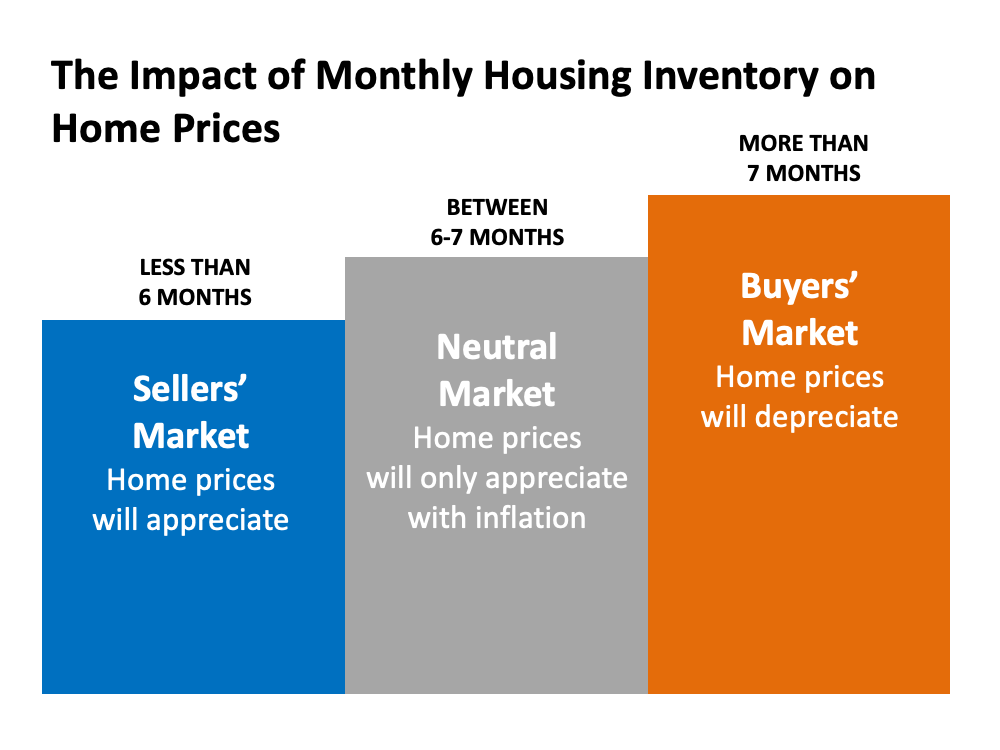

Homeowners ready to make a move are definitely in a great position to sell today. Housing inventory is incredibly low, driving up buyer competition. This gives homeowners leverage to sell for the best possible terms, and it’s fueling a steady rise in home prices.

In such a hot market, houses are selling quickly. According to the National Association of Realtors (NAR), homes are typically on the market for just 18 short days. Despite the speed and opportunity for sellers, there are still steps you can take to prep your house to shine so you get the greatest possible return.

1. Make Buyers Feel at Home

One of the ways to make this happen is to take time to declutter. Pack away any personal items like pictures, awards, and sentimental belongings. The more neutral and tidy the space, the easier it is for a buyer to picture themselves living there. According to the 2021 Profile of Home Staging by NAR:

“82% of buyers’ agents said staging a home made it easier for a buyer to visualize the property as a future home.”

Not only will your house potentially attract the attention of more buyers and likely sell quickly, but the same report also notes:

“Eighteen percent of sellers' agents said home staging increased the dollar value of a residence between 6% and 10%.”

As Jessica Lautz, Vice President of Demographics and Behavior Insights for NAR, says:

“Staging a home helps consumers see the full potential of a given space or property…It features the home in its best light and helps would-be buyers envision its various possibilities.”

2. Keep It Clean

On top of making an effort to declutter, it’s important to keep your house neat and clean. Before a buyer stops by, be sure to pick up toys, make the beds, and wash the dishes. This is one more way to reduce the number of things that can distract a buyer from the appeal of the home.

Ensure your home smells fresh and clean as well. Buyers will remember the smell of your house, and according to the same report from NAR, the kitchen is one of the most important rooms of the house to focus on if you want to attract more buyers.

3. Give Buyers Access

Buyers are less likely to make an offer on your house if they aren’t able to easily schedule a time to check it out. If your home is available anytime, that opens up more opportunities for multiple buyers to go from curious to eager. It also allows buyers on tight schedules to still get in to see your house.

While health continues to be a great concern throughout the country, it’s important to work with your agent to find the best safety measures and digital practices for your listing. This will drive visibility and create access options that also keep everyone in the process safe.

4. Price It Right

Even in a sellers’ market, it’s crucial to set your house at the right price to maximize selling potential. Pricing your house too high is actually a detriment to the sale. The goal is to drive high attention from competing buyers and let bidding wars push the final sales price up.

Work with your trusted real estate professional to determine the best list price for your house. Having an expert on your side in this process is truly essential.

Bottom Line

If you want to sell on your terms, in the least amount of time, and for the best price, today’s market sets the stage to make that happen. Let’s connect today to determine the best ways to maximize the sale of your house this year.

![Should I Buy Now or Wait? [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/04/29143208/20210423-MEM-1-1046x1534.png)

.jpg)

![Multigenerational Housing Is Gaining Momentum [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/04/08105653/20210319-MEM-1046x1980.png)