Holiday Happenings - All Around Town

Displaying blog entries 1-10 of 18

According to the latest report from the US Census Bureau and the Department of Housing and Urban Development, newly constructed home sales jumped 5.7% month-over-month and 21.6% year-over-year to an annual pace of 552,000.

Many buyers are looking to the new homes market to make up for the lack of existing home sales inventory. National Association of Home Builders Chief Economist David Crowe explains:

"Today's report indicates the release of pent-up housing demand as the overall economy strengthens, consumer confidence grows and mortgage interest rates remain low. The housing market should continue to move forward at a modest but more persistent pace throughout the rest of 2015."

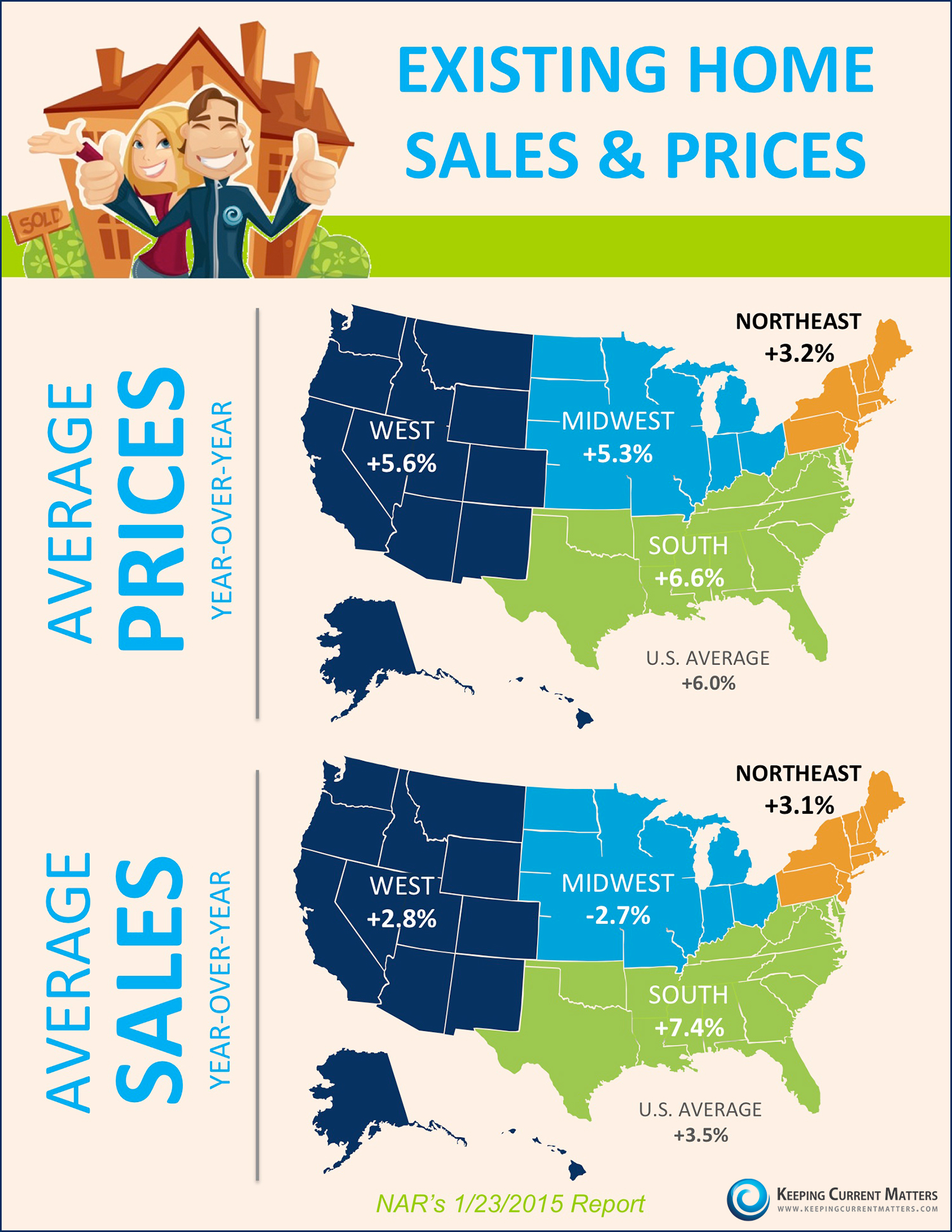

Regionally, the Northeast led the way with a 24.1% increase in new home sales, followed by the South (7.4%) and West (5.4%). Sales in the Midwest declined by 9.1%.

The inventory of new homes for sale currently sits at a 4.7-month supply down slightly from July (4.9) and significantly from August 2014 (5.4).

Buyers who purchased a new home were willing to spend more to get the amenities that they wanted. The median home price for new homes was $64,000 higher thanexisting homes in August at $292,700!

Approved applications for building permits increased 3.5% over July and 12.5% over this time last year. Permit applications are seen as a strong indicator of builder confidence in the market.

Buyer demand continues to outpace inventory of homes for sale. If you are thinking of selling your house this year, now may be the time to list before builders have a chance to replenish the supply of new homes.

Frisco TX recently cleared the way for the a new home for the US Soccer Federation's Hall of Fame. Included in a $39 million renovation, the National Soccer Hall of Fame may have found a new home in Frisco TX. The National Soccer Hall of Fame & Museum has been "homeless" since closing in NY in 2010. The Toyota Stadium complex already draws well over 1 million visitors per year. The latest renovations are designed to better prepare the venue for NCAA Football & other high profile events. The announcement is expected on October 14th.

Based on the National Association of REALTOR's latest September numbers, the pace of home sales has slowed; however, the year over year gains continue for the 11th month.

Just in case you missed it, Dallas Business Journal, Frisco EDC, & Frisco ISD had a huge event in conjuction with The Star in Frisco, The Gate, Frisco Station, & Wade Park to discuss and present the opportunities in Frisco's $5 Billion Mile.

You can find the full presentation here - It is a great opportunity to see why so many investors are looking toward frisco & to better understand the growth of our city!

Just incase you are not up to date on the #5BMile in Frisco, here is aquick primer:

The housing market has taken a great turn toward recovery over the last few years. The opinions of the American public toward real estate took longer to recover, until recently.

For the first time since 2006, Americans have an overall positive view of real estate, giving the industry a 12% positive ranking in a Gallup poll.

Americans were asked to rate 24 different business sectors and industries on a five-point scale ranging from "very positive" to "very negative." The poll was first conducted in 2001, and has been used as an indicator of “Americans’ overall attitudes toward each industry”.

Americans’ view of the real estate industry worsened from 2003 to the -40% plummet of 2008. Gallup offers some insight into the reason for decline:

“In late 2006, real estate prices in the U.S. began falling rapidly, and continued to drop. Many homeowners saw their home values plummet, likely contributing to real estate's image taking a hard hit.”

“The large drops in the positive images of banking and real estate in 2008 and 2009 reflect both industries' close ties to the recession, which was precipitated in large part because of the mortgage-related housing bubble.”

“Although the image of real estate remains below the average of 24 industries Gallup has tracked, the sharp recovery from previous extreme low points suggests it is heading in the right direction.”

- Have Questions? Call Christie - 469-951-9588

Looking for more Local Data - Try Here for data or Here for a custom report on your home.

Have Questions? - You can always give me a call at 469-951-9588 - Christie Cannon

Why Have Interest Rates Dropped Despite Predictions of Rising Rates?

The headlines agree mortgage interest rates have dropped substantially below initial projections. Many who are considering purchasing a home, or moving up to their dream home, might think that they should wait to buy, because rates may continue to fall.

A recent article on the Economists’ Outlook blog by the National Association of REALTORS® (NAR) provides insight into one major factor in the decline in interest rates, the crude oil price.

“As of January 5, 2015, the U.S. Energy Information Administration (EIA) reported that the price of regular gasoline was $2.20/gallon, the lowest since gas prices peaked to about $ 4/gallon in May 2011.”

You may have noticed that filling your gas tank has become substantially less expensive in recent months. A welcome change from the close to $5 a gallon that many Americans were paying this time last year. The average US household is projected to save around $550 in 2015.

NAR explains the correlation like this:

“Lower oil prices mean lower inflation rate, which pushes down mortgage rates.”

Based on Freddie Mac’s weekly mortgage survey as of January 22, 2015, the 30-year fixed rate averaged 3.63% and the 15-year fixed rate averaged 2.93%.

“The decline in oil prices is generally positive to households by way of the gas savings and lower mortgage payments. That savings will boost consumer spending in other areas. But there may be some layoffs in oil-producing states.”

No one really knows how long oil prices will continue to support low mortgage rates. In a New York Times article, the author points to the fact that “adding hundreds of billions of dollars to consumer spending” could start to have a “counter effect” on rates as the economy continues to strengthen.

“If firms start hiring again, and wages increase — that’s when the level of all interest rates in the U.S. would increase.”

The low interest rates we are currently experiencing are not going to stay around forever. The current projections from Freddie Mac, Fannie Mae, NAR and the Mortgage Bankers Association all agree that interest rates will increase to between 4.3-5.4% by the end of 2015.

NAR reports: “At the median home price of $205,300, a 0.75 percentage point drop in mortgage rates will yield savings of about $1,000 annually.”

- Looking for a Mortgage Expert to assist you? Please feel free to give me a call - 469-951-9588

Every home must be sold TWICE! Once to the buyer, and once to the bank appraiser if a mortgage is involved.

A new program announced by Fannie Mae may slow down the home-sale closing process by causing more disputes over prices between sellers and buyers.

In a recent Washington Post article they explained the basics of the program:

“Starting Jan. 26, Fannie plans to offer mortgage lenders access to proprietary home valuation databases that they can use to assess the accuracy and risks posed by the reports submitted by appraisers.”

“The Fannie data will flag possible errors in the appraiser’s work before the lender commits to fund the loan, will score the appraisal for overall risk of inaccuracy and may provide as many as 20 alternative “comps” — properties in the area that have sold recently and are roughly comparable to the house the lender is considering for financing but were not used by the appraiser.”

Using the additional information provided by Fannie Mae, the lender can then ask for an explanation from the appraisal company for any discrepancies and request an amended appraisal.

This added step in the process of determining the price of the home to be bought/sold, could add time to the closing process and cost to the appraisal for the additional work.

Fannie Mae wants lenders to make informed decisions when agreeing to the amount of a loan that a buyer will be approved for.

“Excessive valuations create the risk of future losses to lenders and investors if the borrower defaults and the house goes to foreclosure.”

You’ve put your house on the market, picked an agent who has helped you determine that the best price to list your home for is $250,000, and found a buyer willing to pay that price. The appraiser comes to the home and agrees your home is worth the asking price and writes their report. Everything is working perfectly!

You’ve found your dream home, in the right neighborhood, in the right school district, with the perfect yard, at the high end of your budget, but all the pluses are worth it. You agree on a price and start daydreaming about living in your new home.

The lender submits the appraisal report to the new Fannie Mae program and they come back with “lower-risk comps” that value the home at $230,000. The lender then turns to the appraisal company to justify the $20,000 difference, adding time and frustration to the process.

If the lender does not agree with the reasons for the price difference they will not lend the buyer the amount they need to purchase their dream home and the amicable, agreeable sale turns into a heated justification of the higher price. The buyer may even have to give up on the home if the funding isn’t there.

An article by Housing Wire shares the appraiser’s point of view:

“The bottom line, appraisers say, is this could lead to delays to closings and higher costs, as well as a depression of prices in markets where prices are rising.

Appraisers complain that if they have to justify every step of their comps for their valuation, rather than those coming from the one-size-fits-all evaluation from Fannie, it will delay closing, throw off buyer and seller timetables, and delay real estate broker commissions.”

The fear of some real estate practitioners is that if appraisers feel as though they are constantly being second-guessed, they may become more conservative in their assessments, impacting home values and slowing growth in the market.

Displaying blog entries 1-10 of 18