Storm & High Winds Take Down Frisco TX Silo!

Displaying blog entries 1-10 of 31

New Master-Planned community announced west of the Dallas North Tollway & just north of Legacy! This new Hines development is situated in the heart of West Frisco & is expected to boast some of the area's top builders - Huntington Homes, Shaddock Homes, Darling Homes, Coventry Homes & Village Builders. With approimately 311 acres, Edgestone at Legacy is currently planned for single-family residences.

Nationwide just released their 2015 Q2 report on the Health of US Housing & incase the conflict of numbers is not great enough.... they rank TX negatively in affordability! Several years of strong housing has started to reflect a drop in housing affordability in Dallas & North Texas. While overall Dallas-Irving-Plano continue to rank in the top 10 best performing markets, this is largely due to our otherwise strong economic indicators. The entire Q2 2015 report can be viewed here!

Niche.com just released their Best Places list for 2015. Included in these ranks is the Best Suburbs List for Texas. Not surprisingly North Texas secured 6 of the top 10 spots! Collin County alone has 4 of the top 10 spots!

In Steve Brown's recent Dallas Morning News article is reporting that the nationally median home price is up 7.4%, breaking the $200K barrier with a US Median price of $205,200! All but 25 of the 170 Market areas are reporting gains in home prices.

The National Association of REALTORs is also reporting that 51 of the market areas saw double digit growth (more than twice the number of last year.) However, chief economist Lawrence Yun also cautions that pricing could level out if housing supplies improve. Yun further described an all too familiar sentiment in our market, as buyers “are hesitant to move up and sell because they aren’t confident they’ll find another home to buy.” And that, he says, is “leading to the ongoing inventory shortages and subsequent run-up in prices seen in many markets.” This same report places a fair amount of blame on "subpar homebuilding activity," as home builders are still trailing behind the demand.

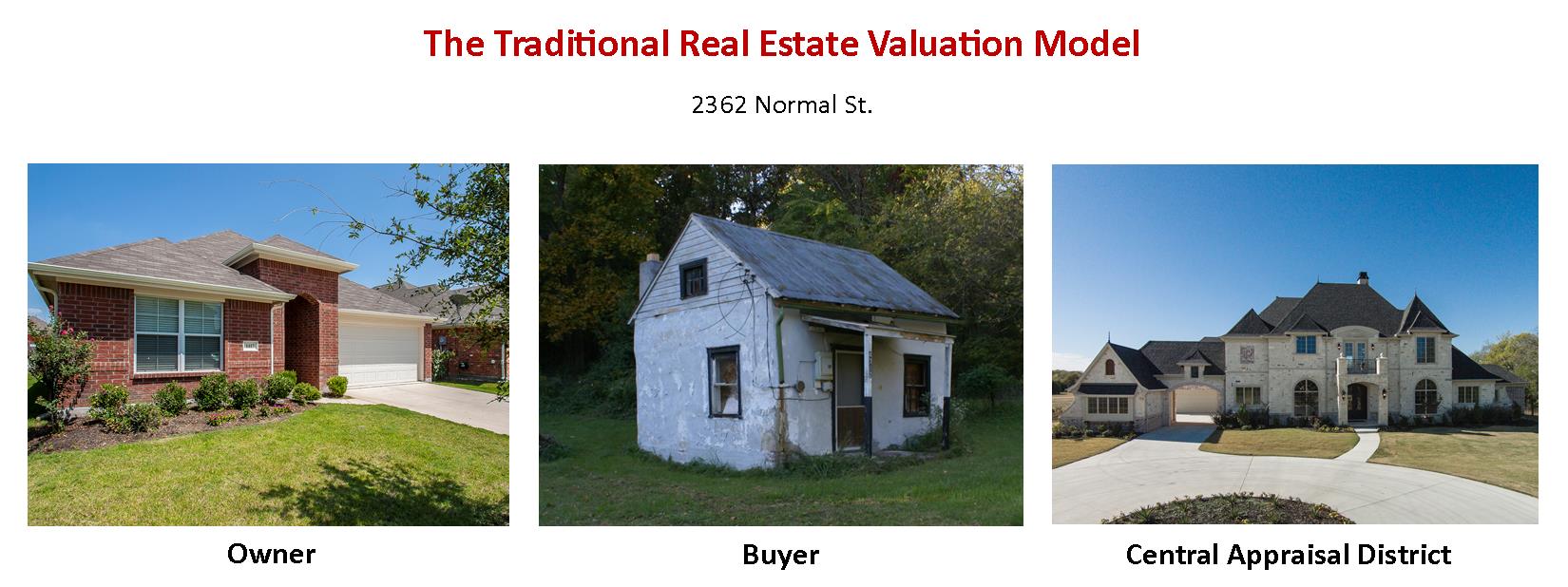

The season is upon us - let the tax protests begin! So the dreaded letter arrived; the good news, the market is up; the bad news, your local appraiser knows it!

So when your tax assessed value jumps the full 10%, what comes next? First don't panic, second review our helpful tips on determining if you should protest.

- Good Luck & please let me know if you have any questions - Christie Cannon

* Be sure to check with a qualified tax agent & your county's central appraisal district for specific procedures & questions.

After the housing market bust we experienced across the country in 2008, many experts have been quick to warn that a new bubble may be forming in some areas.

One particular example of this is a recent article pointing toward the California Bay Area’s price gains over the last 18 months.

The quickest and easiest way to show how far we’ve come and how far we still need to go in regards to the ‘Peak’ is to share CoreLogic’s Price & Time Since Peak figures, used to create the map below.

Even with the high performance of prices in the Bay Area, the state of California as a whole is still -14.4% below their Peak, experienced in May of 2006.

The biggest challenge facing the housing market’s recovery right now is the lack of inventory available for sale. Prices are determined by supply and demand. Right now buyer demand is out-pacing seller supply, across many price ranges, driving prices up.

Traditionally the Spring months have been the most popular dates sellers choose to list their homes. With additional inventory coming to market soon, meet with a professional in your local market to evaluate your best course of action.

The price of any item is determined by the supply of that item, and the market demand. The National Association of Realtors (NAR) released their latest Existing Home Sales Report this week.

Amidst reporting on the fact that sales of existing homes rose 1.2% from January, and outpaced year-over-year figures for the fifth consecutive month, was the news that total unsold housing inventory is at 4.6-month supply.

This is down 0.5% from last February and remains below the 6 months that is needed for a historically normal market.

Consumer confidence is at the highest level in over a decade. Pair that with interest rates still under 4%, new programs available for down payments as low as 3%, and you have an attractive market for buyers.

Buyer demand for housing remains twice as high as this time last year.

February marked the 36th consecutive month of year-over-year price gains as the median price of existing homes sold rose to $202,600 (up 7.5% from 2014).

The chart below shows the impact that inventory levels have on home prices.

NAR’s Chief Economist, Lawrence Yun gave some insight into the correlation:

"Insufficient supply appears to be hampering prospective buyers in several areas of the country and is hiking prices. Stronger price growth is a boon for homeowners looking to build additional equity, but it continues to be an obstacle for current buyers looking to close before (interest) rates rise."

If you are debating putting your home on the market this year, now may be the time. The amount of buyers ready and willing to make a purchase is at the highest level in years. Contact a local professional in your area to get the process started

A recent Bloomberg Business article reports that both Lowes & Home Depot experienced fourth quarter profits that beat revenue projections by the most in six quarters. So what does that mean to the housing market?

Lowe’s Chief Executive Officer Robert Niblock said,

“Consumers are feeling better about their jobs, their wages and certainly feeling better about the value of their home, they are re-engaging in projects that they have put off.”

Sales to professional contractors have increased significantly as well, and were a driving factor in the quarter. Home Depot’s Chief Financial Officer Carol Tome calls this a “sign of health. If they are putting more items in their basket, it means they have work coming at them.”

In a quarterly consumer survey conducted by Lowe’s since 2007, the percentage of respondents who said that the value of their home is rising increased to its highest value ever, at 50%.

Whether Americans are finally adding that man-cave they’ve always wanted, or renovating a master suite, an increased confidence in the value of one’s home often sparks homeowners to invest in big-ticket projects.

The National Association of Realtors (NAR) reports that the median price of an existing home (for all housing types) rose year-over-year for the 35th consecutive month.

Not all who are renovating are planning on staying in their home. The Demand Institute reports that “nearly half of American households plan to move at some point in the future.”

For those who are planning on listing their home this spring, spending the time and money needed to update that 1950’s bathroom or kitchen can fetch higher prices in today’s market.

Meeting with a local real estate professional can give you insight into the small (or big) improvements your home could use to draw the highest price and return on investment this spring. Have Questions about our local market? - Please give me a call - Christie Cannon - 469-951-9588

Displaying blog entries 1-10 of 31