Are rapidly rising home prices a warning sign of a real estate bubble? Could the U.S. housing market collapse as it did 14 years ago, triggering a severe recession? Real estate brokers and analysts who pay close attention to market fundamentals say the answer is no.

“I feel very strongly that we are not in a housing bubble simply because of the excessively low inventory,” says Anthony Lamacchia, CEO, Lamacchia Companies, Waltham, Mass. “It is impossible for the housing market to tip over in the next two years.”

A shortage of homes for sale is just one of the reasons the U.S. housing market will not suddenly slide into a tailspin. Lenders are far more cautious today than they were in 2006-2007 – a time when no-downpayment mortgages and easy credit fueled a wave of speculation, only to result in mass foreclosures when prices collapsed.

“After 50 years in the real estate business, this is the first time I have ever seen such a perfect storm,” says Thomas Sbarra, owner and principal, CENTURY 21 Sbarra, Johnson City, New York. “Inventory is at low levels, demand is running wild and prices are still rising pretty much everywhere in the country. While the buying frenzy is like the early 2000s, I think it will be two or three more years before there’s a correction, and the market could just level off.”

An Urban Land Institute survey of 43 economists at real estate organizations found little likelihood of a market meltdown. In fact, the economists projected home prices will grow an average of 4.1 percent over the next three years, above the long-term average of 3.9 percent. In a recent forecast, Fannie Mae projected new and existing home sales will be 6.2 percent high than last year, although the pace of transactions will slow later this year.

“We will certainly see a rebalancing at some point, but no one can predict when,” says Kuba Jewgieniew, CEO and founder of Realty ONE Group, Las Vegas. “I think things are going to calm down, stabilize and rebalance rather than seeing a bubble that’s going to pop.

Here are seven reasons the U.S. is not in a housing bubble.

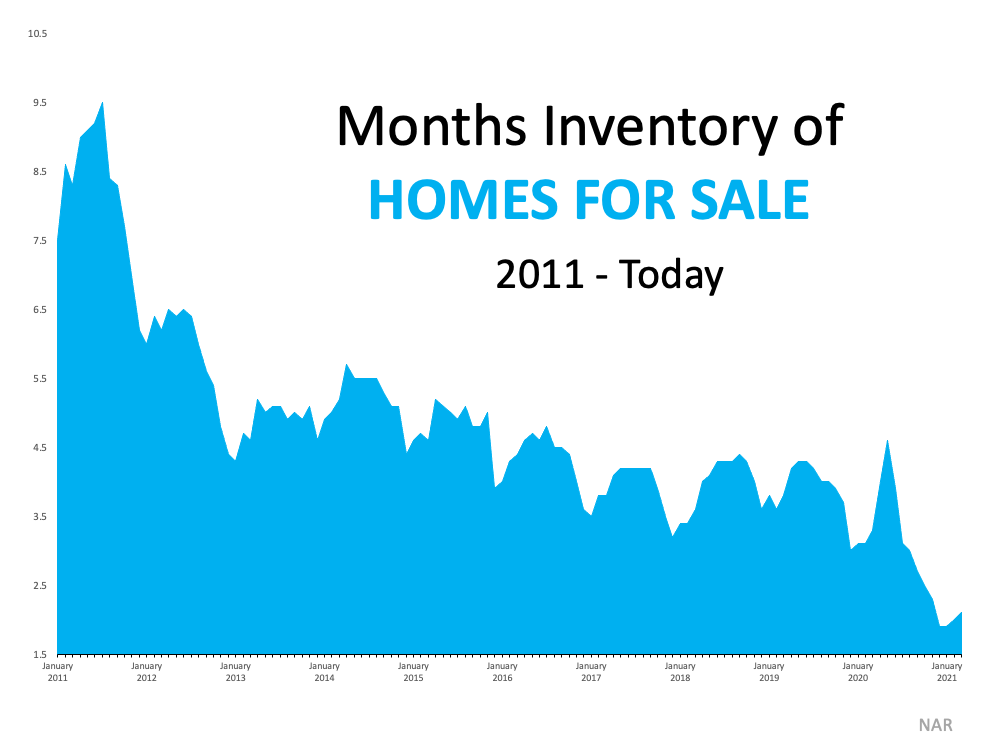

1. Low inventory

Housing sales across the country declined this spring, according to data released by the National Association of Realtors. The primary reason is lack of supply. In March, there were 1.07 million homes for sale, down 28.2 percent from the prior year. That is far below the 4 million homes on the market in July 2007 during the last housing bubble.

“Our ongoing issues of low inventory, caused in part by the high cost of new builds, will not go away anytime soon,” says Jewgieniew.

With only a 2.1-month supply of inventory for single-family homes in March – well below normal levels – home prices are likely to continue to rise. As Lawrence Yun, chief economist of the National Association of Realtors®, says, “This is not a bubble. It is simply lack of supply.”

2. Lack of supply

Currently, the U.S. housing market is 3.8 million single-family homes short of demand, according to a recent analysis from Freddie Mac. A low level of new home construction over the past three years has increased that shortfall, which was estimated at 2.5 million units in 2018.

New housing starts are rising this spring, but the supply of new homes is projected to remain well below demand. In March, housing starts reached a seasonally adjusted annual rate of 1.739 million units, the highest level since June 2006. Doug Duncan, chief economist for Fannie Mae, says production may decline later this year as homebuilders face supply constraints, such as increasing prices of lumber and other materials.

Overall, the Mortgage Bankers Association (MBA) forecasts single-family housing starts to be around 1.134 million, increasing to 1.165 million single-family homes in 2022 and 1.210 million in 2023. That gradual increase in production will help to ease the current shortage.

3. Favorable demographics

Nearly 5 million millennials will be turning 30 this year, with similar numbers coming in 2022. A significant percentage are looking to buy homes and condominiums – a big change in the market compared with five years ago.

In fact, millennials are expected to continue to drive the nation’s real estate market for the next decade, spurring demand for starter and move-up homes. Again, strong demand for homes is one of the main reasons a market bubble appears unlikely.

4. Return of international demand

As the COVID-19 pandemic recedes, international travel and home purchases will pick up later in the year. In many states, buyers from Canada, Europe, Asia and the Middle East have sought vacation homes, primary residences and investment properties in the U.S. That global demand for homes – many from all-cash buyers – can buoy many U.S. markets

“There is still a huge influx of foreign capital pouring into the United States as we’re still one of the most stable and attractive countries in the world,” says Jewgieniew. “Now is the time for real estate professionals to create new relationships and networks and grow their opportunities to connect with international clients.”

5. Low mortgage rates

While mortgage rates have begun creeping up, there are no signs of a spike that could bring the home financing process to a halt. “Real estate professionals should prepare their clients for rates to potentially hit 4 percent, while reassuring them that this is still ridiculously low,” says Jewgieniew.

This spring, the Federal Reserve is supporting housing market by keeping short-term rates low for borrowers – a practice it intends to follow until 2022 at least. The Fed is also purchasing agency mortgage-backed securities (MBS) to stabilize the lending market. Again, there is no sign of a bubble caused by home financing policies.

6. Tight credit

Risky credit practices in the early 2000s were a leading cause of the last housing bubble. Back then, lenders offered loans with “nothing down,” adjustable rates or balloon payments and easy terms to borrowers with marginal credit ratings. At that time, risky loans comprised about 40 percent of the mortgage market, according to a Morgan Stanley report. Currently, those loans are only 2 percent of the market.

7. Greater equity

Rising home prices and greater savings rates have increased equity for millions of U.S. owners. A first quarter report from ATTOM Data Solutions, found that one in three of the 55.8 million mortgaged homes was “equity-rich,” with loans 50 percent or less of estimated market value.

On the other side of the equation, just 2.6 million mortgaged homes were considered seriously underwater, combined loans at least 25 percent more than the value. In addition, distressed sales — including bank-owned (REO) sales, third-party foreclosure auction sales and short sales — accounted for just 5.8 percent of sales, the smallest percentage since 2003 and dramatically below the 42.2 percent in the first quarter of 2009.

A look ahead

Looking ahead to the second half of the year, the pace of home sales may decline and mortgage rates may rise. But those changes should be gradual, rather than bursting a bubble. As Jewgieniew says, “Brokers should be looking forward the future and remember not to be short-sighted. Be sure to have money set aside, especially as there are less and less transactions, and be disciplined with your spending.”

Article provided by: Richard Westlund with RealTrends

See the entire article here!

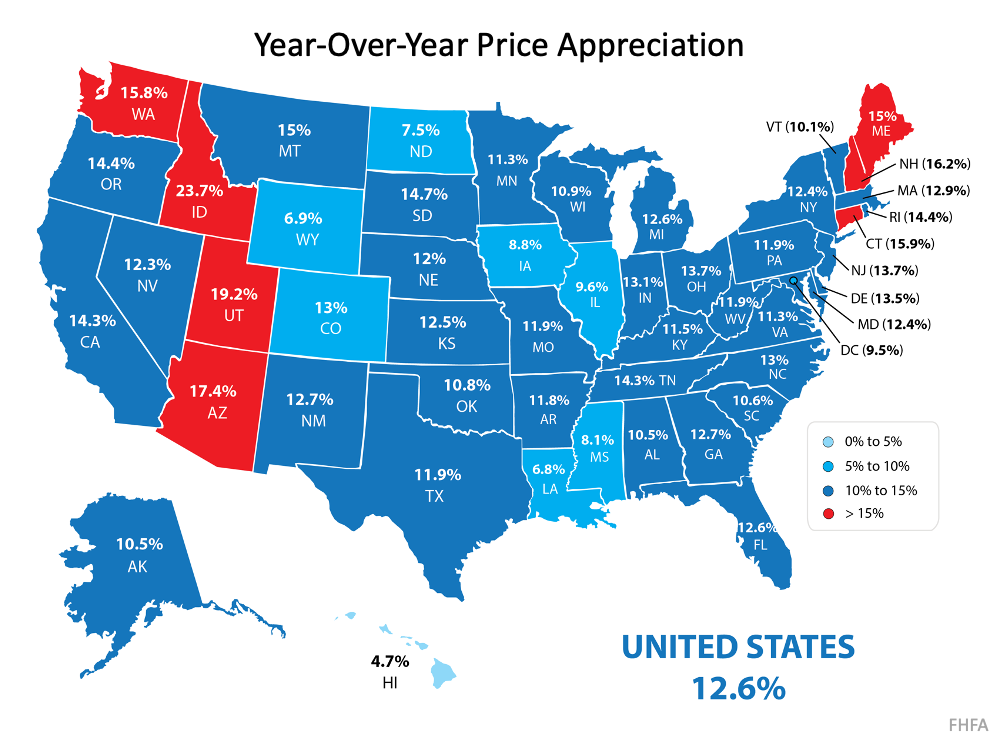

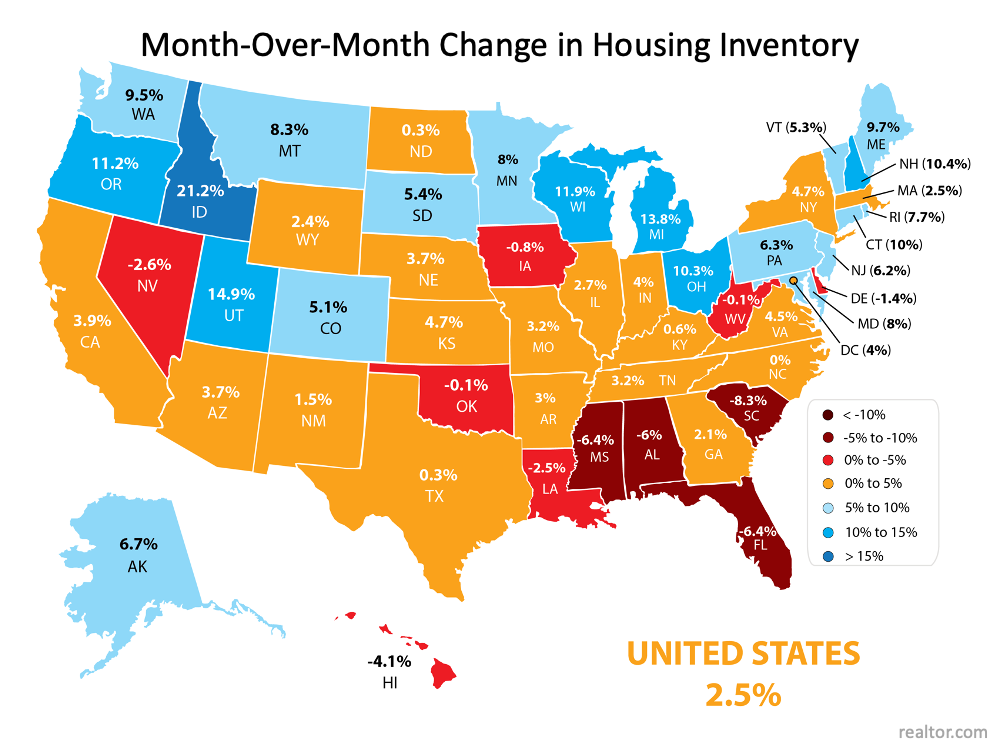

As the map shows, certain states (colored in red) have appreciated well above the national average of 12.6%.

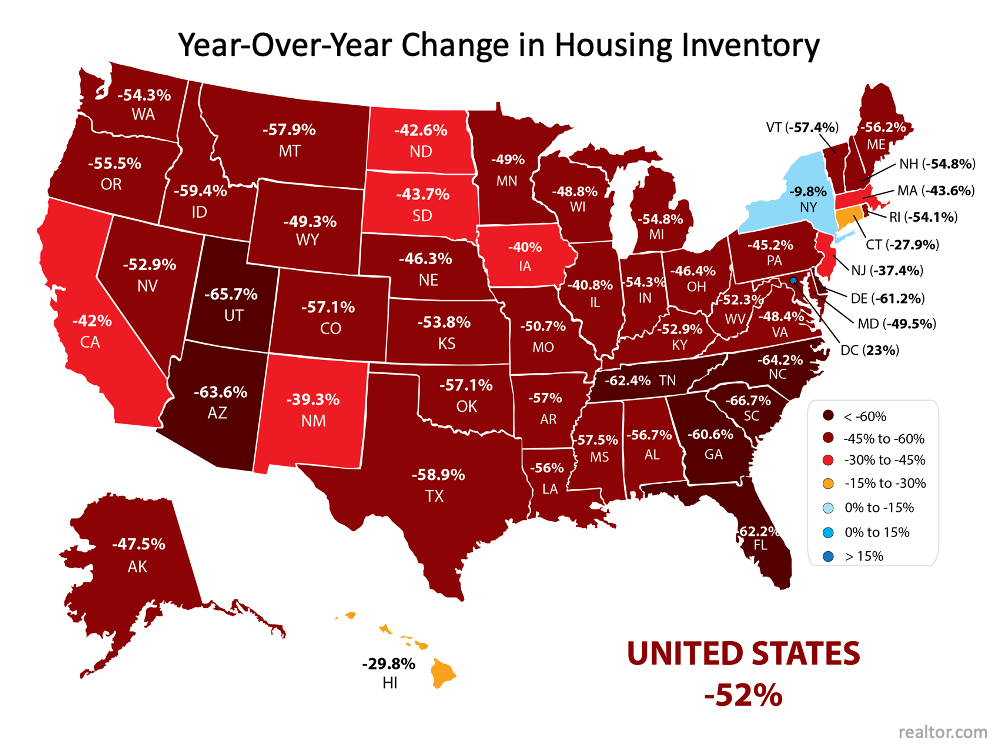

As the map shows, certain states (colored in red) have appreciated well above the national average of 12.6%. Comparing the two maps shows a correlation between change in listing inventory and price appreciation in many states. The best examples are Idaho, Utah, and Arizona. Though the correlation is not as easy to see in every state, the overall picture is one of causation.

Comparing the two maps shows a correlation between change in listing inventory and price appreciation in many states. The best examples are Idaho, Utah, and Arizona. Though the correlation is not as easy to see in every state, the overall picture is one of causation. As the map indicates, 39 of the 50 states (plus the District of Columbia) saw increases in inventory over the last month. This may be evidence that homeowners who have been afraid to let buyers in their homes during the pandemic are now putting their houses on the market.

As the map indicates, 39 of the 50 states (plus the District of Columbia) saw increases in inventory over the last month. This may be evidence that homeowners who have been afraid to let buyers in their homes during the pandemic are now putting their houses on the market.