Happy Summer!

It's Summer time and it is getting HOT in Texas!

We compiled a list of the hottest attractions to visit this summer. From water parks to hotels for a staycation, we have you covered!

.jpg)

Displaying blog entries 81-90 of 369

It's Summer time and it is getting HOT in Texas!

We compiled a list of the hottest attractions to visit this summer. From water parks to hotels for a staycation, we have you covered!

.jpg)

When it comes to buying a house, you’re looking for the perfect place to call home. The problem is, in today’s market there just aren’t that many homes available to purchase. With inventory hovering near record lows and sky-high buyer demand, a multi-offer scenario is the new normal. Here are five things to keep in mind when you’re ready to make an offer.

Having a complete understanding of your budget and how much house you can afford is essential. That’s why you should connect with a lender to get pre-approved for a loan early in the homebuying process. Taking this step shows sellers you’re a serious, qualified buyer and can give you a competitive edge in a bidding war.

Today’s market is dynamic and fast-paced. According to the Realtors Confidence Index from the National Association of Realtors (NAR), the average home is on the market for just 17 days – that means from start to finish, a house for sale in today’s climate is active for roughly 2.5 weeks. A skilled agent will do everything they can to help you stay on top of every possible opportunity. And, as soon as you find the right home for your needs, that agent will help you draft and submit your best offer as quickly as possible.

While homebuying may seem like a whirlwind process to you, local real estate agents do this every day, and we know what works. That expertise can be used to give you a significant leg up on your competition. An agent can help you consider what levers you can pull that might be enticing to a seller, like:

It may seem simple, but catering to what a seller may need can help your offer stand out.

Let’s face it – we all love a good deal. In the past, offering at or near the asking price was enough to make your offer appealing to sellers. In today’s market, that’s often not the case. According to Lawrence Yun, Chief Economist at NAR:

“For every listing there are 5.1 offers. Half of the homes are being sold above list price.”

In such a competitive market, emotions and prices can run high. Use an agent as your trusted advisor to make a strong, but fair offer based on market value, recent sales, and demand.

If you followed tip #3, you drafted the offer with the seller’s needs in mind. That said, the seller may still counter with their own changes. Be prepared to amend your offer to include flexible move-in dates, a higher price, or minimal contingencies (conditions you set that the seller must meet for the purchase to be finalized). Just remember, there are certain contingencies you don’t want to forego. Freddie Mac explains:

“Resist the temptation to waive the inspection contingency, especially in a hot market or if the home is being sold ‘as-is’, which means the seller won’t pay for repairs. Without an inspection contingency, you could be stuck with a contract on a house you can’t afford to fix.”

When it’s time to make an offer, it’s important to consider not just what you need, but what the seller may need too. Let’s connect so you have expert advice on this step in the homebuying process to put your best offer on the table.

We’re in the ultimate sellers’ market right now. If you’re a homeowner thinking about selling, you have a huge advantage in today’s housing market. High buyer demand paired with very few houses for sale makes this the optimal time to sell for those who are ready to do so. Whatever the move you want to make looks like, here’s an overview of what’s creating the prime opportunity to sell this summer.

Demand is strong, and buyers are actively searching for homes to purchase. In the Realtors Confidence Index Survey published monthly by the National Association of Realtors (NAR), buyer traffic is considered “very strong” in almost every state. Homebuyers aren’t just great in number right now – they’re also determined to find their dream home. NAR shows the average home for sale today receives five offers from hopeful buyers. These increasingly frequent bidding wars can drive up the price of your house, which is why high demand from competitive homebuyers is such a win for this summer’s sellers.

Purchaser demand is so high, the market is running out of available homes for sale. Danielle Hale, Chief Economist at realtor.com, explains:

“For most sellers listing sooner rather than later could really pay off with less competition from other sellers and potentially a higher sales price... They’ll also avoid some big unknowns lurking later in the year, namely another possible surge in COVID cases, rising interest rates and the potential for more sellers to enter the market.”

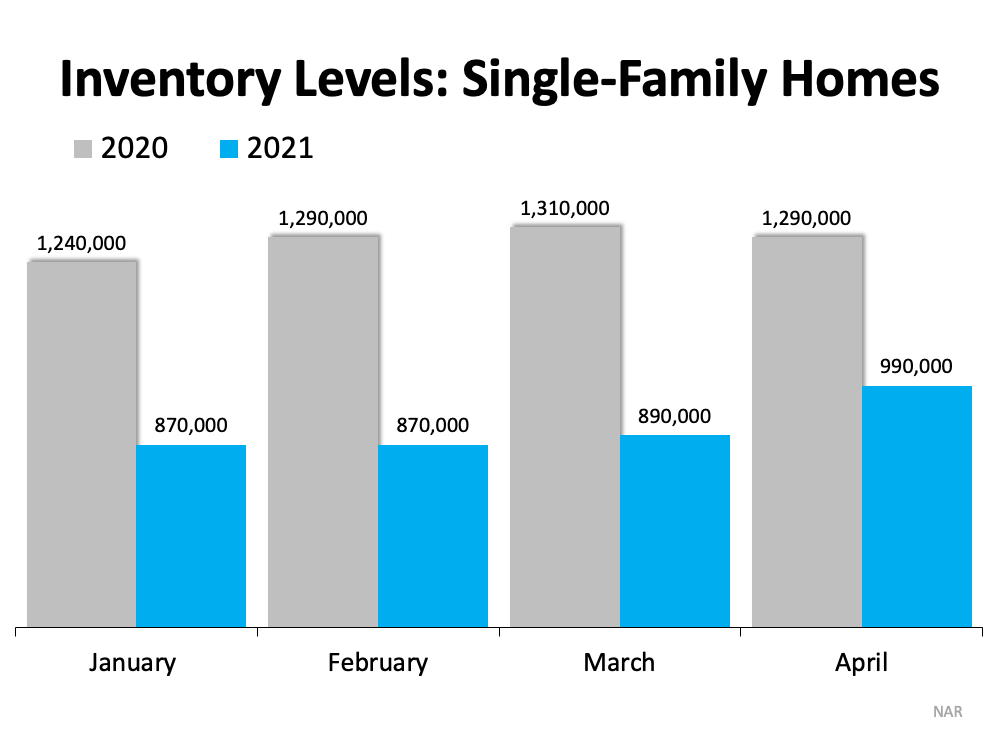

NAR also reveals that unsold inventory sits at a 2.4-months’ supply at the current sales pace. This is far lower than the historical norm of a 6.0-months’ supply. Homes are essentially selling as fast as they’re hitting the market. Below is a graph of the existing inventory of single-family homes for sale: At the same time, homebuilders are increasing construction this year, but they can’t keep up with the growing demand. While reporting on the inventory of newly constructed homes, the U.S. Census Bureau notes:

At the same time, homebuilders are increasing construction this year, but they can’t keep up with the growing demand. While reporting on the inventory of newly constructed homes, the U.S. Census Bureau notes:

“The seasonally‐adjusted estimate of new houses for sale at the end of April was 316,000. This represents a supply of 4.4 months at the current sales rate.”

If you’re thinking of putting your house on the market, don’t wait. A seller will always negotiate the best deal when demand is high and supply is low. That’s exactly what’s happening in the real estate market today.

As vaccine rollouts progress and we continue to see the economy recover, more houses will come to the market. Don’t wait for the competition in your neighborhood to increase. If you’re ready to make a move, now is the time to sell. Let’s connect today to get your house listed at this optimal moment in time.

It is that time of year again! The Christie Cannon Team has complied a list of events happening all across the DFW for 4th of July!

Be safe and have fun!

Home price appreciation continues to accelerate. Today, prices are driven by the simple concept of supply and demand. Pricing of any item is determined by how many items are available compared to how many people want to buy that item. As a result, the strong year-over-year home price appreciation is simple to explain. The demand for housing is up while the supply of homes for sale hovers at historic lows.

Let’s use three maps to show how this theory continues to affect the residential real estate market.

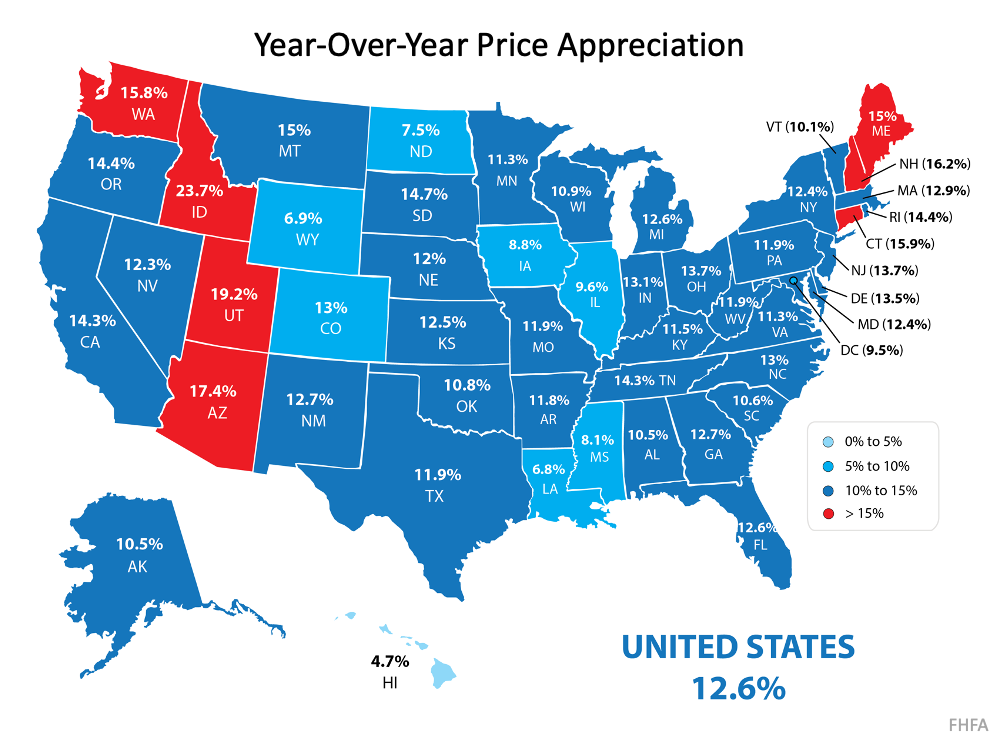

Map #1 – State-by-state price appreciation reported by the Federal Housing Finance Agency (FHFA) for the first quarter of 2021 compared to the first quarter of 2020: As the map shows, certain states (colored in red) have appreciated well above the national average of 12.6%.

As the map shows, certain states (colored in red) have appreciated well above the national average of 12.6%.

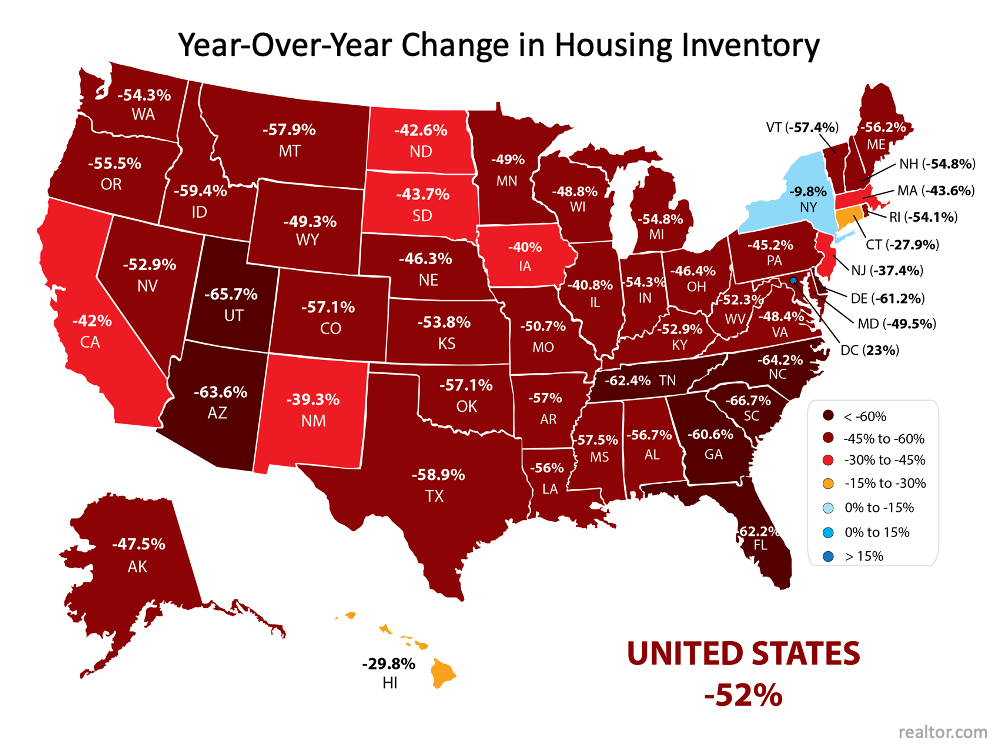

Map #2 – The change in state-by-state inventory levels year-over-year reported by realtor.com: Comparing the two maps shows a correlation between change in listing inventory and price appreciation in many states. The best examples are Idaho, Utah, and Arizona. Though the correlation is not as easy to see in every state, the overall picture is one of causation.

Comparing the two maps shows a correlation between change in listing inventory and price appreciation in many states. The best examples are Idaho, Utah, and Arizona. Though the correlation is not as easy to see in every state, the overall picture is one of causation.

The reason prices continue to accelerate is that housing inventory is still at all-time lows while demand remains high. However, this may be changing.

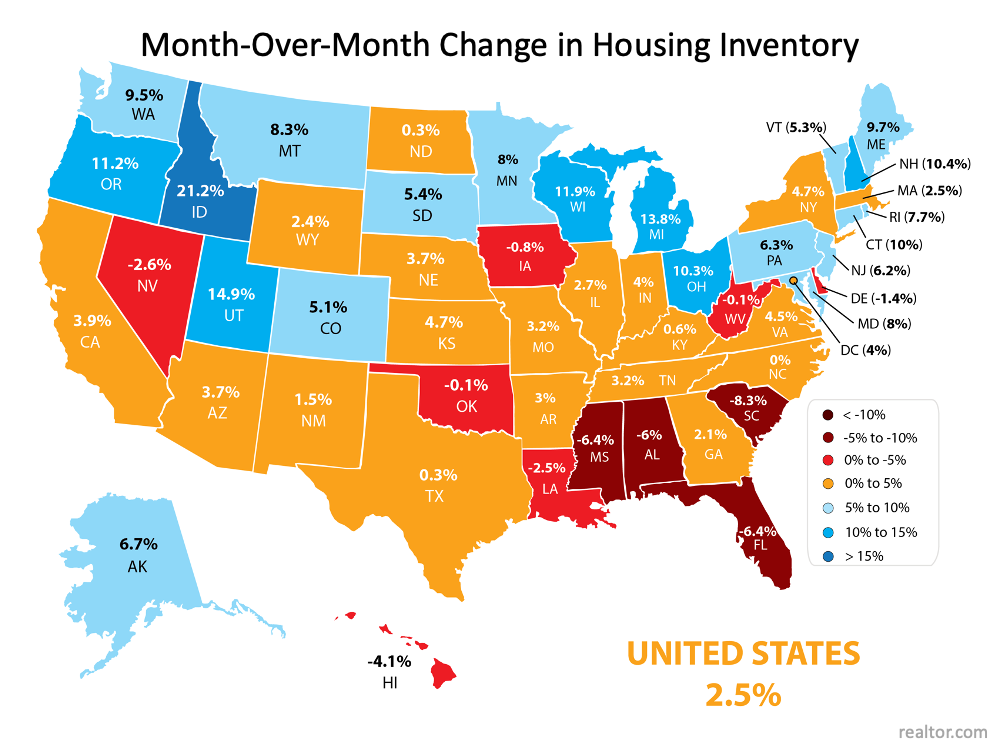

The report by realtor.com also shows the monthly change in inventory for each state.

Map #3 – State-by-state changes in inventory levels month-over-month reported by realtor.com: As the map indicates, 39 of the 50 states (plus the District of Columbia) saw increases in inventory over the last month. This may be evidence that homeowners who have been afraid to let buyers in their homes during the pandemic are now putting their houses on the market.

As the map indicates, 39 of the 50 states (plus the District of Columbia) saw increases in inventory over the last month. This may be evidence that homeowners who have been afraid to let buyers in their homes during the pandemic are now putting their houses on the market.

We’ll know for certain as we move through the rest of the year.

Some are concerned by the rapid price appreciation we’ve experienced over the last year. The maps above show that the increases were warranted based on great demand and limited supply. Going forward, if the number of homes for sale better aligns with demand, price appreciation will moderate to more historical levels.

For generations, the process of buying and selling a home never really changed. A homeowner would try to estimate the market value of their house, then tack on a little extra to give themselves some negotiating room. That figure would become the listing price. Buyers would then try to determine how much less than the full price they could offer and still get the home. As a result, the listing price was generally the ceiling of the negotiation. The actual sales price would almost always be somewhat lower than what was listed. It was unthinkable to pay more than what the seller was asking.

The record-low supply of homes for sale coupled with very strong buyer demand is leading to a rise in bidding wars on many homes. Because of this, homes today often sell for more than the list price. In some cases, they sell for a lot more.

According to Lawrence Yun, Chief Economist at the National Association of Realtors (NAR):

“For every listing there are 5.1 offers. Half of the homes are being sold above list price.”

In this market, you likely can’t shop for a home with the former approach of negotiating to a lower price.

Due to the low supply of houses for sale, many homes are now being offered in an auction-like atmosphere in which the highest bidder wins the home. In an actual auction, the seller of an item agrees to take the highest bid, and many sellers set a reserve price on the item they’re selling. A reserve price is the minimum amount a seller will accept as the winning bid.

When navigating a competitive housing market, think of the list price of the house as the reserve price at an auction. It’s the minimum the seller will accept in many cases. Today, the asking price is often becoming the floor of the negotiation rather than the ceiling. Therefore, if you really love a home, know that it may ultimately sell for more than the sellers are asking. So, as you’re navigating the homebuying process, make sure you know your budget, know what you can afford, and work with a trusted advisor who can help you make all the right moves as you buy a home.

Someone who’s more familiar with the housing market of the past than that of today may think it’s foolish to offer more for a home than the listing price. However, frequent and competitive bidding wars are creating an auction-like atmosphere in many real estate transactions right now. Let’s connect today so you have a trusted real estate professional on your side to provide the best advice on how to make a competitive offer on a home.

Are you clamoring for extra rooms or a more functional floorplan in your house? Maybe it’s time to make a move. If you’ll be able to work remotely for the long-term or your overall needs have simply changed, it’s a great time to sell your house and move up. Why? With mortgage rates in their favor and higher-priced home sales powering more moves across the country, sellers in today’s market are finding the space they need (and have always dreamed of) by purchasing a home in the upper end of the housing market.

With so few homes available for sale and high demand from today’s homebuyers, sellers are profiting in major ways this season. Bidding wars are gaining traction, driving up the sale price of more and more homes throughout the country. This means sellers are able to leverage extra cash from higher-priced sales while also taking advantage of today’s low mortgage rates when they purchase their next home. It’s the perfect scenario to move up into a true dream home. According to the April Luxury Market Report from the Institute for Luxury Home Marketing:

“The Institute’s recent analysis of sales in 2020 for homes over 5,000 square feet support the continuing preference for larger homes. The analysis determined that there was a 17% increase in the number of 5,000+ sq ft homes sold when compared to the number of sales in 2019.

Luxury home prices continue to see record highs in the majority of affluent ex-urban communities, as the influence of being able to work from home is still driving buyers away from living in high density areas. Low interest rates also remain in play, allowing buyers to realize the affordability of owning a larger property, which further reinforces this trend.”

Lawrence Yun, Chief Economist for the National Association of Realtors (NAR), also explains:

“The market is hot pretty much everywhere and across all price points . . . The only area where there is sufficient inventory is in $1 million-plus homes . . . .”

While this price range certainly doesn’t fit every budget, if it’s in your reach this summer, you may want to make your move sooner rather than later. Today, more homes are available in this segment of the market, but as the report mentions, more buyers are investing here too, so competition may heat up sooner rather than later.

If you’re planning to sell your current home to move into a larger one, let’s connect today. We’ll discuss your current situation and the opportunities in our local market.

Join us this Saturday the 5th from 12PM - 3PM for an OPEN HOUSE!

3181 Briarwood has just had a huge price reduction and is hosting an open house this weekend!

Stop by to see this gorgeous custom estate with an amazing backyard that is perfect for entertaining!

There’s a lot of discussion about affordability as home prices continue to appreciate rapidly. Even though the most recent index on affordability from the National Association of Realtors (NAR) shows homes are more affordable today than the historical average, some still have concerns about whether or not it’s truly affordable to buy a home right now.

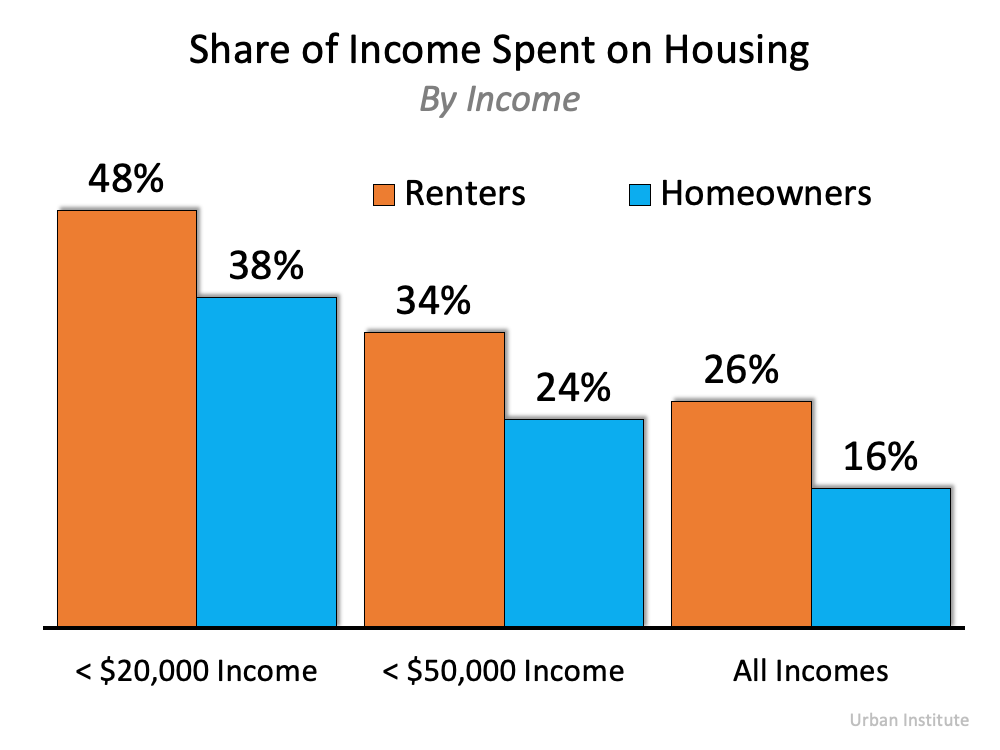

When addressing this topic, there are various measures of affordability to consider. However, very few of the indexes compare the affordability of owning a home to renting one. In a paper just published by the Urban Institute, Homeownership Is Affordable Housing, author Mike Loftin examines whether it’s more affordable to buy or rent. Here are some of the highlights included.

The report explains:

“When we look at the median housing expense ratio of all households, the typical homeowner household spends 16 percent of its income on housing while the typical renter household spends 26 percent. This is true, you might say, because people who own their own home must make more money than people who rent. But if we control for income, it is still more affordable to own a home than to rent housing, on average.”

Here’s the data from the report shown in a graph:

The report goes on to say:

“Buying a home is not a decision between investing in real estate versus investing in stocks, as financial advisers often claim. Instead, the home buying investment simply converts some portion of an existing expense (renting) into an investment in real estate.”

It explains that you still have a housing expense (rent payments) even if you don’t buy a home. You can’t live in your 401K, but you can transfer housing expenses to your real estate investment. A mortgage payment is forced savings; it goes toward building equity you will likely get back when you sell your home. There’s no return on your rent payments.

The report also notes:

“Whereas renters are continuously vulnerable to cost increases, rising home prices do not affect homeowners. Nobody rebuys the same home every year. For the homeowner with a fixed-rate mortgage, monthly payments increase only if property taxes and property insurance costs increase. The principal and interest portion of the payment, the largest portion, is fixed. Meanwhile, the renter’s entire payment is subject to inflation.

Consequently, over time, the homeowner’s and renter’s differing trajectories produce starkly different economic outcomes. Homeownership’s major affordability benefit is that it stabilizes what is likely the homeowner’s biggest monthly expense, assuming a buyer has a fixed-rate mortgage, which most American homeowners do. The only portion of the homeowner’s housing expenses that can increase is taxes and insurance. The principal and interest portion stays the same for 30 years.”

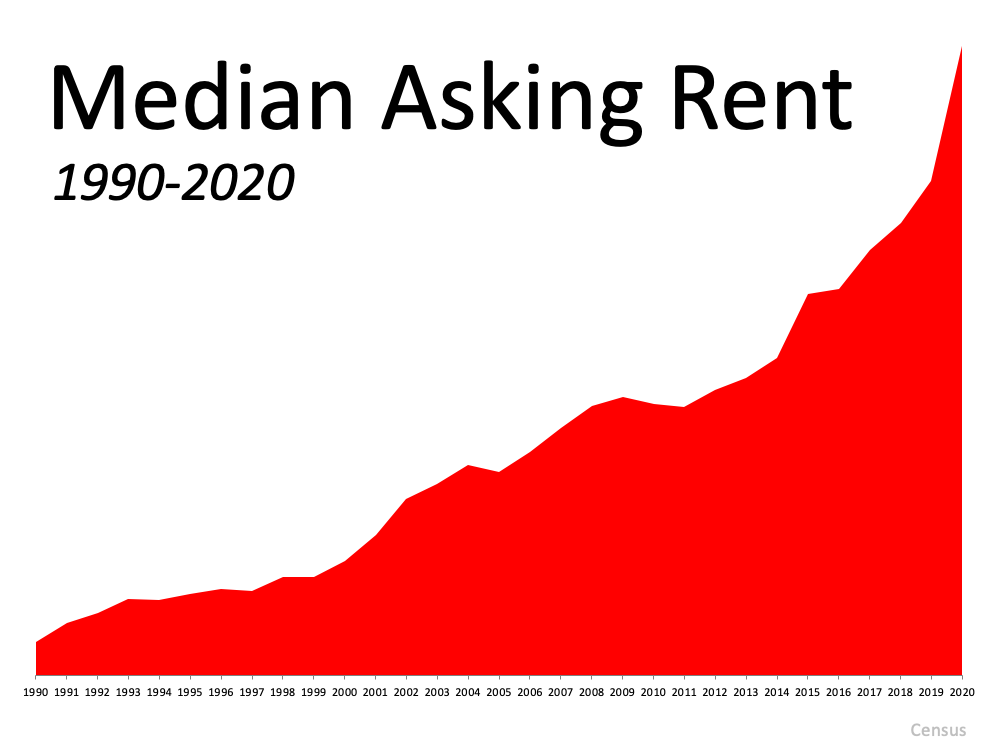

A mortgage payment remains about the same over the 30 years of the mortgage. Here’s what rents have done over the last 30 years:

As the report also indicates:

“We need to stop seeing housing as a reward for financial success and instead see it as a critical tool that can facilitate financial success. Affordable homeownership is not the capstone of economic well-being; it is the cornerstone.”

Homeownership is the first rung on the ladder of financial success for most households, as their home is most often their largest asset.

If the current headlines reporting a supposed drop-off in home affordability are making you nervous, let’s connect to go over the real insights into our area.

Are rapidly rising home prices a warning sign of a real estate bubble? Could the U.S. housing market collapse as it did 14 years ago, triggering a severe recession? Real estate brokers and analysts who pay close attention to market fundamentals say the answer is no.

“I feel very strongly that we are not in a housing bubble simply because of the excessively low inventory,” says Anthony Lamacchia, CEO, Lamacchia Companies, Waltham, Mass. “It is impossible for the housing market to tip over in the next two years.”

A shortage of homes for sale is just one of the reasons the U.S. housing market will not suddenly slide into a tailspin. Lenders are far more cautious today than they were in 2006-2007 – a time when no-downpayment mortgages and easy credit fueled a wave of speculation, only to result in mass foreclosures when prices collapsed.

“After 50 years in the real estate business, this is the first time I have ever seen such a perfect storm,” says Thomas Sbarra, owner and principal, CENTURY 21 Sbarra, Johnson City, New York. “Inventory is at low levels, demand is running wild and prices are still rising pretty much everywhere in the country. While the buying frenzy is like the early 2000s, I think it will be two or three more years before there’s a correction, and the market could just level off.”

An Urban Land Institute survey of 43 economists at real estate organizations found little likelihood of a market meltdown. In fact, the economists projected home prices will grow an average of 4.1 percent over the next three years, above the long-term average of 3.9 percent. In a recent forecast, Fannie Mae projected new and existing home sales will be 6.2 percent high than last year, although the pace of transactions will slow later this year.

“We will certainly see a rebalancing at some point, but no one can predict when,” says Kuba Jewgieniew, CEO and founder of Realty ONE Group, Las Vegas. “I think things are going to calm down, stabilize and rebalance rather than seeing a bubble that’s going to pop.

Here are seven reasons the U.S. is not in a housing bubble.

Housing sales across the country declined this spring, according to data released by the National Association of Realtors. The primary reason is lack of supply. In March, there were 1.07 million homes for sale, down 28.2 percent from the prior year. That is far below the 4 million homes on the market in July 2007 during the last housing bubble.

“Our ongoing issues of low inventory, caused in part by the high cost of new builds, will not go away anytime soon,” says Jewgieniew.

With only a 2.1-month supply of inventory for single-family homes in March – well below normal levels – home prices are likely to continue to rise. As Lawrence Yun, chief economist of the National Association of Realtors®, says, “This is not a bubble. It is simply lack of supply.”

Currently, the U.S. housing market is 3.8 million single-family homes short of demand, according to a recent analysis from Freddie Mac. A low level of new home construction over the past three years has increased that shortfall, which was estimated at 2.5 million units in 2018.

New housing starts are rising this spring, but the supply of new homes is projected to remain well below demand. In March, housing starts reached a seasonally adjusted annual rate of 1.739 million units, the highest level since June 2006. Doug Duncan, chief economist for Fannie Mae, says production may decline later this year as homebuilders face supply constraints, such as increasing prices of lumber and other materials.

Overall, the Mortgage Bankers Association (MBA) forecasts single-family housing starts to be around 1.134 million, increasing to 1.165 million single-family homes in 2022 and 1.210 million in 2023. That gradual increase in production will help to ease the current shortage.

Nearly 5 million millennials will be turning 30 this year, with similar numbers coming in 2022. A significant percentage are looking to buy homes and condominiums – a big change in the market compared with five years ago.

In fact, millennials are expected to continue to drive the nation’s real estate market for the next decade, spurring demand for starter and move-up homes. Again, strong demand for homes is one of the main reasons a market bubble appears unlikely.

As the COVID-19 pandemic recedes, international travel and home purchases will pick up later in the year. In many states, buyers from Canada, Europe, Asia and the Middle East have sought vacation homes, primary residences and investment properties in the U.S. That global demand for homes – many from all-cash buyers – can buoy many U.S. markets

“There is still a huge influx of foreign capital pouring into the United States as we’re still one of the most stable and attractive countries in the world,” says Jewgieniew. “Now is the time for real estate professionals to create new relationships and networks and grow their opportunities to connect with international clients.”

While mortgage rates have begun creeping up, there are no signs of a spike that could bring the home financing process to a halt. “Real estate professionals should prepare their clients for rates to potentially hit 4 percent, while reassuring them that this is still ridiculously low,” says Jewgieniew.

This spring, the Federal Reserve is supporting housing market by keeping short-term rates low for borrowers – a practice it intends to follow until 2022 at least. The Fed is also purchasing agency mortgage-backed securities (MBS) to stabilize the lending market. Again, there is no sign of a bubble caused by home financing policies.

Risky credit practices in the early 2000s were a leading cause of the last housing bubble. Back then, lenders offered loans with “nothing down,” adjustable rates or balloon payments and easy terms to borrowers with marginal credit ratings. At that time, risky loans comprised about 40 percent of the mortgage market, according to a Morgan Stanley report. Currently, those loans are only 2 percent of the market.

Rising home prices and greater savings rates have increased equity for millions of U.S. owners. A first quarter report from ATTOM Data Solutions, found that one in three of the 55.8 million mortgaged homes was “equity-rich,” with loans 50 percent or less of estimated market value.

On the other side of the equation, just 2.6 million mortgaged homes were considered seriously underwater, combined loans at least 25 percent more than the value. In addition, distressed sales — including bank-owned (REO) sales, third-party foreclosure auction sales and short sales — accounted for just 5.8 percent of sales, the smallest percentage since 2003 and dramatically below the 42.2 percent in the first quarter of 2009.

Looking ahead to the second half of the year, the pace of home sales may decline and mortgage rates may rise. But those changes should be gradual, rather than bursting a bubble. As Jewgieniew says, “Brokers should be looking forward the future and remember not to be short-sighted. Be sure to have money set aside, especially as there are less and less transactions, and be disciplined with your spending.”

Article provided by: Richard Westlund with RealTrends

See the entire article here!

Displaying blog entries 81-90 of 369