If you purchased a home this past year, now is the time to file your homestead exemption (if applicable). Despite any mail you may receive from a service offering to do this for a fee, paying such a fee is not required.

So what does a Homestead exemption do?

A homestead exemption removes part of your home’s value from taxation. The Homestead Exemption also “caps” the taxable market value growth for your home! It may also afford you certain legal protections from creditors & circumstances arising from the death of a spouse.

How does a homestead exemption work?

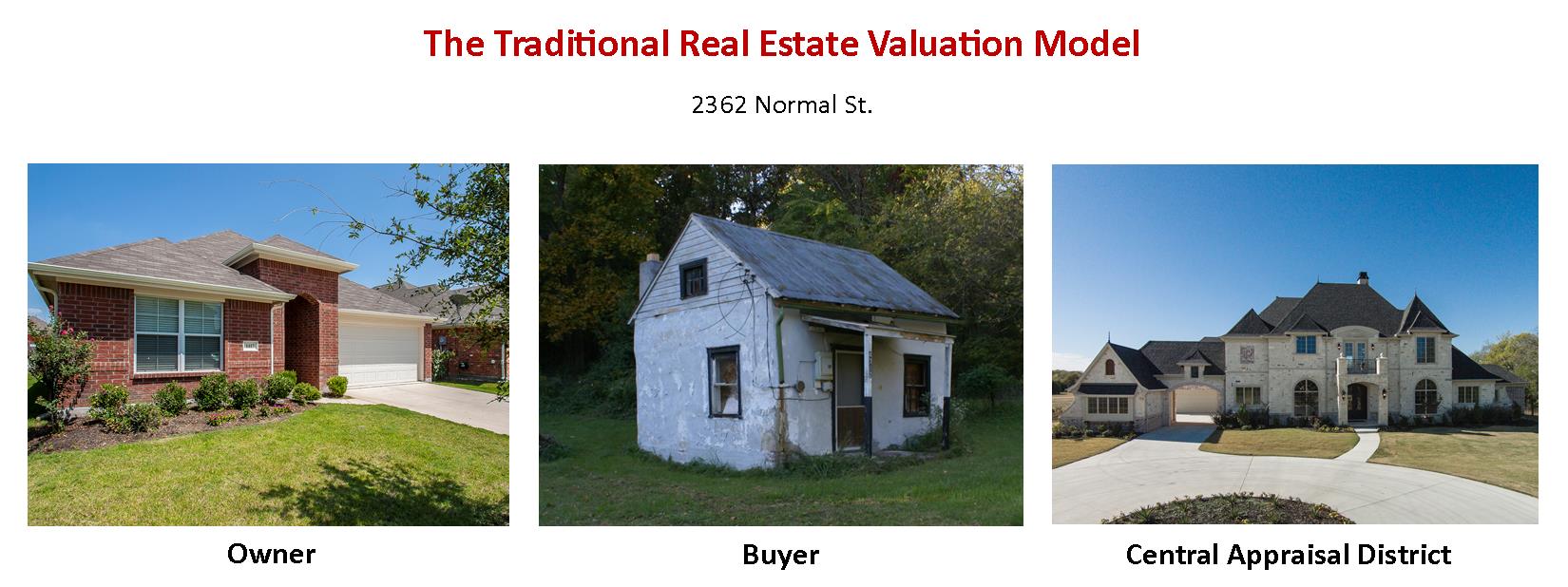

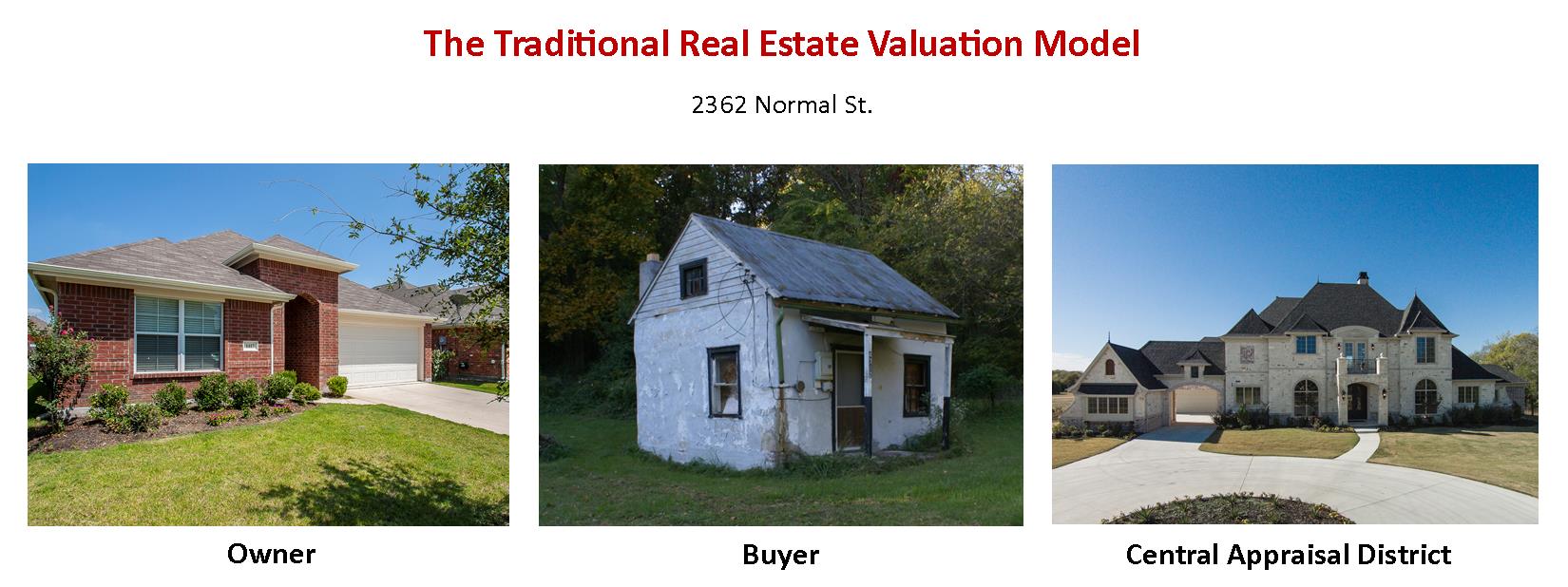

For most home owners, they seek an exemption for the possibility of lowering their taxable value. Simply as an example, if a home were assessed by the county at $200,000, and the home owner received a $20,000 exemption – they would be taxed on $180,000 for their homestead.

Do all homes qualify for an exemption?

No, typically only your primary residence will qualify. The homeowner must be an individual (not a corporation or business entity) and have owned/occupied the home prior to January 1st of the tax year. For an Over-65 or Disabled exemption, the Jan 1st requirement is waived.

What homestead exemptions exist?

Any taxing unit, including a city, county, school, or special district, may offer an exemption of up to 20 percent of a home's value (but not less than $5,000). Additional Homestead Exemptions exist for “65 or older” &/or “Dis-abled”, Over-55 Surviving Spouse of a Person Who Received an over 65 Exemption, 100% Disabled Veteran, & Service Connected Disabled Veteran & Surviving Spouses.

What if my home has more than 1 owner?

You may still qualify if you are not the sole owner. For instance, if you own 50% of the property, & otherwise qualify, you may received 50% of the tax benefit.

When is the filing deadline?

BETWEEN JANUARY 1 & APRIL 30….. and again, it is FREE!

OH NO! I missed by deadline last year, did I miss my chance?

You may file up to one year from the date the taxes became delinquent!

What is the Homestead Cap?

Your homestead is protected from future appraisal tax-value increases in excess of 10% per year from the date of the last appraisal PLUS the value of any NEW improvements (like an addition, pool, etc).

How do I file?

Filing is done at your local county &/or county assessor’s office.

Collin County click HERE

Denton County click HERE

Dallas County click HERE

Not sure you filed last year?

You can check in your local county’s tax rolls or simply give the county a call & they will be happy to confirm.

Want to know more?

Collin County & Denton County each have excellent FAQ’s on their websites!

Don’t see your county, check here!

https://www.comptroller.texas.gov/taxes/property-tax/county-directory/

Have additional questions, please let us know!

Christie Cannon REALTOR

The Christie Cannon Team

Keller Williams Frisco TX

469.951.9588: Mobile

972.215.7747: Office

Voted as one of the BEST Realtors in D Magazine for 2010-2016

Voted as a Five Star Professional 2012-2016 Texas Monthly Magazine

Named among America's Best Real Estate Agents by Real Trends Magazine

Certified Luxury Home Marketing Specialist

Global Property Specialist

#1 Keller Williams Agent 2011-2016

Top 50 Agents in the Nation / KW

4783 Preston Rd #300 Frisco TX 75034