Keller Williams Frisco

Frisco Texas Real Estate Blog

Christie Cannon

Blog

Displaying blog entries 571-580 of 706

US Median Home Price Up over $200K - Local up 10%

In Steve Brown's recent Dallas Morning News article is reporting that the nationally median home price is up 7.4%, breaking the $200K barrier with a US Median price of $205,200! All but 25 of the 170 Market areas are reporting gains in home prices.

The National Association of REALTORs is also reporting that 51 of the market areas saw double digit growth (more than twice the number of last year.) However, chief economist Lawrence Yun also cautions that pricing could level out if housing supplies improve. Yun further described an all too familiar sentiment in our market, as buyers “are hesitant to move up and sell because they aren’t confident they’ll find another home to buy.” And that, he says, is “leading to the ongoing inventory shortages and subsequent run-up in prices seen in many markets.” This same report places a fair amount of blame on "subpar homebuilding activity," as home builders are still trailing behind the demand.

The Power of Interest Rates!

The Take Away:

- Interest rate changes have a profound affect on buying power.

- Affordability and interest rate have direct relationship.

- Spend your money on your dream home, not on interest.

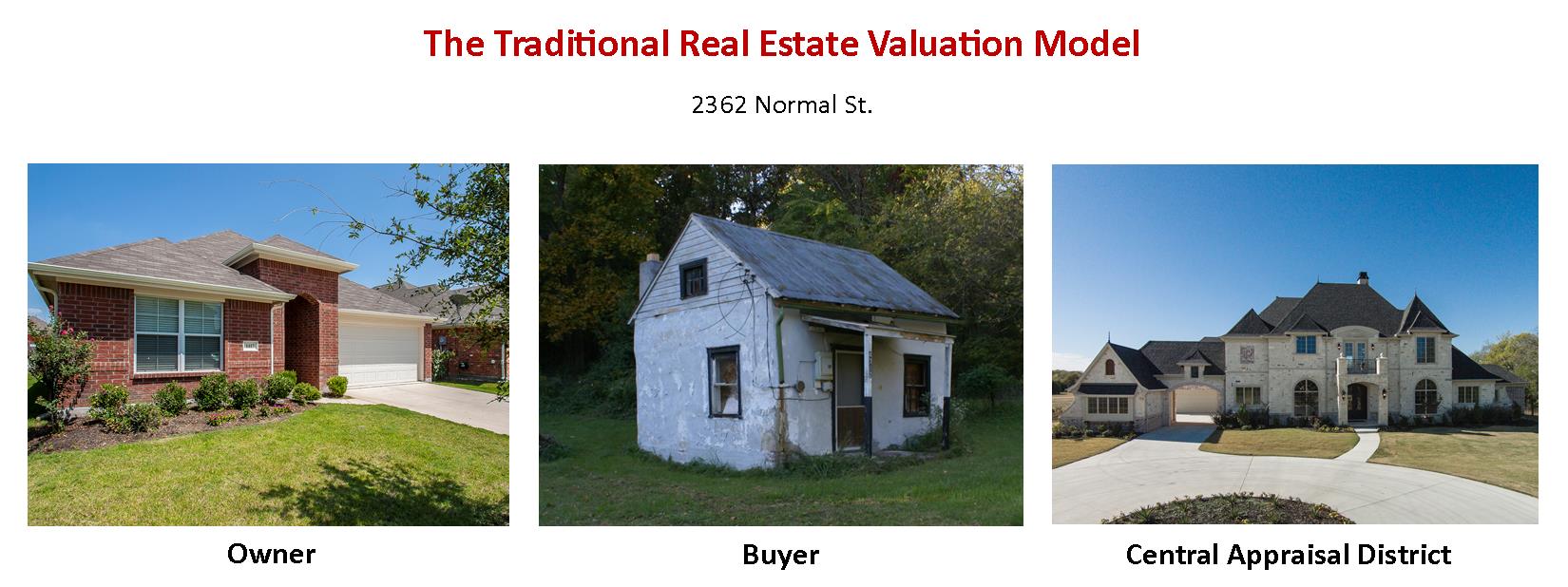

Tis the Season of Property Value Protests

The season is upon us - let the tax protests begin! So the dreaded letter arrived; the good news, the market is up; the bad news, your local appraiser knows it!

So when your tax assessed value jumps the full 10%, what comes next? First don't panic, second review our helpful tips on determining if you should protest.

- Key things to keep in mind

- There are generally no costs in contesting your tax value (if you do so on your own),

- There is no separate penalty for protesting your taxes but not succeeding,

- Most counties allow for an "informal review" & even encourage such a review prior to an ARB (Appraisal Review Board) hearing,

- County procedures differ for the request of a review or protest (some allow mail or electronic methods, others require a scheduled appointment conducted in person),

- Like most "government" services, there is a processes that appears mush more complex than it actually is,

- Your fellow citizens & residents serve as part of the final Appraisal Review Board,

- You have a right to review the information that the appraisal office used in determining your value.

- Thoroughly review your Notice of Appraised Value

- Have you taken full advantage of tax exceptions for which you qualify (Homestead if owned before Jan 1st, Over 65, etc),

- Is the information on your appraisal about your home correct?,

- is the information on the CAD's (Central Appraisal District) website correct (bedrooms, SqFt, etc)

- Did your appraised value increase greater than 10%, if you have a homestead exemption & no new improvements.

- Understand what you can protest

- Proposed value,

- Denied exemptions for which you believe you qualify,

- Incorrect information regarding the scope or use of your property,

- Incorrect owner,

- Incorrect taxing units (authorities),

- Defects of the home or property that would otherwise affect the value.

- Understand how value is derived in Texas for the property tax assessed value

- Appraisers look for homes that sold closest to Jan 1st in the tax year assessed

- Homes that are closest in size, year built, location, age, & construction style are given the greatest weight.

- Be Prepared - Bring organized data whether you are meeting "informally" with an appraiser or for an ARB hearing

- If you purchased or refinanced your home recently (especially close to Jan 1st) and your tax assessed value exceeds your sales price, bring your signed HUD-1 &/or a copy of the appraisal conducted for your mortgage

- Bring Sales Comps for comparable properties (see 4.2) & include: address, sale date, sale price, supporting docs, names of owners, MLS information, etc.

- Proof of defects of your home, functional or economic obsolescence

- Know your Dates, Deadlines, & Procedures

- File on-time or you may miss your chance

- In most cases your protest must be filed by May 31st (*CHECK with your CAD!)

- READ YOUR COUNTY's PROTEST INFORMATION CAREFULLY - if you don't understand something, give them a call!

- Denton CAD (click for info)

- Dallas CAD (click for info)

- Collin CAD (click for info)

- Good Luck & please let me know if you have any questions - Christie Cannon

* Be sure to check with a qualified tax agent & your county's central appraisal district for specific procedures & questions.

Best Places to Buy in 2015

SelfStorage.com's blog posted their 12 best places to move to in 2015 & Texas takes 4 of the 12 top spots!

So how did the Lonestar state fair:

1. AUSTIN, TX

The capital of Texas boasts the highest long-term job growth and the second-highest economic growth numbers among the Top 12. It also has the second-highest share of recent construction. Yet homes remain affordable, with median prices slightly higher than three times median incomes. The only drawback? Real estate taxes, which are higher in Austin than anywhere else in the Top 12.

2. HOUSTON, TX

Four of the Top 12 spots belong to metro areas in Texas, and Houston actually outperforms Austin in many ways: cost premiums are lower, prices recently have increased more and real estate taxes are lower. However, there’s less recent construction in Houston, and economic growth — while healthy — is slower than in Austin.

5. SAN ANTONIO, TX

Like its Texas compatriots on our list, San Antonio scores well across the board and offers buyers a low cost premium combined with attractive recent price increases. Real estate taxes per capita are lower here than in the other Texas cities, too.

6. DALLAS, TX

Dallas’ economic numbers are essentially the same as San Antonio’s. However, Dallas’ recent price increases and real estate taxes are higher, and the cost premium is slightly higher here than in San Antonio.

Appraisals - every home is sold twice!

Appraisals & why we must sell every home twice!

Every house on the market has to be sold twice; once to a prospective buyer and then to the bank (through the bank’s appraisal). In a housing market where supply is very low and demand is very high, home values increase rapidly. One major challenge in such a market is that bank appraisal. If prices are jumping, it is difficult for appraisers to find adequate comparable sales (similar houses in the neighborhood that closed recently) to defend the price when doing the appraisal for the bank.

With escalating prices, the second sale might be even more difficult than the first. And now, there may be a second issue further complicating the appraisal issue.

The Mortgage News Daily (MND) recently published an article titled Conservative Appraisals Increasingly Mentioned in 2015; Did Something Change?

The article revealed that there was a “flurry” of comments on their website from members expressing concern about…

“…a sudden increase in appraisals reflecting market values well below what had been expected. In some cases the low appraisals had merely required the restructuring of the loan, in others they killed the deal.”

The National Association of Realtors revealed this month that 8% of the contracts that fell through over the last three months were terminated because of appraisal issues.

MND decided to survey their members and ask why this sudden increase in “short” appraisals could be taking place. Here is one result of that survey:

“Almost everyone we spoke to mentioned Fannie Mae's new Collateral Underwriter (CU).”

Collateral Underwriter provides a risk score on individual appraisals which will lead to a ranking of appraisals by risk profile, allowing lenders to identify appraisals with heightened risk of quality issues, overvaluation, and compliance violations. It went on-line on January 26.

Marianne Sullivan, senior vice president of single-family business capability with Fannie Mae believes that CU is not a problem for appraisers. She claimed:

“From an appraiser perspective, one of the lender's responsibilities has always been to review the quality of an appraiser, and they have been using various methods to do that forever. I don’t think appraisers will find this tool to be disruptive.”

However, some think that CU has caused appraisers to become too cautious with their appraised values. One mortgage professional in the MND article explained it this way:

"My personal opinion is that appraisers are being overly conservative in choosing comps because of CU. If CU questions the comps, adjustments, etc., the appraiser would have to do a lot of extra work to justify them. I had anticipated that CU would cause delays because of this extra work, but it seems that appraisers are one step ahead and are being ultra conservative, thus avoiding the extra work in the first place. I haven't spoken to an appraiser about it; this is just my interpretation of what I am seeing."

Ryan Lundquist, a Certified Residential Appraiser in the Sacramento area, agreed:

“One of the unintended consequences of CU may be more conservative appraisals.”

Bottom Line

We must realize that, in today’s housing market, every house must be sold twice and the second sale (to the bank’s appraiser) could be the more difficult one.

Q & A's with D Magazine on Frisco's new Corporate Neighbors

Thank you to Caitlin Clark of D Magazine & D Home for thinking of us in their recent blog post & QA. We discussed the affect of corporate relocations to the North TX area & how this may affect Frisco's real estate market.

Below is a quick glimpse - For all the Questions & Answers, please be sure to check out the Blog - HERE

________________________

How do you think all the development in and around Frisco will affect the city’s housing market?

It is an exciting time to be in Frisco! The name recognition that comes with the Cowboys is priceless. As we continue develop and draw new employment anchors and employees, that name recognition will keep our great city in the forefront of buyers’ minds. Likewise, the affect we will see from our new corporate neighbors will be profound...

Are there any up-and-coming neighborhoods or residential developments that homebuyers looking in Frisco should know about?

We could talk all day! New home communities include: Phillips Creek Ranch with huge amenities, Lawler Park with creek lots and mature trees, and the gated Newman Village, which has come on strong over this past year. I do caution buyers not to let new build prices or inventory scare you from our market; the traditional heavy hitters in Frisco will always draw interest like Trails of West Frisco, Starwood, Stonebriar, Griffin Parc, etc. Likewise, the Hillcrest & Lebanon area of Plantation Estates, Hillcrest Estates, Cecile Place and others are wonderfully priced, just off 121, and offer amazing schools and amenities. Really, we could talk all day!

Do you have any tips or insight for homebuyers looking to make the move to Frisco?

Sure I do; give us a call!

The best advice I can offer is to get started early. Frisco is much larger than people expect. The city offers such a wide variety of communities, home styles, and amenities that it can be overwhelming for home seekers new to the area. Work with someone to get to know the area, not just the houses. This isn’t just about where you lay your head at night, but where do you work, live, relax, and play – how can your home, community, & city enhance this?

And, if you are relocating from another state, don’t worry, we native Texans are easy to win over – just let us know that while you may not be from here, you got here as soon as you could.

Interest Rate projection costs

The Bottom Line:

- Freddie Mac Primary Mortgage Market Survey reports the 30-year fixed rate at 3.7%.

- Freddie Mac's projection for Q2 2016 - interest rates will be 4.7%.

- The Home Price Expectation Survey predicts prices (national averages) will appreciate by 4.4% during this same time

Real Estate Comeback of Bubble?

After the housing market bust we experienced across the country in 2008, many experts have been quick to warn that a new bubble may be forming in some areas.

One particular example of this is a recent article pointing toward the California Bay Area’s price gains over the last 18 months.

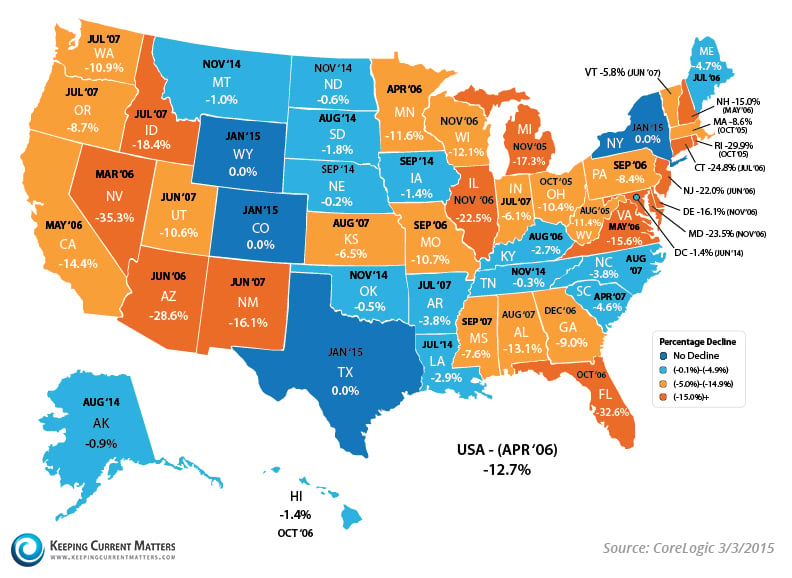

The quickest and easiest way to show how far we’ve come and how far we still need to go in regards to the ‘Peak’ is to share CoreLogic’s Price & Time Since Peak figures, used to create the map below.

Even with the high performance of prices in the Bay Area, the state of California as a whole is still -14.4% below their Peak, experienced in May of 2006.

The biggest challenge facing the housing market’s recovery right now is the lack of inventory available for sale. Prices are determined by supply and demand. Right now buyer demand is out-pacing seller supply, across many price ranges, driving prices up.

Bottom Line

Traditionally the Spring months have been the most popular dates sellers choose to list their homes. With additional inventory coming to market soon, meet with a professional in your local market to evaluate your best course of action.

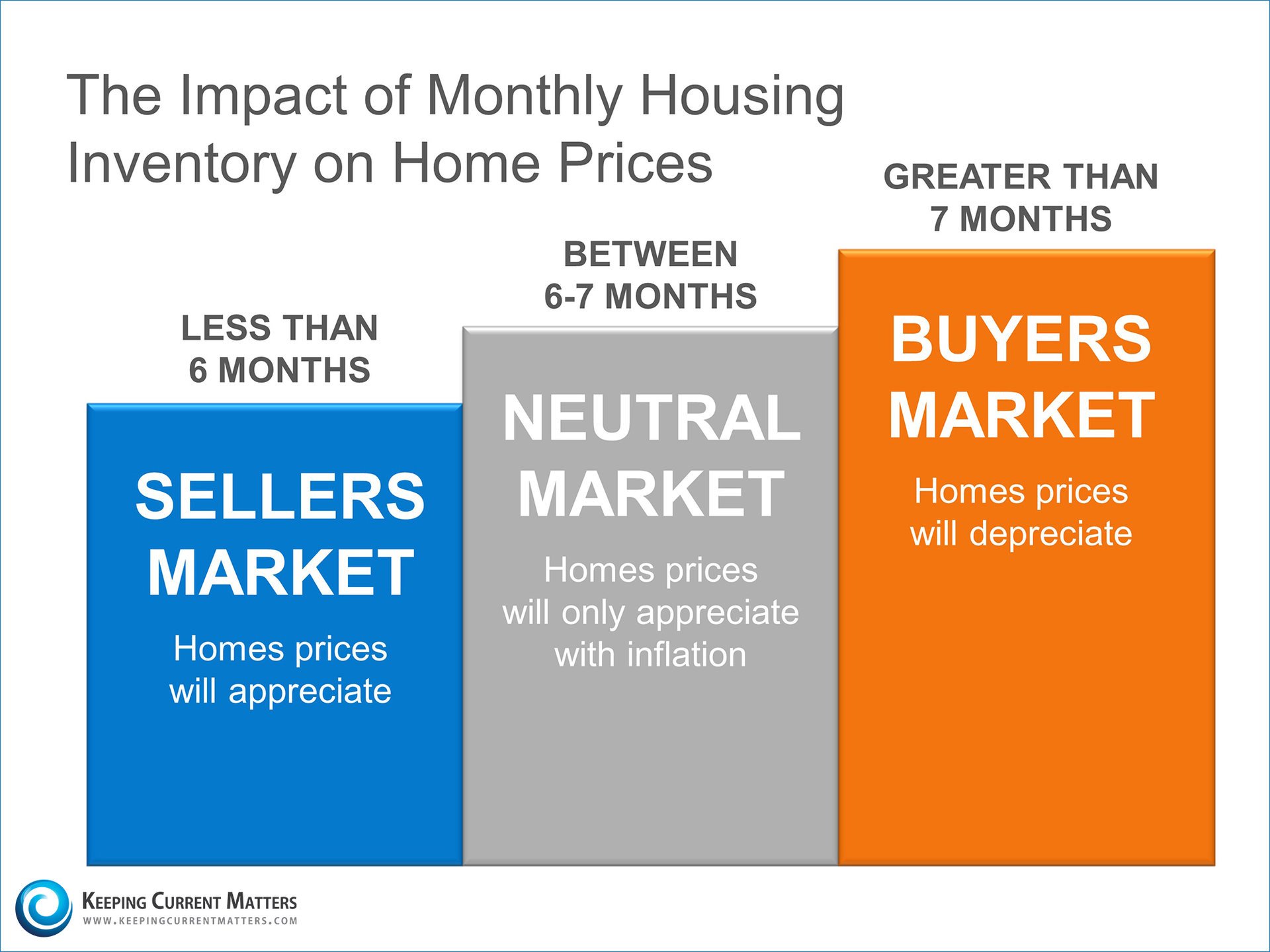

Inventory Levels are LOW!

The price of any item is determined by the supply of that item, and the market demand. The National Association of Realtors (NAR) released their latest Existing Home Sales Report this week.

Inventory Levels & Demand

Amidst reporting on the fact that sales of existing homes rose 1.2% from January, and outpaced year-over-year figures for the fifth consecutive month, was the news that total unsold housing inventory is at 4.6-month supply.

This is down 0.5% from last February and remains below the 6 months that is needed for a historically normal market.

Consumer confidence is at the highest level in over a decade. Pair that with interest rates still under 4%, new programs available for down payments as low as 3%, and you have an attractive market for buyers.

Buyer demand for housing remains twice as high as this time last year.

Prices Rising

February marked the 36th consecutive month of year-over-year price gains as the median price of existing homes sold rose to $202,600 (up 7.5% from 2014).

So What Does This Mean?

The chart below shows the impact that inventory levels have on home prices.

NAR’s Chief Economist, Lawrence Yun gave some insight into the correlation:

"Insufficient supply appears to be hampering prospective buyers in several areas of the country and is hiking prices. Stronger price growth is a boon for homeowners looking to build additional equity, but it continues to be an obstacle for current buyers looking to close before (interest) rates rise."

Bottom Line

If you are debating putting your home on the market this year, now may be the time. The amount of buyers ready and willing to make a purchase is at the highest level in years. Contact a local professional in your area to get the process started

Displaying blog entries 571-580 of 706

Categories

- (0)

- (1)

- (0)

- (0)

- 75033 Real Estate (199)

- 75034 Real Estate (201)

- 75035 Real Estate (201)

- Allen Real Estate (176)

- Frisco's Real Estate (231)

- Heritage Ranch in Fairview (43)

- La Cima in Stonebridge Ranch McKinney (43)

- Market Conditions (174)

- Market Statistics (157)

- McKinney Real Estate (151)

- New Communities (65)

- real estate (1)

- Real Estate Tax Tips (52)

- Real Estate Tips (169)

![The Difference Your Interest Rate Makes [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2015/05/Cost-of-Interest.jpg)

![The Difference A Year Can Make [INFOGRAPHIC] | Keeping Current Matters](http://www.keepingcurrentmatters.com/wp-content/uploads/2015/04/Payment-Difference-KCM.jpg)