big on your next move if you sell now. CoreLogic reports homeowners gained an average of $51,500 in equity over the past year. This wealth boost is the result of buyer competition driving home prices up. You can leverage that equity to fuel a move, before mortgage rates and home prices climb higher. To get a feel for how rates are projected to rise, see the chart below. The longer you wait to make your move, the more it will cost you down the road. As mortgage rates rise, even modestly, it will impact your monthly payment when you purchase your next home. Waiting just a few months to make that change could mean a long-term financial impact.

The longer you wait to make your move, the more it will cost you down the road. As mortgage rates rise, even modestly, it will impact your monthly payment when you purchase your next home. Waiting just a few months to make that change could mean a long-term financial impact.

The good news is today’s rates are still hovering in a historically low range. According to Doug Duncan, Senior VP and Chief Economist at Fannie Mae:

“Right now, we forecast mortgage rates to average 3.3 percent in 2022, which, though slightly higher than 2020 and 2021, by historical standards remains extremely low . . .”

Selling before rates climb higher means you can make your move and lock in a low rate on the mortgage for your next home. This helps you get more home for your money and keeps your payments down too.

Bottom Line

As a homeowner, you have a great opportunity to get the best of both worlds this season. You can truly win when you sell and when you buy. If you’re thinking about making a move, let's connect so you have the information you need to get the process started.

4 Ways Homeowners Can Use Their Equity

4 Ways Homeowners Can Use Their Equity

Your equity is a powerful tool that can help you achieve your goals as a homeowner. And chances are, your equity grew substantially over the past year. According to the latest Equity Insights Report from CoreLogic, homeowners gained an average of $51,500 in equity over the past year.

If you’re looking for the best ways to use your growing equity, here are four options:

1. Use Your Equity To Buy a Home That Fits Your Needs

If you’re finding you no longer have the space you need, it might be time to move into a larger home. Or, it’s possible you have too much space and would like something smaller. No matter the situation, consider using your equity to power a move into a home that fits your changing lifestyle. Moving into a larger home can provide extra space for remote work or loved ones. Downsizing, on the other hand, may mean saving time and money by caring for a smaller home.

2. Move to the Location of Your Dreams

If the size of your home isn’t a challenge but your current location is, it could be time to relocate to a new area. Maybe you enjoy vacationing in the mountains, at the beach, or another area, and you’re dreaming of living there year-round. Or perhaps the distance between you and your loved ones is greater than you’d like, and you want to close the gap. No matter what, your home equity can fuel your move to the location where you really want to live.

3. Start a New Business

If you’re not ready to move into a new home, you can use your equity to invest in a new business venture. As the U.S. Small Business Administration Office of Advocacy says:

“There is an estimate of 31.7 million small business owners in the United States, many of them started their business with the equity they had in their home.”

While it’s not recommended that homeowners use their equity for unnecessary spending, leveraging your equity to start a business that you’re passionate about can potentially grow your nest egg further.

4. Fund an Education

Whether you have a loved one preparing to head off to college or you’re planning to go back to school yourself, the thought of paying for higher education can be daunting. In either situation, using a portion of your growing equity can help with those costs, so you can make an investment in someone’s future.

Bottom Line

Your equity can help you achieve your goals. If you’re unsure how much equity you have in your home, let’s connect today so you can start planning your next move.

What’s Happening with Home Prices?

What’s Happening with Home Prices?

Many people have questions about home prices right now. How much have prices risen over the past 12 months? What’s happening with home values right now? What’s projected for next year? Here’s a look at the answers to all three of these questions.

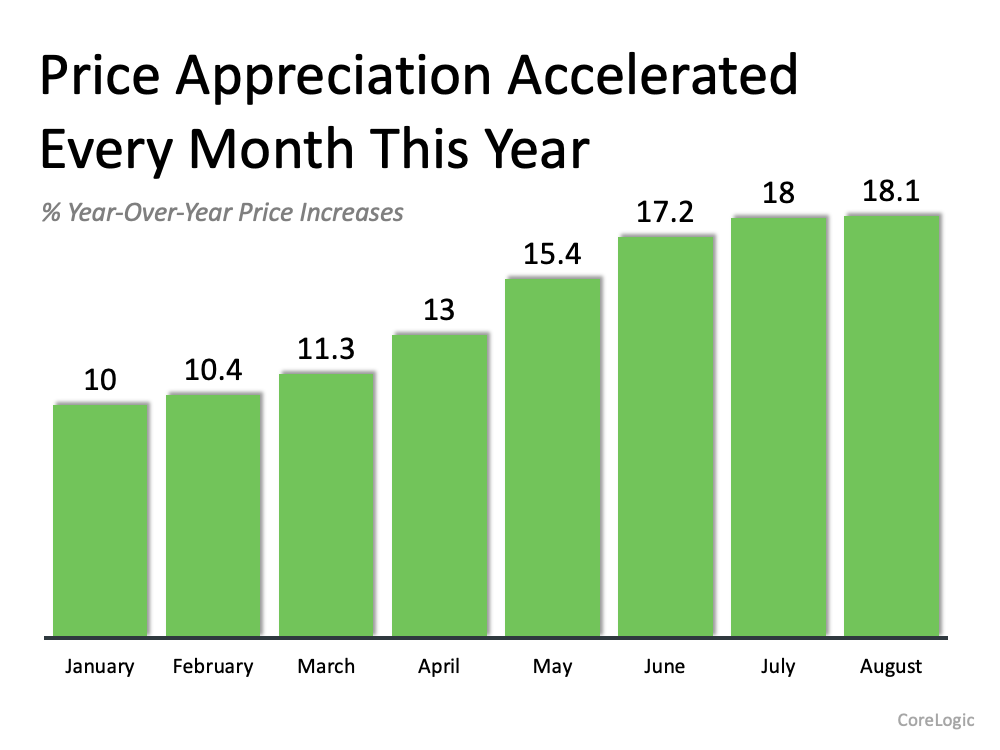

How much have home values appreciated over the last 12 months?

According to the latest Home Price Index from CoreLogic, home values have increased by 18.1% compared to this time last year. Additionally, prices have gone up at an accelerated pace for each of the last eight months (see graph below): The increase in the rate of appreciation that’s shown by CoreLogic coincides with data from the other two main home price indices: the FHFA Home Price Index and the S&P Case Shiller Index.

The increase in the rate of appreciation that’s shown by CoreLogic coincides with data from the other two main home price indices: the FHFA Home Price Index and the S&P Case Shiller Index.

The last year has shown tremendous home price appreciation, which is resulting in a major gain in wealth for homeowners through rising equity.

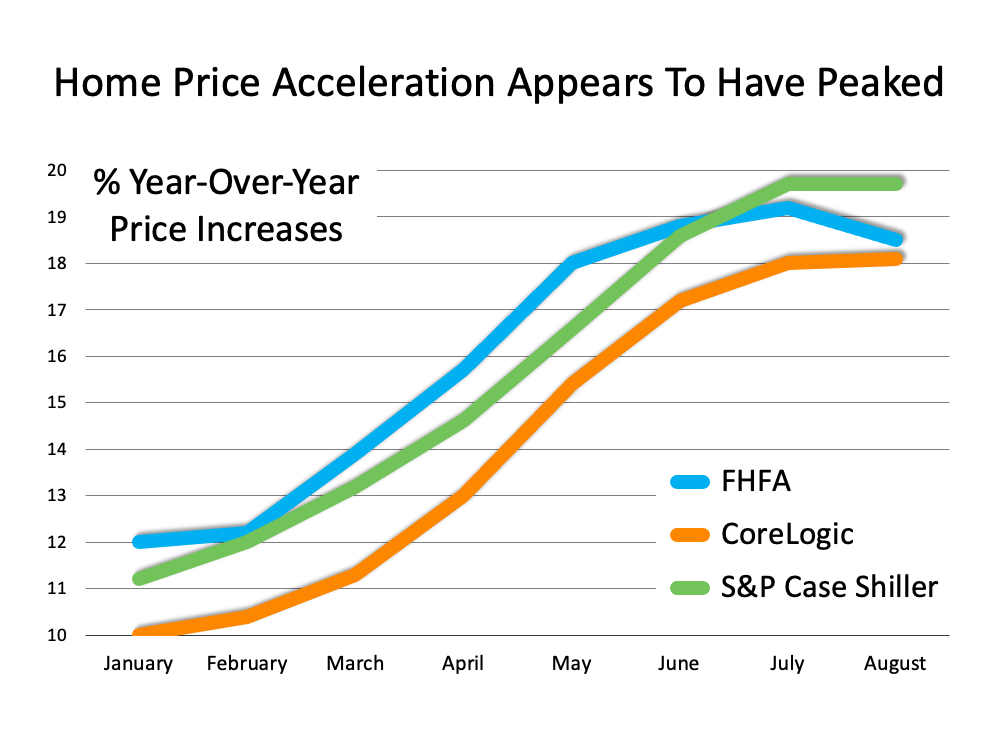

What’s happening with home prices right now?

All three indices mentioned above also show that while appreciation is in the high double digits right now, that price acceleration is beginning to level off (see graph below): Year-over-year appreciation is still close to 20%, but it’s clearly plateauing at that rate. Many experts believe it will drop below 15% by the end of the year.

Year-over-year appreciation is still close to 20%, but it’s clearly plateauing at that rate. Many experts believe it will drop below 15% by the end of the year.

Keep in mind, that doesn’t mean home values will depreciate. It means the rate of appreciation will slow, yet stay well above the 25-year average of 5.1%.

What about next year?

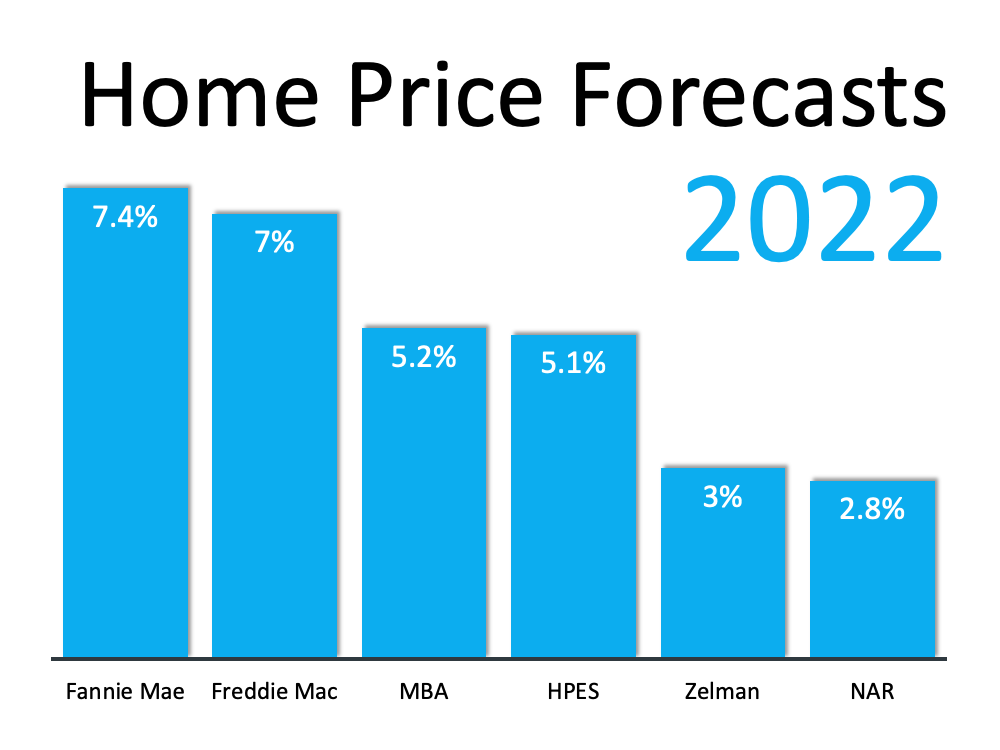

The recent surge in prices is the result of heavy buyer demand and a shortage of homes available for sale. Most experts believe that as more housing inventory comes to market (both new construction and existing homes), the supply and demand for housing will come more into balance. That balance will bring a lower rate of appreciation in 2022. Here’s a look at home price forecasts from six major entities, and they all project future appreciation:

- Fannie Mae

- Freddie Mac

- Mortgage Bankers Association

- Home Price Expectation Survey

- Zelman & Associates

- National Association of Realtors

While the projected rate of appreciation varies among the experts, due to things like supply chain challenges, virus variants, and more, it’s clear that home values will continue to appreciate next year.

While the projected rate of appreciation varies among the experts, due to things like supply chain challenges, virus variants, and more, it’s clear that home values will continue to appreciate next year.

Bottom Line

There have been historic levels of home price appreciation over the last year. That pace will slow as we finish 2021 and enter into 2022. Prices will still rise in value, just at a much more moderate pace, which is good news for the housing market.

Displaying blog entries 71-80 of 190

Categories

- (0)

- (1)

- (0)

- (0)

- 75033 Real Estate (199)

- 75034 Real Estate (201)

- 75035 Real Estate (201)

- Allen Real Estate (176)

- Frisco's Real Estate (231)

- Heritage Ranch in Fairview (43)

- La Cima in Stonebridge Ranch McKinney (43)

- Market Conditions (174)

- Market Statistics (157)

- McKinney Real Estate (151)

- New Communities (65)

- real estate (1)

- Real Estate Tax Tips (52)

- Real Estate Tips (169)

Contact Information